This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Trump Unveils Tariff Measures for 14 Nations; Carnival, GuocoLand, Shinhan Financial Price Bonds

July 8, 2025

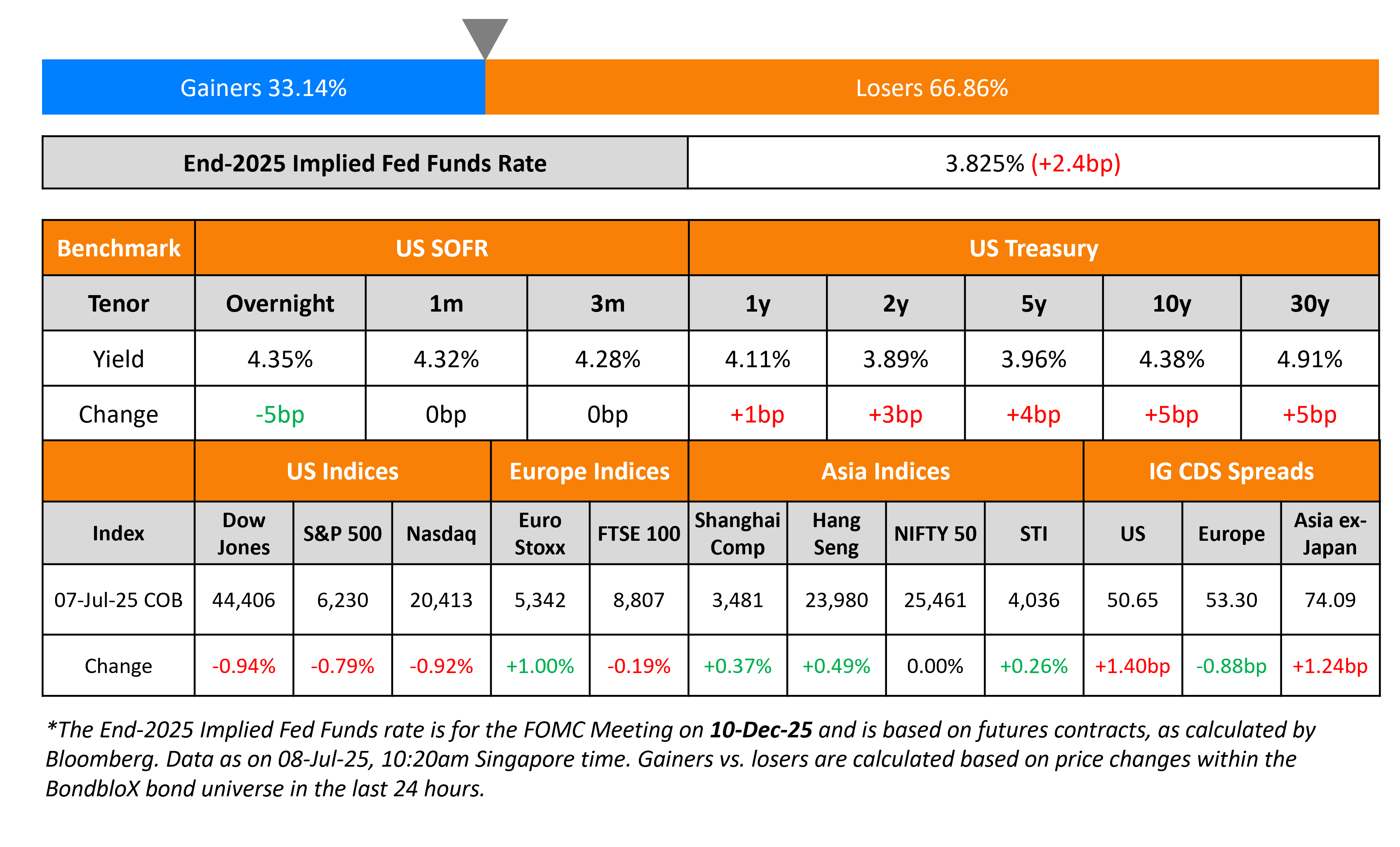

US Treasury yields rose by 3-5bp across the curve on Monday. US President Donald Trump unveiled his tariff plans for 14 countries that have yet to secure a trade deal with him. To highlight a few, the US will impose a 25% tariff on Japan, South Korea, Malaysia, alongside a 30% tariff on South Africa among other countries beginning this August.

Looking at equity markets, the S&P and Nasdaq dropped by 0.8% and 0.9% respectively. US IG and HY CDS spreads widened by 1.4bp and 9.1bp respectively. European equity markets ended mixed . The iTraxx Main CDS spreads tightened by 0.9bp while Crossover CDS spreads tightened by 4.3bp. Asian equity markets have opened higher today. Asia ex-Japan CDS spreads were wider by 1.2bp.

New Bond Issues

- Nissan $ 5Y/7Y/20Y at Mid-7/High-7/Low-8% area

Carnival raised $3bn via a 7Y bond at a yield of 5.75%, ~6.25bp inside initial guidance of 5.75-5.875% area. The senior unsecured bond is rated Ba3/BB+/BB+. Proceeds, together with cash, will be used to prepay its remaining Term Loan B due 2028 and partially redeem its 5.25% 2027s. The new bond was priced roughly in line with its existing 6.125% 2033s that currently yield 5.73%.

GuocoLand raised S$120mn via a tap of its PerpNC5 bond at a yield of 4.25%, 10bp inside initial guidance of 4.35% area. If not called by 25 February 2030, the coupon will reset to the 5Y SGD OIS plus 180.3bp. The note has a coupon step-up of 100bp if there is a change of control event. The notes have both, a dividend pusher and a dividend stopper. Proceeds will be used to finance general working capital and corporate requirements of the group.

Shinhan Financial raised $500mn via a 5Y bond at a yield of 4.597%, 27bp inside initial guidance of T+90bp area. The senior unsecured note is unrated. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Heimstaden hires for € 5.5NC2.5 bond

-

Trafigura hires for $ 5Y bond

- Port of Newcastle hires for A$ 8Y/10Y bond

- EnfraGen hires for $ 7NC3 bond

Rating Changes

- Moody’s Ratings has downgraded Dow’s rating to Baa2 from Baa1; Outlook negative

- Moody’s Ratings downgrades Coronado’s ratings to Caa2, ratings remain on review for downgrade

-

GMR Hyderabad Airport Outlook Revised To Positive From Stable; ‘BB’ Rating Affirmed

- Moody’s Ratings affirms Shandong Guohui’s Baa2 rating; changes outlook to stable

Term of the Day: Moratorium

A moratorium is a temporary suspension on debt wherein the borrower does not have to make any repayments. It is a waiting period with some protections for the borrower before repayments begin. However, the interest is accumulated until the end of the moratorium period and the accrued interest is then added to the principal amount of the debt.

Talking Heads

On Investors To Double Down On US Junk Bonds On Another Tariff Tantrum

Sandeep Desai, Deutsche Bank

“Investors are likely to take any news of a tariff deadline extension in their stride and not overreact because there is always a put with this government”

Joseph Lynch, Neuberger Berman

“Spreads could widen slightly, if at all, come Wednesday. If they do, we could be allocating more capital to high-yield.”

Piers Ronan, Truist Securities

“You have a situation where the supply of bonds is just not keeping up with the demand”

On Betting Big on Colombia, Brazil Bonds – Alaa Bushehri, EM, BNP Paribas

“On dollar notes, the long-end of Brazil and Colombia offer very attractive valuations…The premium that is offered on those curves is reflected…EM is very much the markets that are going to benefit from changes in supply routes and trade agreements”

On Seeing Weaker Asian Currencies on Latest Tariff Demands – Strategists

Nick Twidale, AT Global Markets

“Japan and South Korea will be most impacted initially on last night’s update…Today, I think KRW will take a hit and will be keeping a wary eye on the CNY as well.”

Aroop Chatterjee, Wells Fargo

“FX is likely to be more sensitive to this with Asian exporters looking particularly vulnerable…Long positioning is the most stretched for the yen in G10 and the flip around in Korean won positioning has been significant as well.”

Sean Callow, InTouch Capital Markets

“The US clearly only has bandwidth for negotiation with a handful of trading partners, with the rest seemingly blamed for failing to reach a deal. This is likely to place pressure on currencies including IDR, MYR and THB.”

Top Gainers and Losers- 08-Jul-25*

Go back to Latest bond Market News

Related Posts: