This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Trump Announces 90-Day Tariff Pause

April 10, 2025

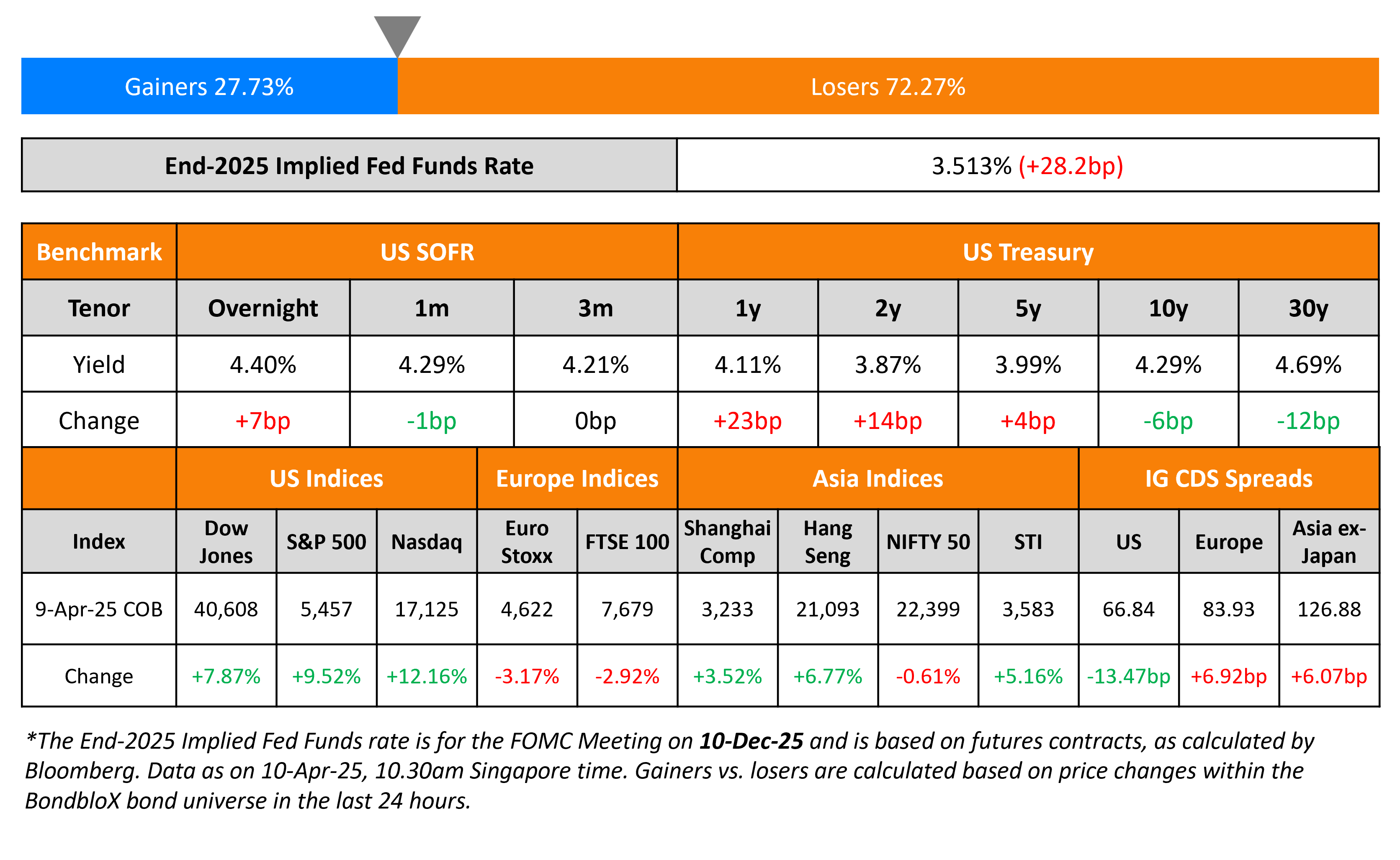

The US Treasury curve bear flattened yesterday with the 2Y yield rising by 14bp while the 10Y yield was 6bp lower. US President Donald Trump announced a 90-day pause on the reciprocal tariff imposition for more than 75 countries. Over this period, these countries will be charged a “substantially lowered reciprocal tariff” of 10%, he noted. However, he raised tariffs on China to 125%, after China had retaliated by raising its own tariffs on US imports to 84%. Separately, the FOMC’s March meeting minutes showed that uncertainty around the economic outlook had increased, with inflation risks tilted to the upside and employment risks tilted to the downside.

Looking at US equity markets, the S&P and Nasdaq skyrocketed, closing 9.5% and 12.2% higher. Looking at credit markets, US IG and HY CDS spreads tightened by 13.5bp and 70bp respectively. European equity markets ended lower. The iTraxx Main and Crossover CDS spreads widened by 6.9bp and 34bp respectively. Asian equity markets have opened in the green this morning. Asia ex-Japan CDS spreads were wider by 6.1bp.

New Bond Issues

Rating Changes

-

Fitch Upgrades Meituan to ‘BBB+’; Outlook Positive

-

Macy’s Retail Holdings LLC’s Downsizes ABL Facility, Debt Recovery Rating Improves

-

Moody’s Ratings withdraws Allianz S.p.A.’s rating at issuer’s request

Term of the Day: Private Placement

A private placement is a sale of securities directly to select private investors, rather than issuing them via a public offering. Investors in privately placed bonds generally comprise large banks, mutual funds, or insurance companies. The advantage of private placements is that they may not be subject to the same strict regulations regarding disclosure and reporting of public offerings. Also, the cost and time savings add to its attractiveness. On the other hand, they may carry a higher rate to entice investors and they limit the number and variety of investors that can take part unlike public offerings. Unlike bonds issued via public offerings, privately placed bonds may not trade on the secondary market.

Talking Heads

On US corporate bond market dries up on Trump tariff volatility

Dan Krieter, BMO Capital Markets

“Risk sentiment is once again sharply lower this morning, likely keeping any borrowers on the sidelines as issuers continue to wait for any semblance of calm that remains elusive”

Natalie Trevithick, Payden & Rygel

“But it feels like the spread widening has finally caught up with the equity rally we saw earlier, and I’d say we might get a little bit of stabilization”

On Seeing Fed Intervention If Market Turmoil Lasts – Apollo Global CEO, Marc Rowan

“During Covid, the Fed was buying $100 billion of Treasury bonds a day… Those deals that involve non-tariff barriers, particularly with the EU, will be much harder to make and will take longer… ase case tells me that I expect the administration to resolve the financially oriented tariff deals over the near-term”

On ‘Normal Deleveraging’ in Bonds – US Treasury Secretary, Scott Bessent

“There’s one of these deleveraging convulsions that’s going on right now in the markets… There are some very large leverage players who are experiencing losses — that are having to deleverage… there is nothing systemic about this — I think that it is an uncomfortable but normal deleveraging”

Top Gainers and Losers- 10-April-25*

Go back to Latest bond Market News

Related Posts: