This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Yields Tick Lower

January 27, 2025

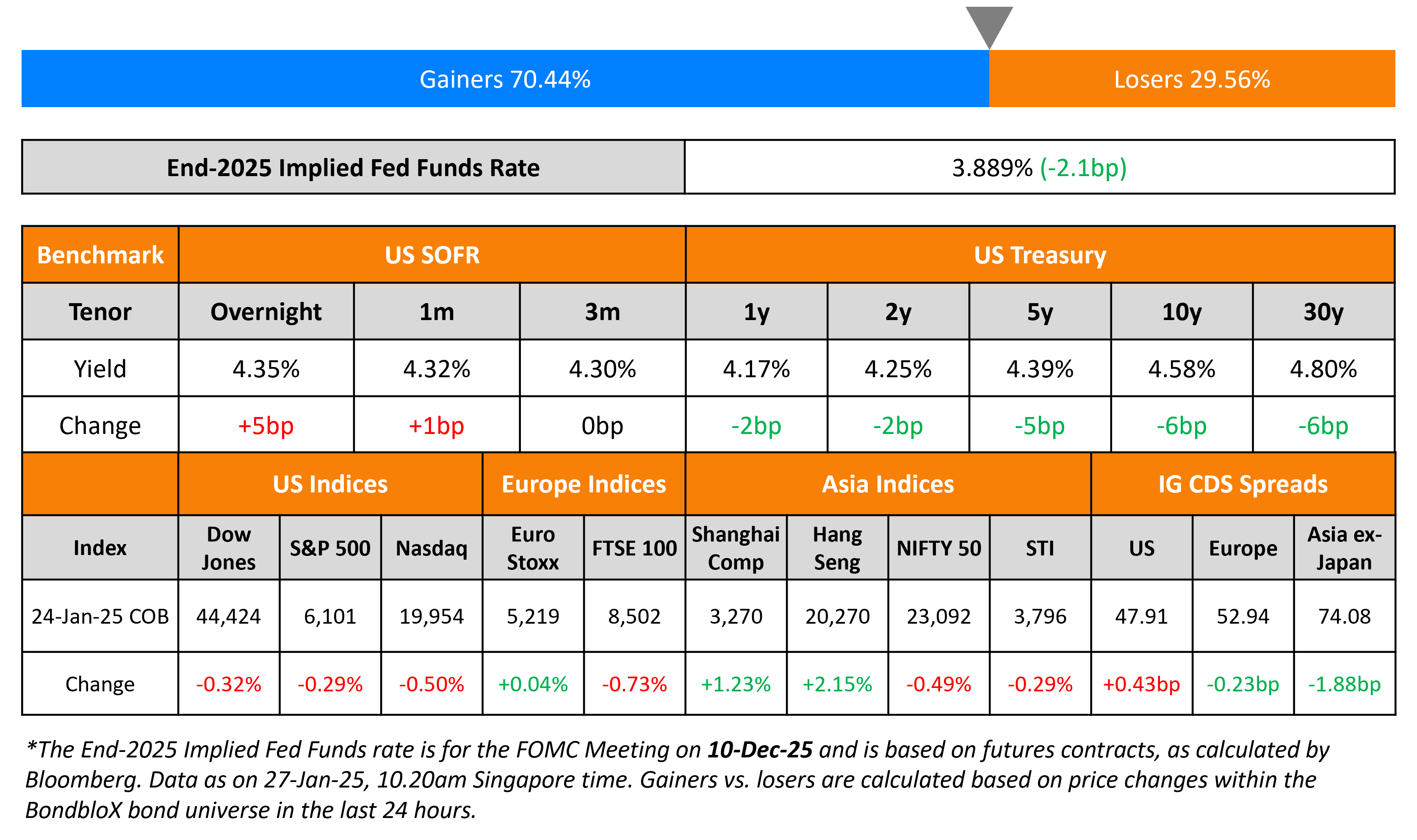

The US Treasury curve bull steepened with the 2Y yield down 2bp while the 10Y yield fell 6bp. The preliminary US S&P Manufacturing PMI edged higher to 50.1 in January vs. 49.4 a month ago. However, the Services PMI fell to 52.8 vs. 56.8 a month prior. Similarly, the composite PMI declined to 52.4 from 55.4. Separately, the Michigan consumer sentiment index for January decreased to 71.1 from 74.0.

US IG and HY CDS spreads widened by 0.4bp and 2bp respectively. US equity markets ended higher, with the S&P and the Nasdaq up by 0.3% and 0.5% respectively. European equities ended higher too. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.2bp and 0.5bp respectively. Asian equities have opened broadly lower this morning. Asia ex-Japan CDS spreads were 1.9bp tighter.

New Bond Issues

Rating Changes

-

Moody’s Ratings upgrades Argentina’s ratings to Caa3; changes outlook to positive from stable

-

Ukrainian Railways JSC Ratings Raised To ‘CCC-‘ On Coupon Payments; Outlook Negative

-

Fitch Downgrades Gabon to ‘CCC’

-

Fitch Downgrades Bolivia to ‘CCC-‘

-

Selecta Group AG Downgraded To ‘CCC-‘ Due To Delayed Interest Payment; Ratings Placed On CreditWatch Negative

-

Moody’s Ratings changes Kenya’s outlook to positive from negative; affirms Caa1 ratings

-

Moody’s Ratings revises Samsung Electronics’ outlook to negative; affirms Aa2 rating

-

Romania ‘BBB-/A-3’ Ratings Affirmed; Outlook Revised To Negative From Stable On Higher Fiscal And External Risks

Term of the Day: Sukuk

A Sukuk is a sharia-compliant fixed income instrument that essentially works similar to bonds. In a Sukuk, key differentiators vs. conventional bonds are:

– Investors share partial ownership of an asset rather than it being a debt obligation by the issuer

– The pricing is based on the underlying value of assets rather than credit worthiness

– The holder receives a share of underlying profits rather than interest payments (considered ‘riba’)

Sharia compliance broadly implies that any profits derived from these funding arrangements must be derived from commercial risk-taking and trading only; that interest income is prohibited on lending activities and; that the assets must be halal.

Talking Heads

On probably time to invest in Europe

Larry Fink, BlackRock

“There’s too much pessimism on Europe. I believe it’s probably time to be investing back into Europe… I can see a scenario, I am not calling for it, where we see 5.5% on the 10Y (US) yields”

ECB President Christine Lagarde

“If European leaders can get their act together and respond to this existential threat, there is a huge potential for Europe to respond to the call”

On Better Stock Breadth as Fed Rates Diverge – BofA Strategists

Equity breadth is “still poor”… “virtuous cycle” in the US of higher equity prices translating to more wealth, which is then recycled again into risk assets.

On World inflation not fully defeated yet – IMF’s Kristalina Georgieva

“The head of the genie is in the bottle, most of the body of the genie is in the bottle, kind of getting stuck there, but the legs are kind-of hanging still out… need to push it all the way down”

Top Gainers and Losers- 27-January-25*

Go back to Latest bond Market News

Related Posts: