This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Trump Announces ‘Ceasefire’ Between Israel & Iran; Frasers, Westpac, Nomura Launch New Bonds; Tenet Upgraded to BB-

June 24, 2025

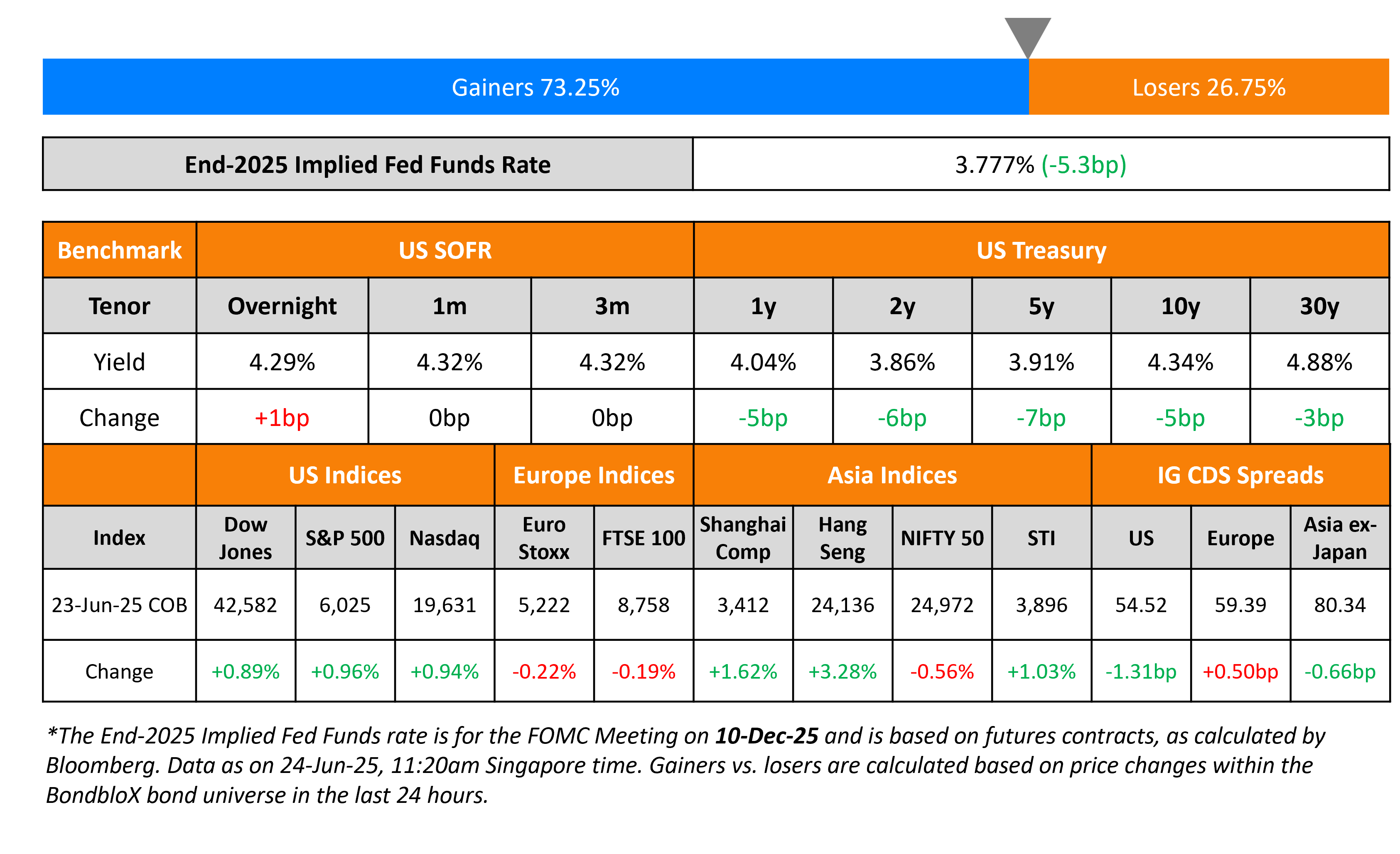

US President Donald Trump announced early this morning that he has mediated a ‘ceasefire’ between Israel and Iran. US Treasury yield fell, with the 10Y dropping by 5bp. The preliminary S&P Manufacturing PMI for June came in at 52.0, higher than expectations of 51.0. Fed Chairman Jerome Powell will testify before the House Financial Services Committee and the Senate Banking Committee later this week to justify to lawmakers why the FOMC has held rates steady thus far.

Looking at US equity markets, S&P and Nasdaq jumped higher by 0.96% and 0.94% respectively on Monday. In credit markets, US IG CDS spreads and US HY CDS spreads tightened by 1.3 and 5.5bp respectively. European equity markets closed lower. The iTraxx Main CDS spreads and Crossover CDS spreads widened by 0.5bp and 3.1bp respectively. Asian equity markets have opened higher today, with HSI up by 1.95% at the time of writing. Asia ex-Japan CDS spreads tightened by 0.7bp.

New Bond Issues

- Frasers Centrepoint S$200mn PerpNC5 capped at 4.25% area

- Westpac $ 5Y/5Y FRN at T+70-75bp area/SOFR Equiv

- Nomura $ PerpNC5.5 at 7.75% area, $ 5Y/10Y at T+130-135/150-155bp

- Sembcorp S$ 20.5Y at 3.8% area

- Toyota $ 2Y/5Y/10Y at T+65/95/105bp area

BNP Paribas raised $1.5bn via a PerpNC10 AT1 bond at a yield of 7.45%, 55bp inside initial guidance of 8% area. The junior subordinated note is rated Ba1/BBB-/BBB (Moody’s/S&P/Fitch). If not called by 27 June 2035, the coupon will reset to the 5Y US Treasury yield plus 313.4bp. A trigger event will occur if at any time the Group’s CET1 Ratio is less than 5.125%. Below is a table comparing BNP’s latest AT1 issuance with its European peers, sorted by yield-to-call.

-2.png)

Commerzbank raised €750mn via 12NC7 green Tier 2 bond at a yield 4.193%, 32bp inside the initial guidance of MS+215bp. The subordinated note is rated Baa3/BBB-, and received orders of €2.1bn, 2.8x the issue size. The bonds carry an annual coupon of 4.125%. If not called by 30 June 2032, the coupon will reset to 5Y MS + 183bp. Net proceeds will be exclusively used to finance or refinance new and existing green assets.

Mexico raised $4.5bn debt in a two-tranche deal. It raised:

- $2.5bn via 7Y bond at a yield of 5.859%, 35bp inside initial guidance of T+210bp area

- $2bn via 12Y bond at a yield of 6.642%, 35bp inside initial guidance of T+265bp area

These senior unsecured notes are Baa2/BBB/BBB- rated. Proceeds will be used to retire outstanding debt, fund redemption of all of its 4.125% 2026s and for general purposes.

JBS USA raised $3.5bn debt in a three-tranche deal. It raised:

- $1.25bn via 10Y bond at a yield of 5.572%, 25bp inside the initial guidance of T+150bp area

- $1.25bn via 30Y bond at a yield of 6.265%, 30bp inside the initial guidance of T+170bp area

- $1bn via a 40Y bond at a yield of 6.415%, 35bp inside the initial guidance of T+190bp area

These senior unsecured notes are Baa3/BBB-/BBB- rated. Proceeds will be used to pay for tender offer of the outstanding 2028s and repay all outstanding short-term unsecured notes.

Piraeus Bank raised €400mn via a PerpNC5.5 AT1 bond at a yield of 6.75%, 50bp inside initial guidance of 7.25% area. The junior subordinated bond is rated B1 (Moody’s). If the bond is not called by 30 December 2030, the coupon will reset to 5Y Mid-Swaps plus 459.6bp. A trigger event will occur if at any time, the CET1 ratio (either on consolidated or individual basis) falls below 5.125%. Proceeds will be used by the Issuer for general corporate and financing purposes of the Group and to further strengthen its capital base and capital adequacy ratios.

Turk Eximbank raised $500mn via a 3Y bond at a yield of 7%, 50bp inside initial guidance of 7.5% area. The senior unsecured bond is rated B1/BB- (Moody’s/Fitch). Proceeds will be used for general corporate purposes.

KT Corp raised $500mn via a 3.5Y bond at a yield of 4.522%, 38bp inside initial guidance of T+110bp area. The senior unsecured note is rated A-/A. Proceeds will be used for general corporate purposes.

Royal Bank of Canada (RBC) raised €750mn via a 6.25NC5.25 green bond at a yield of 3.195%, 20bp inside initial guidance of MS+115bp area. The senior unsecured bond is rated A1/A/AA-. Proceeds will be used to for green purposes in accordance with the issuer’s Sustainable Bond Framework dated June 2020.

Rating Changes

- Tenet Healthcare Corp. Upgraded To ‘BB-‘ From ‘B+’ On Improved Performance

-

Ineos Group Petrochemical Co. Ratings Lowered To ‘BB-‘ On Sustained High Leverage; Outlook Stable

- NTT Downgraded To ‘A-‘ On Acquisition Of NTT Data Through Tender Offer; Outlook Negative

Term of the Day: Trigger Event

Triggers, or trigger events are an important feature of contingent convertible (CoCo) or additional tier 1 (AT1) bonds and define when the loss absorption mechanism is activated. Triggers can either be mechanical or discretionary. Mechanical triggers are numerically defined and most commonly refer to the bank’s capital ratio level. Discretionary triggers, also known as point of non-viability (PONV) triggers are based on supervisors’ judgement of the bank’s solvency position. On occurrence of a trigger event, an AT1’s loss absorption mechanism kicks in, which may include a conversion to equity and/or a principal write-down, both of which boost the bank’s capital position.

Talking Heads

On Investors Rushing to Pour Cash Into $7.4 Trillion US Money-Market Fund Industry

Deborah Cunningham, Federated Hermes

“Inflows have continued even as the industry sees some investors embrace alternatives, such as ultra-short funds in the fixed income or equities”

Michael Bird, Allspring Global

“Even if the Fed picks up its easing campaign this year, rates will still be relatively high…the expectation is when the debt ceiling gets resolved, there will be a significant increase in bill issuance, which helps yields”

On Young Investor Demanding for Alternative Assets

Mark Steffen, Wells Fargo Investment Institute

“Some advisors may have just used the 60/40 portfolio over time…But I think that’s probably changing.”

Brian Werner, Winthrop Partners

“most often easier to convince an entrepreneur to put money into a 1-in-10 shot startup than it is to get them to park money in a conservative, long-term strategy,”

Michael Pelzar,BofA

“You’ve got this mix of investor preferences and product availability evolving in a way that they actually compliment each other”

On Companies Looking to Borrow Before Yields Rise on Iran Retaliation

Winifred Cisar, CreditSights Inc

“Even as uncertainty remains a defining factor in markets, borrowing costs have come down for both spread and coupon issuers”

Pauline Chrystal, Kapstream Capital

“If we are adding credit, we would need a decent concession as a buffer to additional volatility,”

Top Gainers and Losers- 24-Jun-25*

Go back to Latest bond Market News

Related Posts: