This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

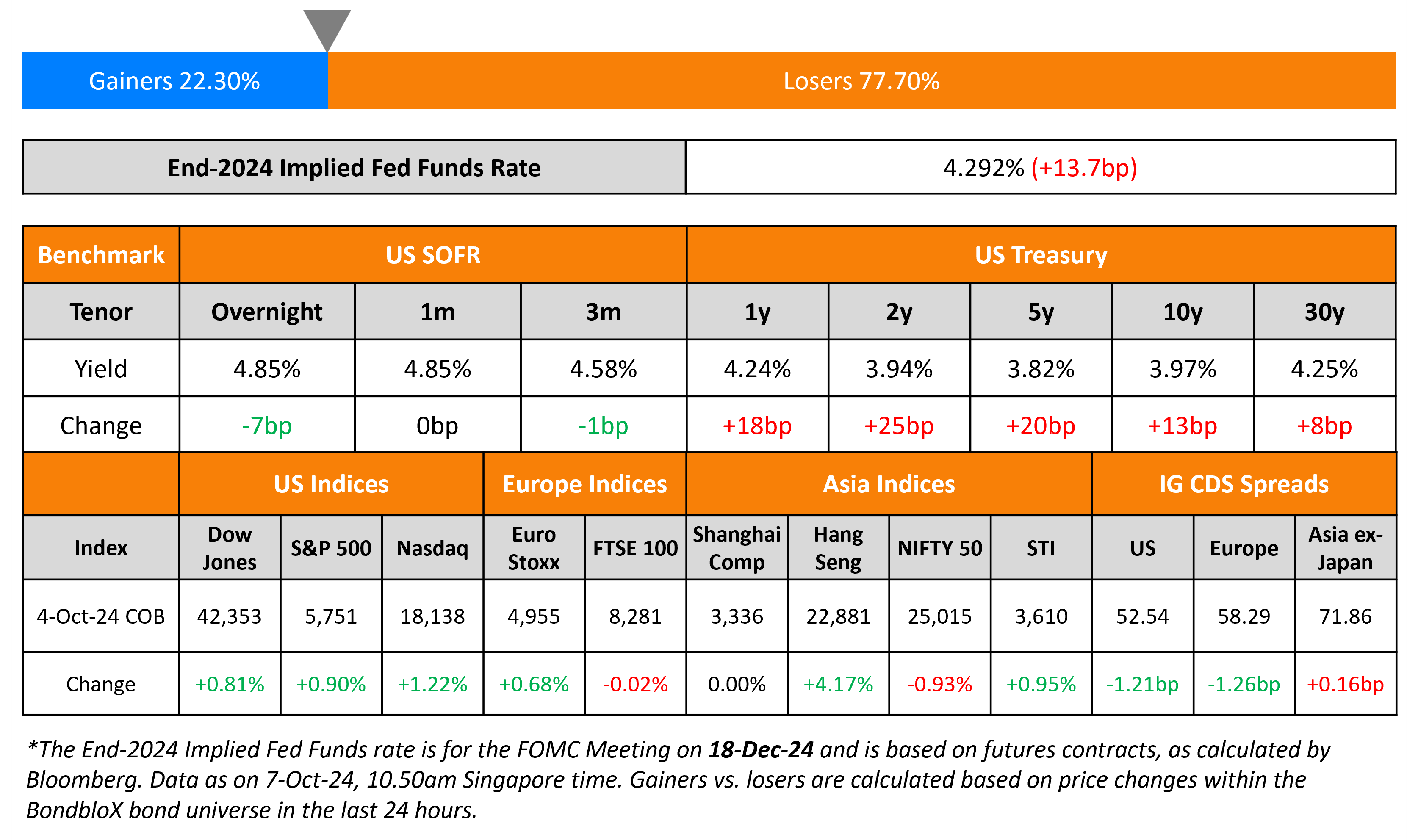

Treasury Yields Soar on Strong US Jobs Report

October 7, 2024

US Treasury yields surged higher across the curve, after the jobs report outperformed on all fronts. The 2Y yield jumped 25bp and the 10Y was up 13bp, as the curve bear flattened. US Non Farm Payrolls (NFP) for September saw a rise of 254K, higher than surveyed 147K. AHE YoY rose by 4.0%, higher than the surveyed 3.8%. and the Unemployment Rate stood at 4.1%, lower than surveyed 4.2%. Chicago Fed President Austan Goolsbee said that while the jobs report was “superb”, he still saw rate cuts coming ahead. Markets are now pricing-in just about 50bp in rate cuts from now through end-2024. US IG CDS and HY CDS tightened by 1.2bp and 6bp respectively. Looking at US equity markets, S&P and Nasdaq both closed higher by 0.9% and 1.2% respectively.

European equities ended broadly higher. Looking at Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 1.3bp and 7.2bp, respectively. Asian equity indices have opened broadly lower this morning. Asia ex-Japan CDS spreads widened by 0.2bp.

New Bond Issues

New Bonds Pipeline

- Adani Hybrids Renewables hires for $ 20Y bond

Rating Changes

- Moody’s Ratings downgrades Senegal to B1, places ratings on review for downgrade

- Mongolia Ratings Raised To ‘B+’ On Robust Growth And Fiscal Consolidation; Outlook Positive

- Serbia Upgraded To ‘BBB-/A-3’ On Strong GDP Growth And Increased External Buffers; Outlook Stable

- Telefonica Moviles Chile S.A. Downgraded To ‘BB+’ From ‘BBB-‘ On Sustained Weaker Performance; Outlook Stable

- Aston Martin Lagonda Global Holdings PLC Outlook Revised To Negative On Continued Cash Burn; ‘B-‘ Rating Affirmed

Term of the Day

Formosa Bond

A Formosa bond is a bond that is issued in Taiwan by a foreign issuer that is denominated in a currency other than the New Taiwanese Dollar. It is a way for foreign issuers to raise capital in Taiwan. To qualify as a Formosa, borrowers must have credit ratings of BBB or higher. Formosa bonds are listed and traded on the Taipei Exchange.

Shinhan Bank raised $400mn via a 5Y green Formosa.

Talking Heads

50bp Rate Cut in September Was ‘A Mistake’ – Fmr US Treasury Secy, Larry Summers

“With the benefit of hindsight, the 50 basis point cut in September was a mistake though not one of great consequence… employment report confirms suspicions that we are in a high neutral rate environment where responsible monetary policy requires caution in rate cutting”

On No Longer Seeing a 50bp Fed Cut in November – JPMorgan, BofA

JPMorgan chief US economist Michael Feroli

“Today’s report should also make the Fed’s job easier”… would take a “rather large” in the lead-up to the Fed’s next gathering.. to move policymakers off”

BofA economist Aditya Bhave

“The risks to this figure are to the upside, given the string of data pointing to stronger productivity growth”

On Powell’s Outsized Influence Signaling Smaller Fed Cut – Aichi Amemiya, Nomura

“I do not think that the Fed is considering an additional 50 basis-point rate cut at the moment… Although it depends on incoming data, the Fed will skip lowering the rates in January and shift to quarterly rate cuts in 2025 (beginning March)”

Top Gainers & Losers 7-October-24*

Go back to Latest bond Market News

Related Posts: