This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Yields Tick Higher; SBL Holdings Prices $ Bond

September 22, 2025

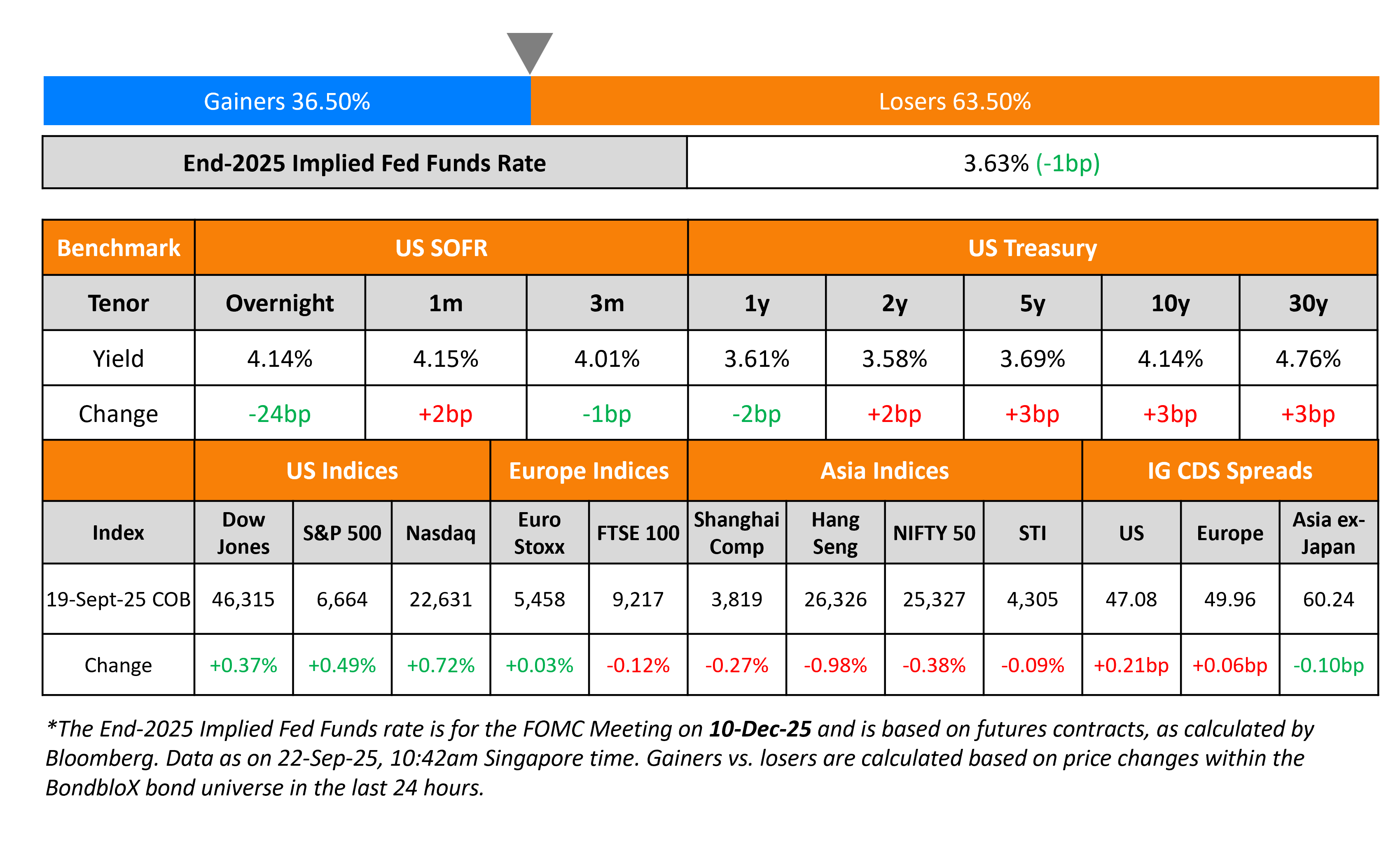

US Treasury yields ticked higher by ~3bp on Friday. US President Donald Trump signed an executive order to add a $100k fee for new applicants to the H-1B visa programme. Separately, Minneapolis Fed President Neel Kashkari said that the FOMC’s September move was an insurance rate cut to “keep the labor market from falling dramatically”.

Looking at US equity markets, the S&P and Nasdaq closed higher by 0.5% and 0.7% respectively. US IG and HY CDS spreads were wider by 0.2bp and 1.2bp respectively. European equity markets ended mixed. The iTraxx Main CDS and Crossover spreads were 0.1bp and 0.8bp wider respectively. Asian equity markets have opened broadly weaker today. Asia ex-Japan CDS spreads were 0.1bp tighter.

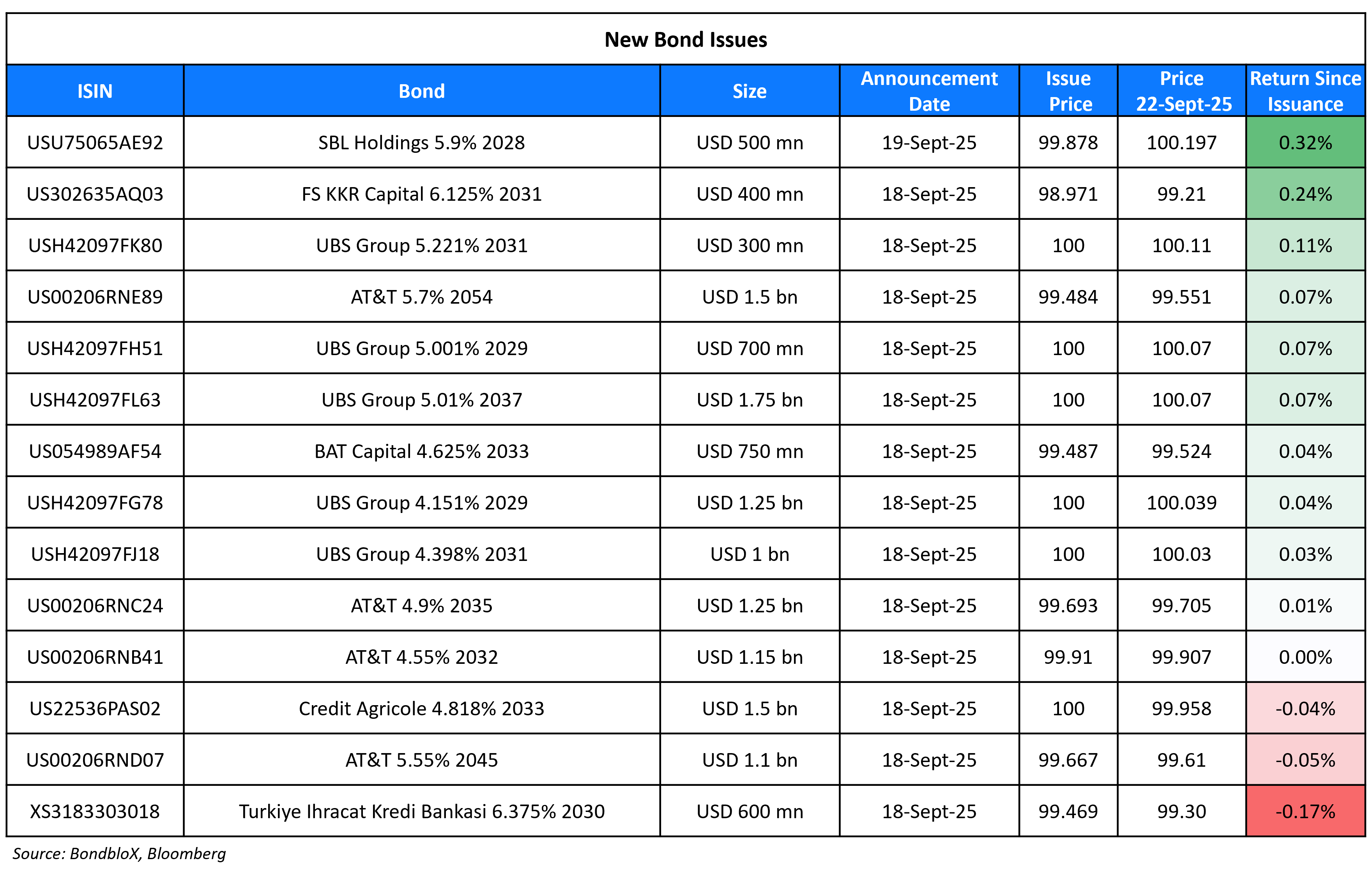

New Bond Issues

- China Minsheng Banking HK $ 3Y FRN atSOFR+110bp area

SBL Holdings raised $500mn via a 3Y bond at a yield of 5.945%, ~18.75bp inside initial guidance of T+250/262.5bp area. The senior unsecured note is rated BBB/BBB-, and has a change of control put at 101. Proceeds will be used to redeem its 5.125% 2026s. Any remaining proceeds will be used for general corporate purposes.

New Bond Pipeline

- Seazen plans $250mn issuance

- China Ping An $ bond issuance

- Mirae Asset Securities $ 3Y/5Y

- Guangxi Communications Investment $ 2Y bond

Rating Changes

-

Moody’s Ratings downgrades Suedzucker to Baa3/ P-3 ; Stable outlook

-

Moody’s Ratings downgrades Getty Images, Inc.’s credit ratings by one notch; outlook remains stable

-

Moody’s Ratings changes Poland’s outlook to negative from stable, affirms A2 ratings

-

Moody’s Ratings changes outlook on Rwanda to stable from negative; affirms B2 rating

Term of the Day: Hostile Takeover

A hostile takeover is an M&A strategy used by the potential buyer to directly go to the target company’s shareholders by making a tender offer or through a proxy vote. This is in contrast to a friendly takeover wherein, the target company’s board approves of the takeover and recommend shareholders vote in favor of it. Target companies can use anti-takeover strategies like poison pills, golden parachutes etc.

Talking Heads

On Traders Seeing Fed Cuts Powering EM Bond Rally After a 15% Gain

Patrick Campbell, Morgan Stanley

“There’s definitely clear interest that people want to allocate to something that’s non dollar,”

Nathan Thooft, Manulife Investment

The Fed’s actions “continue to support the view for a weaker US dollar and lower rates looking forward…Both of which are supportive of emerging-market equities and debt.”

Cathy Hepworth, PGIM

The current environment “continues to be supportive of emerging markets…The direction of travel is clear.”

On ECB at ‘Good Equilibrium,’ No Need to Ease More – Yannis Stournaras, ECB

“We’re data dependent — if we find in our monetary-policy meetings that things have changed, we’ll change as well…it would take a substantial change in our outlook to change our position…If there are risks, they’re slightly more on the downside rather than on the upside…But these risks aren’t severe enough to justify another cut at this moment. The baseline prevails.”

On Private Credit Facing ‘Clear Signs’ of Rising Stress – BofA

Losses have increased since the Federal Reserve started raising interest rates in 2022, “suggesting portfolio companies continue to struggle with interest costs”…As rates aren’t expected to drop to 2021 levels, these “problem vintages are likely to trigger further credit losses,”

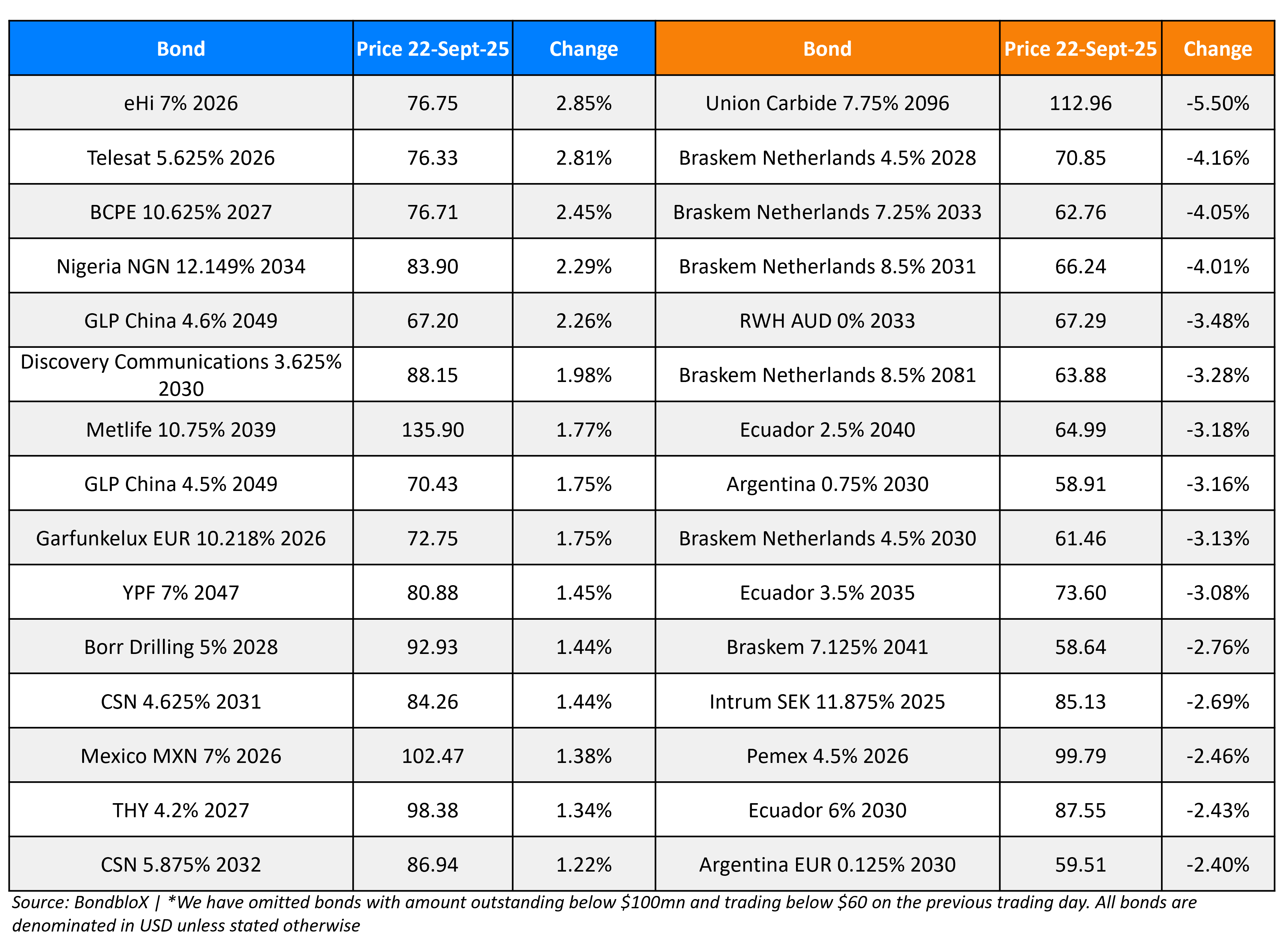

Top Gainers and Losers- 22-Sep-25*

Go back to Latest bond Market News

Related Posts: