This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

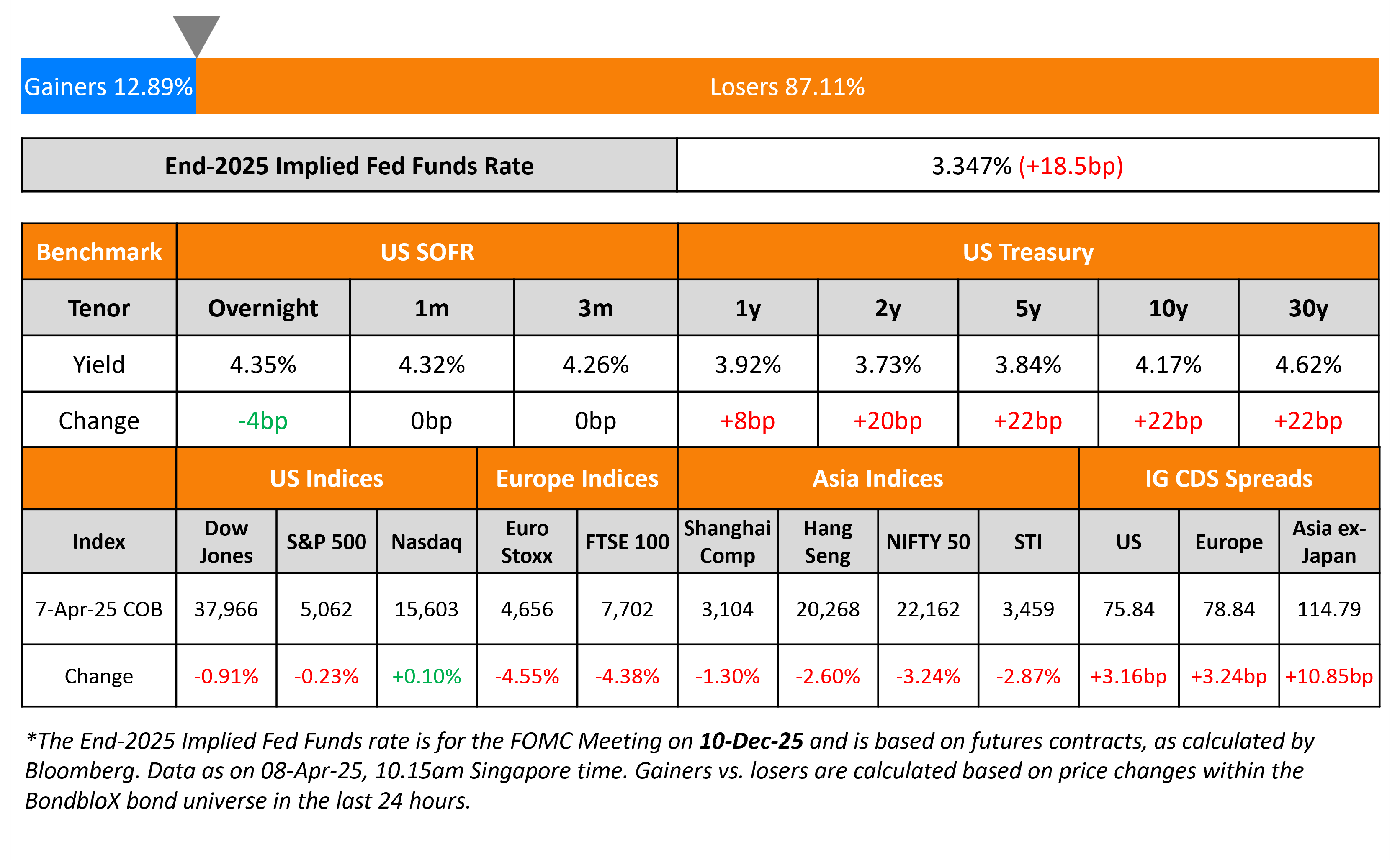

Treasury Yields Soar Higher by 20bp in Volatile Session;

April 8, 2025

US Treasury yields soared higher by over 20bp across the curve on Monday. US President Donald Trump said that he will impose an additional 50% tariff on China from April 9 if China does not go back on its retaliatory 34% tariffs. He added that the US would also terminate all talks with China, while starting negotiations with other countries.

Looking at US equity markets, the S&P closed 0.2% lower and Nasdaq was up 0.1%. Looking at credit markets, US IG and HY CDS spreads widened by 3.2bp and 21.1bp respectively. European equity markets ended sharply lower again. The iTraxx Main and Crossover CDS spreads widened by 3.2bp and 19.1bp respectively. Asian equity markets have opened in the green this morning. Asia ex-Japan CDS spreads were wider by 10.9bp.

New Bond Issues

Rating Changes

-

Alfa S.A.B. de C.V. Upgraded To ‘BBB’ From ‘BBB-‘ On Improved Leverage

-

Fitch Downgrades Kohl’s to ‘BB-‘; Outlook Negative; Removes UCO

-

Fitch Revises Volkswagen’s Outlook to Negative; Affirms IDR at ‘A-‘

-

Moody’s Ratings changes outlook on The Bahamas’ rating to positive from stable, affirms B1 rating

Term of the Day: Bear Steepening

Bear Steepening refers to a move in the yield curve where the longer-dated bond yields move higher than the shorter-dated bond yield (far maturity bonds sell-off more than near maturity ones). A bear steepening move can occur due to different reasons some of them being long term expectations of inflation picking up, higher supply of longer-dated bonds, central bank tapering purchases with a focus on the long-end bonds etc.

Talking Heads

On Credit Markets Paralyzed by Trade War, Putting Debt Deals on Ice

Steve Caprio, Deutsche Bank

“Credit volatility is back. Crippling policy uncertainty, haphazard tariff rate calculations, a partial loss of confidence in US institutional norms and rising inflation are all notably increasing US risks.”

Matt Brill, Invesco

“It’s going to be hard for credit spreads to get back to the tights that they were at previously”

Christian Hoffmann, Thornburg Investment

“All this uncertainty creates its own negative momentum”

On BlackRock Opting for Short-Term Treasuries amid Tariffs

“Policy uncertainty may weigh on growth and stocks in the near term – and the longer elevated uncertainty persists, the more damage it can do… We reduce equity exposure for now and allocate more to short-term US Treasuries”

On UBS Seeing US Credit Spreads Reaching Widest Level Since 2020

“Credit spreads can be volatile in the months heading into the start of a recession… And then you tend to get spreads to gap pretty aggressively… Our new baseline assumes most of the tariffs announced remain in place for about nine months”

Top Gainers and Losers- 08-April-25*

Go back to Latest bond Market News

Related Posts: