This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Trump Passed Tax Cut & Spending Bill into Law; GuocoLand, Shinhan Financial Launch Bonds; Azerbaijan Upgraded to Baa3

July 7, 2025

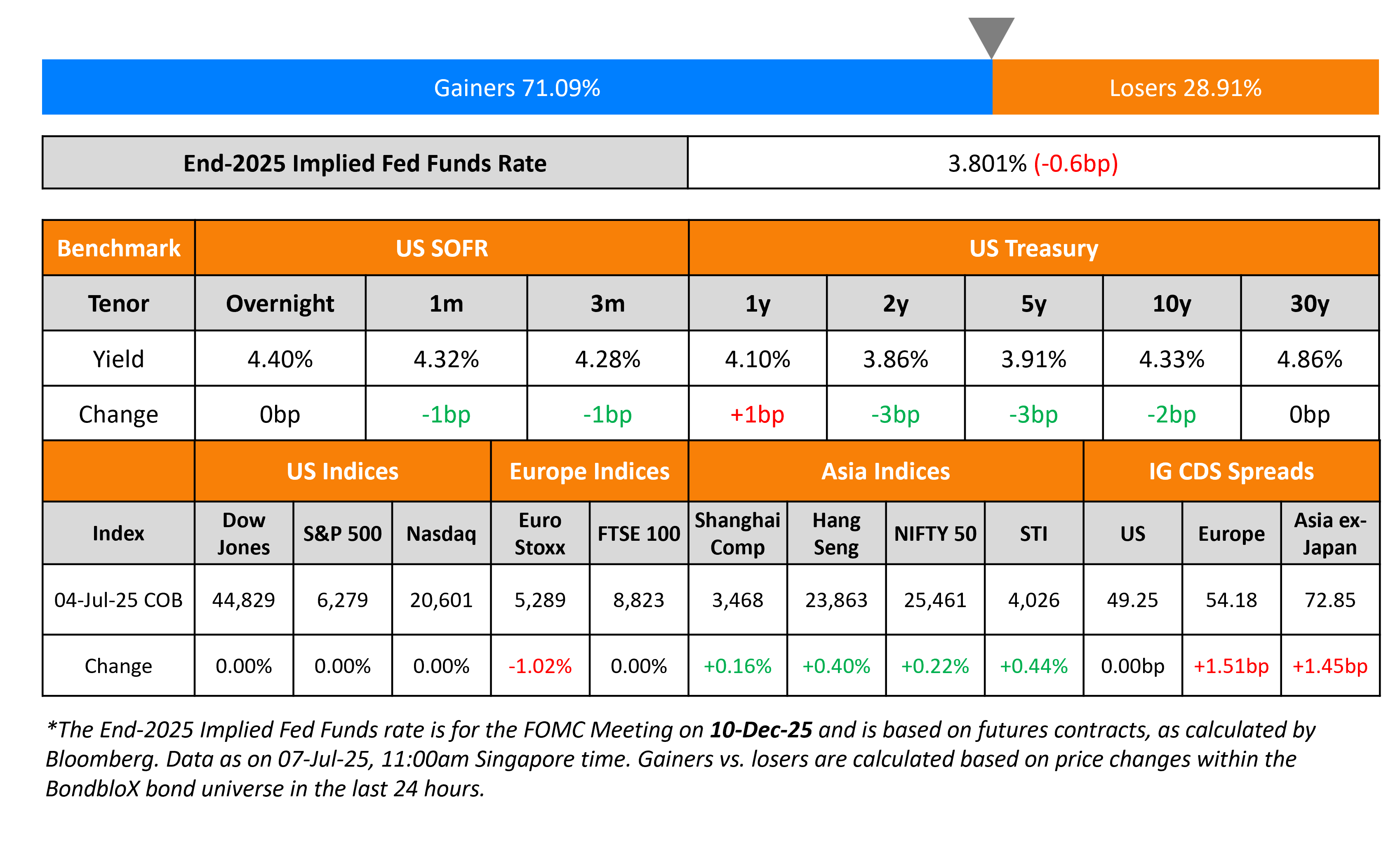

US equity and bond markets were closed on Friday on account of their Independence Day holiday. US Treasury yields have opened 2-3bp lower today. US President Donald Trump said that he has signed letters to 12 countries detailing the various tariff levels they would face on goods they export to the US. He said that the “take it or leave it” offers will be sent out on Monday. Separately, Trump also passed his signature tax cut and spending bill into law on Friday.

European equity markets ended lower. The iTraxx Main CDS spreads widened by 1.5bp while Crossover CDS spreads widened by 8bp. Asian equity markets have opened lower today. Asia ex-Japan CDS spreads were wider by 1.5bp.

New Bond Issues

- Shinhan Financial Group $ 5Y at T+90bp area

- GuocoLand S$ PerpNC5 at 4.35% area

New Bonds Pipeline

-

Trafigura hires for $ 5Y bond

- Riyad Bank hires for $ 10NC5 T2 bond

- Port of Newcastle hires for A$ 8Y/10Y bond

Rating Changes

- Moody’s Ratings upgrades Azerbaijan’s rating to Baa3, maintains positive outlook

- Fitch Downgrades Premier Foods’ Notes to ‘BB+’ on Security Release

Term of the Day: Greenshoe Option

A greenshoe option is an over-allotment in a security offering where the underwriter can sell more securities than the issuer initially planned if there is an oversubscription. Greenshoe options are known to be used in stock IPOs but can also be part of bond offerings.

Talking Heads

On Historic Gains for Developing World Debt

Edwin Gutierrez, Aberdeen

“I don’t think anyone had this much dollar weakness on their bingo card… thought local-currency debt would outperform hard-currency, but not by the magnitude that it ended up”

Lewis Jones, William Blair

“We expect more capacity from emerging central banks to cut rates, and also the trend of a weaker dollar versus the euro to continue. For European investors it could look more attractive”

Adriana Cristea, Pictet Asset

“We remain invested in Mexican bonos, the trade is not over for us”

On Inflation Outpacing BOJ’s View – Tsutomu Watanabe, University of Tokyo

“It’s beyond my expectation and very strong this year. There is no mistake that the BOJ will raise its forecast for this fiscal year… rate hike could take place at the end of this year or early next year… will be a slight upward revision for this year (in inflation).”

On ECB Rates in Good Place, Committed to 2% Goal – ECB President Christine Lagarde

“We have delivered, inflation is measured at 2%, and we will continue doing so… committed to that 2% target and we’ll do whatever it takes

Top Gainers and Losers- 07-Jul-25*

Go back to Latest bond Market News

Related Posts: