This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Trump Plans to Impose 35% Tariff on Canada; Nissan, Turkey Price Bonds

July 11, 2025

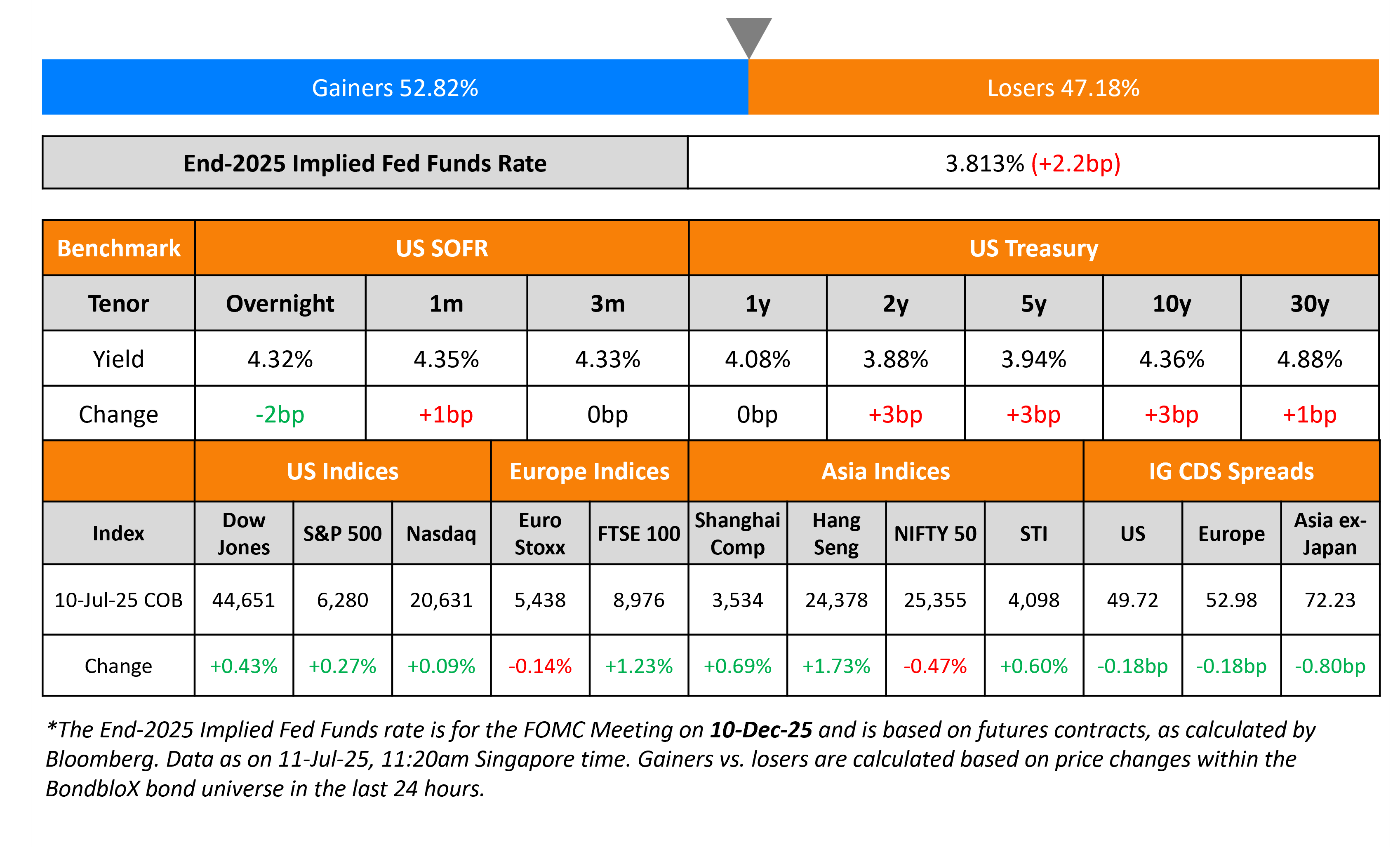

US Treasury yields rose parallelly by 3bp across the curve. US President Donald Trump said that they would impose a 35% tariff on Canadian imports from August and planned to impose blanket tariffs of 15/20% on most other trading partners. Federal Reserve Governor Chris Waller said that the Fed was still trimming its balance sheet and that its QT program to reduce reserve balances remained in place. Separately, US initial jobless claims in the prior week fell by 227k to a 7-week low.

Looking at US equity markets, the S&P and Nasdaq closed at record highs, rallying by 0.3% and 0.1%, respectively. US IG and HY CDS spreads tightened by 0.2bp and 0.8bp respectively. European equity markets ended mixed too. The iTraxx Main CDS spreads tightened by 0.2bp while Crossover CDS spreads tightened by 1.2bp. Asian equity markets have opened higher today. Asia ex-Japan CDS spreads were tighter by 0.8bp.

New Bond Issues

Nissan raised $3bn via a three-part issuance. It raised:

- $1bn via a 5Y bond at a yield of 7.50%, unchanged from the initial guidance. The bonds were priced at a new issue premium of 29bp over its existing 4.81% 2030s that currently yield 7.21%.

- $750mn via a 7Y bond at a yield of 7.75%, unchanged from the initial guidance

- $1.25bn via a 10Y bond at a yield of 8.125%, unchanged from the initial guidance

The senior unsecured notes are rated Ba2/BB/BB. Proceeds will be used for general corporate purposes, including debt refinancing.

Turkiye raised €1.5bn via a 6Y bond at a yield of 5.2%, 30bp inside initial guidance of 5.5% area. The senior unsecured note is unrated. Net proceeds will be used for general budgetary purposes. In comparison to its 5.375% 2030s, the new bond offers a yield pick-up of 70bp.

Rating Changes

- MercadoLibre Inc. Upgraded To Investment Grade On Stronger Credit Metrics And Operating Performance, Outlook Stable

- Fitch Upgrades Bulgaria to ‘BBB+’; Outlook Stable

- Bulgaria Upgraded To ‘BBB+’ On Confirmation Of Eurozone Accession; Outlook Stable

- Rayonier Inc. Upgraded To ‘BBB’ On Completed New Zealand Joint Venture Sale; Outlook Stable

- TechnipFMC PLC Outlook Revised To Positive; ‘BBB-‘ Ratings Affirmed; Assigned ‘A-3’ Short-Term Rating

- Fitch Revises Chesnara’s Outlook to Stable; Affirms IFS at ‘A’

Term of the Day: Quantitative Tightening

Quantitative Tightening (QT) is a contractionary monetary policy measure used by central banks to decrease the amount of liquidity or money supply in the economy. This is the opposite of quantitative easing (QE) whic tries to increase the liqudidity and money supply. This typically takes place via the central bank’s balance sheet normalization policy where it reduces the pace of reinvestment of proceeds from maturing government bonds, ABS and other securities that it bough during the period when it conducted QE.

Talking Heads

On India Widening Global Funds’ Access to $639 Billion Credit Market

Sachin Shah, Standard Chartered India

“There are lot of investors globally who would prefer to come through the TRS route and we have seen good volume growth through our GIFT City branch”

K Rajaraman, IFSCA

“We will soon be floating a consultation paper in this regard”

On Japan Wooing Capital as Tariffs Spur Diversification – Ben Ferguson, Pimco Japan

Donald Trump’s policy announcements have been “disruptive” and the latest tariff announcements “highlight the need to, at least consider diversification…this is one of the most dynamic moments that we’ve seen in this economy for the better part of the last three decades”

On More Junk Firms Struggling to Repay Debts – Oksana Aronov, JPMorgan

“they’re resorting to more inventive ways of paying their interest… As defaults rise, credit investors are finding they can salvage less when deals blow up than they have done in the past…There’s value in shorts and credit protection…It is very undervalued today because of the complacency in the market”

Top Gainers and Losers- 11-Jul-25*

Go back to Latest bond Market News

Related Posts: