This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Trump Nominates Miran As Fed Governor; US 30Y Treasury Auction Saw Weak Demand

August 8, 2025

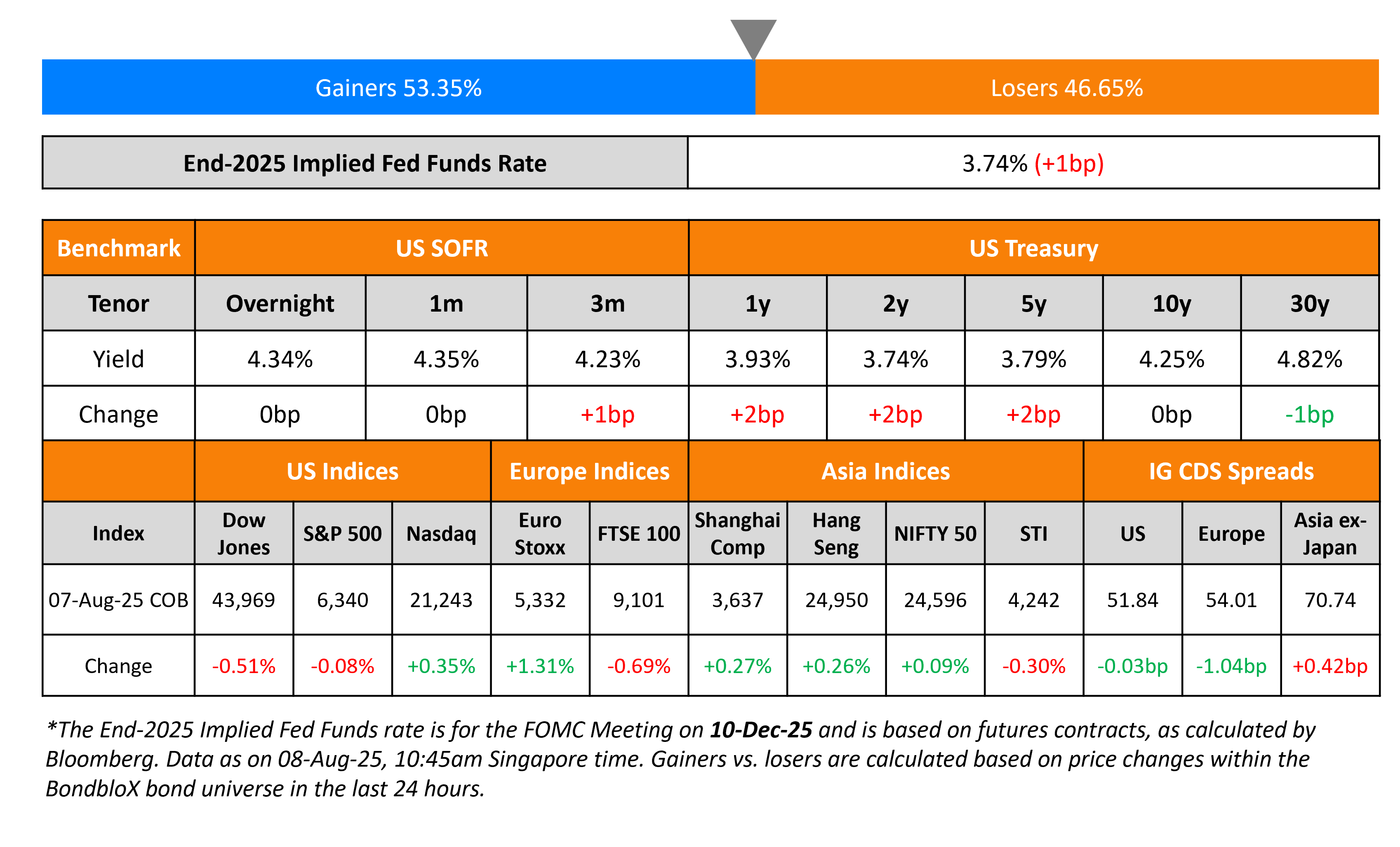

US Treasury yields inched higher on Thursday, led by the front-end. Initial Jobless Claims for the previous week saw a rise of 226k, worse than expectations of 222k. Separately, Fed governor Christopher Waller is said to among the top candidates to replace current Fed chairman Jerome Powell once the latter’s tenure ends. Also, US President Donald Trump has said he will nominate Stephen Miran as a temporary Fed governor, replacing Adriana Kugler who resigned last week. In related news, Atlanta Fed President Raphael Bostic indicated that he expects only one rate cut as likely by the end of the year, being skeptical about the nature of inflationary effects from tariffs. The US Treasury’s 30Y note auction saw soft demand, tailing by 2bp with a bid-to-cover of 2.27x, lower than the prior auction’s 2.38x.

Looking at US equity markets, the S&P closed lower by 0.1% while the Nasdaq ended 0.4% higher. US IG CDS spreads were flat while HY CDS spreads widened by 0.2bp. European equity markets ended mixed. The iTraxx Main and Crossover CDS spreads tightened by 1bp and 4.7bp respectively. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were 0.4bp wider.

New Bond Issues

New Bond Pipeline

- China Aircraft Leasing hires for $ bonds

Rating Changes

- Innovate Corp. Upgraded To ‘CCC’ On Extension Of Maturities; Outlook Negative

-

KeHE Distributors Holdings LLC Downgraded To ‘B’ On Sustained Higher Leverage; Outlook Stable

-

Moody’s Ratings affirms Mondelez’s Baa1 and other ratings; changes outlook to stable from positive

-

OHI Group S.A. Outlook Revised To Stable From Positive On Delayed Deleveraging; ‘B’ Ratings Affirmed

Term of the Day: Stagflation

Stagflation refers to a period of (stag)nant economic growth and high in(flation). It is an economic phenomenon when economic growth is stagnant and the unemployment rate and inflation are high. Stagflation is most commonly caused by supply shocks leading to higher commodity prices or monetary policies that increase money supply in the economy too quickly. An example of stagflation was in the US during the 1970s, when high inflation and high unemployment was at its peak on the back of a surge in commodity prices. Generally. monetary and fiscal policies are not effective at solving economic problems related to a supply side shock, hence it is tougher to get through a period of stagflation.

Wall Street companies including the likes of Apollo Global and BNY are warning about potential stagflation concerns amid the impact of tariffs.

Talking Heads

On Stagflation Concerns Rippling Through Wall Street as Tariffs Hit

Torsten Slok, Apollo Management

“The market is clearly expecting cuts, but the upside risks to inflation are significant…The bottom line is that the stagflation theme in markets is intensifying.”

Geoffrey Yu, BNY

“The still-evolving tariff region will prove stagflationary, both lowering growth and raising inflation,”

On Emerging Assets Gaining on Positive Signals on Trade, Ukraine Truce

Matthew Peacock, Aberdeen

“Semiconductor shares “have performed strongly today in view of the tariff exemption announcement…volatility will likely persist for the remainder of the year due to ongoing tariff uncertainties.”

On Investors Reacting to Miran Being Picked by Trump to be Fed Governor

Andrew Brenner, Natalliance Securities

“Our view is he is very controversial and will not pass the Senate. He will try to change the Fed. First he has no experience. No street. No business. Always politics.”

Robert Tipp, Pgim Fixed Income

“So far bashing the Fed this term has been fruitless…Presumably Miran’s appointment will have at least a marginal impact – but it will depend on the pliability of the rest of the committee members – which is certainly not a given.”

Ryan Sweet, Oxford Economics

“I don’t think it means too much in the context of altering the course of monetary policy.”

Top Gainers and Losers- 8-Aug-25*

Go back to Latest bond Market News

Related Posts: