This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Trump Plans to Announce 50% Tariff on Copper Imports; Mapletree, Nissan Launch Bonds; Alinma Bank, BBVA Price Bonds

July 9, 2025

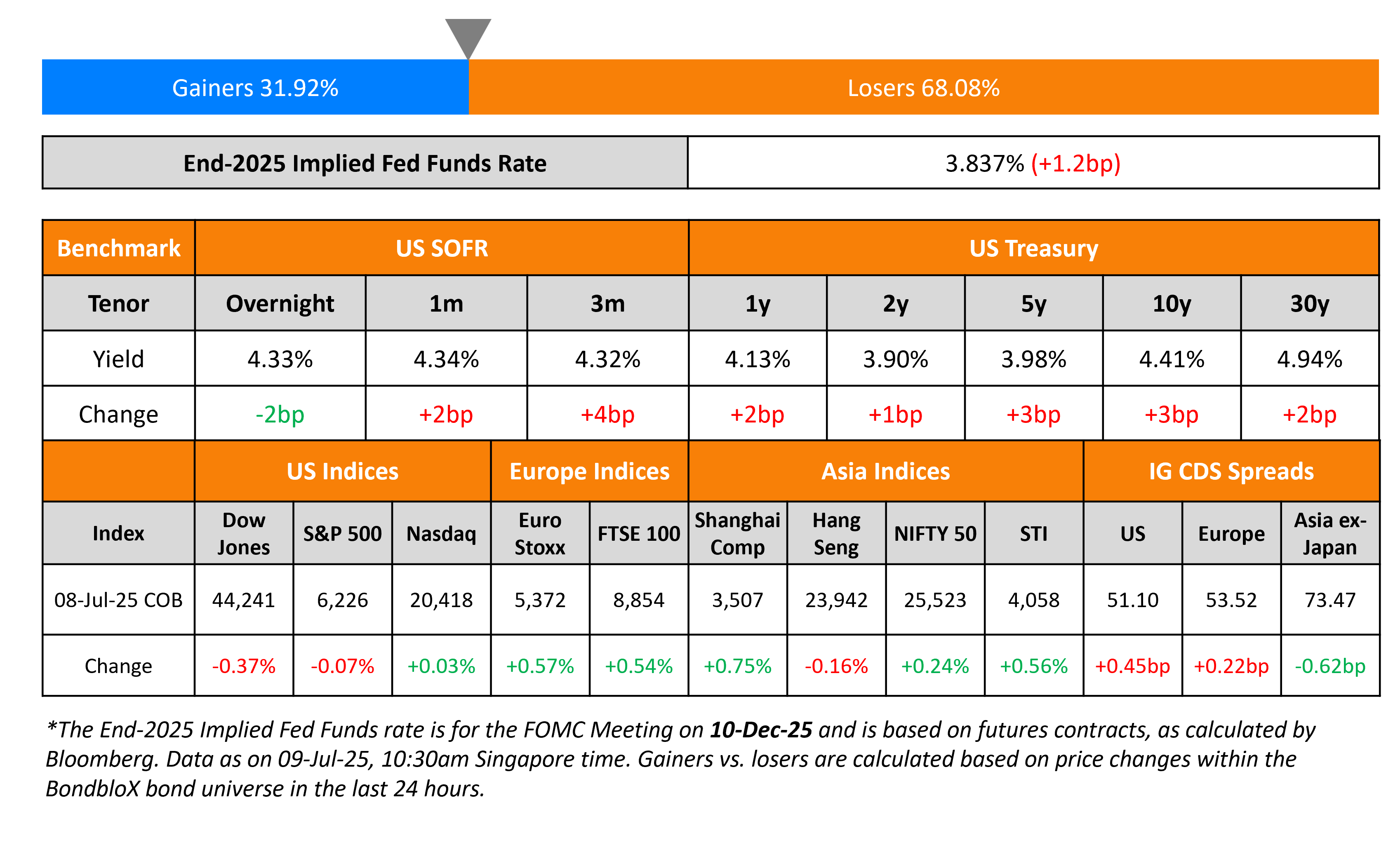

US Treasury yields rose by ~3bp across the curve on Tuesday with no major economic data released. US President Donald Trump said that he plans to announce a 50% tariff on all copper imports, which saw the base metal’s prices jump higher by 14%, posting its best day in nearly four decades. Besides, he also said that he would soon announce tariffs on pharmaceutical imports “at a very, very high rate, like 200%”. The Federal Reserve’s June meeting minutes will be released tonight.

Looking at US equity markets, the S&P and Nasdaq ended nearly unchanged. US IG and HY CDS spreads widened by 0.5bp and 1.5bp respectively. European equity markets ended higher. The iTraxx Main and Crossover CDS spreads widened by 0.2bp each. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were tighter by 0.6bp.

New Bond Issues

-

Mapletree S$ 15Y at 3.3% area

- Nissan $ 5Y/7Y/20Y at Mid-7/High-7/Low-8% area

Alinma Bank raised $500mn via a 5Y sukuk at a yield of 4.937%, 35bp inside initial guidance of T+130bp area. The senior unsecured note is rated A-/A- (S&P/Fitch), and received orders of over $1.9bn, 3.8x issue size. Proceeds will be used for general banking purposes.

BBVA raised €1bn via a 5Y bond at a yield of 3.148%, 25bp inside initial guidance of T+110bp area. The senior non-preferred note is rated Baa2/BBB+/BBB+, and received orders of over €2.6bn, 2.6x issue size. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

-

Trafigura hires for $ 5Y bond

- Port of Newcastle hires for A$ 8Y/10Y bond

- EnfraGen hires for $ 7NC3 bond

Rating Changes

Term of the Day: Policy-based Guarantee

A policy-based guarantee is an instrument, often provided by development banks like the World Bank, that mitigates risk for lenders, typically commercial banks, when they provide loans to a country, especially for budgetary support and policy reforms. Unlike project-based guarantees, these are not tied to specific investment projects, but rather to broader government programs which aim at promoting growth, reducing poverty etc.

Talking Heads

On Preferring European Government Bonds Over US Treasuries – BlackRock

Jean Boivin & Wei Li

“We prefer euro area government bonds and credit over the US…Yields are attractive, and term premium has risen closer to our expectations relative to US Treasuries.”

“Monetary policy in Japan needs to be vigilant not to be left behind the curve…another couple of rate hikes won’t materially change the easy monetary conditions in Japan…BOJ faces heightened uncertainty caused by Trump 2.0…Firms find it easier to pass on higher costs…This runs the risk of inflation expectations overshooting.”

On Flagging Risks to German Bonds as Spending Surge Looms

George Cole & Friedrich Schaper, Goldman Sachs

“Absent tariff fears and potential safe haven flows, bund yields would price a substantially bigger impact from the fiscal expansion,”

Ven Ram, Markets Live Strategist

“An increase in long-dated yields makes the securities more compelling in the current global macroeconomic backdrop around fiscal spending. The euro zone is probably the only region across the developed world where inflation is well under control.”

Top Gainers and Losers- 09-Jul-25*

Go back to Latest bond Market News

Related Posts: