This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Yields Rise by 5bp After PPI; Rolls-Royce Upgraded; Spirit Airlines Downgraded

August 15, 2025

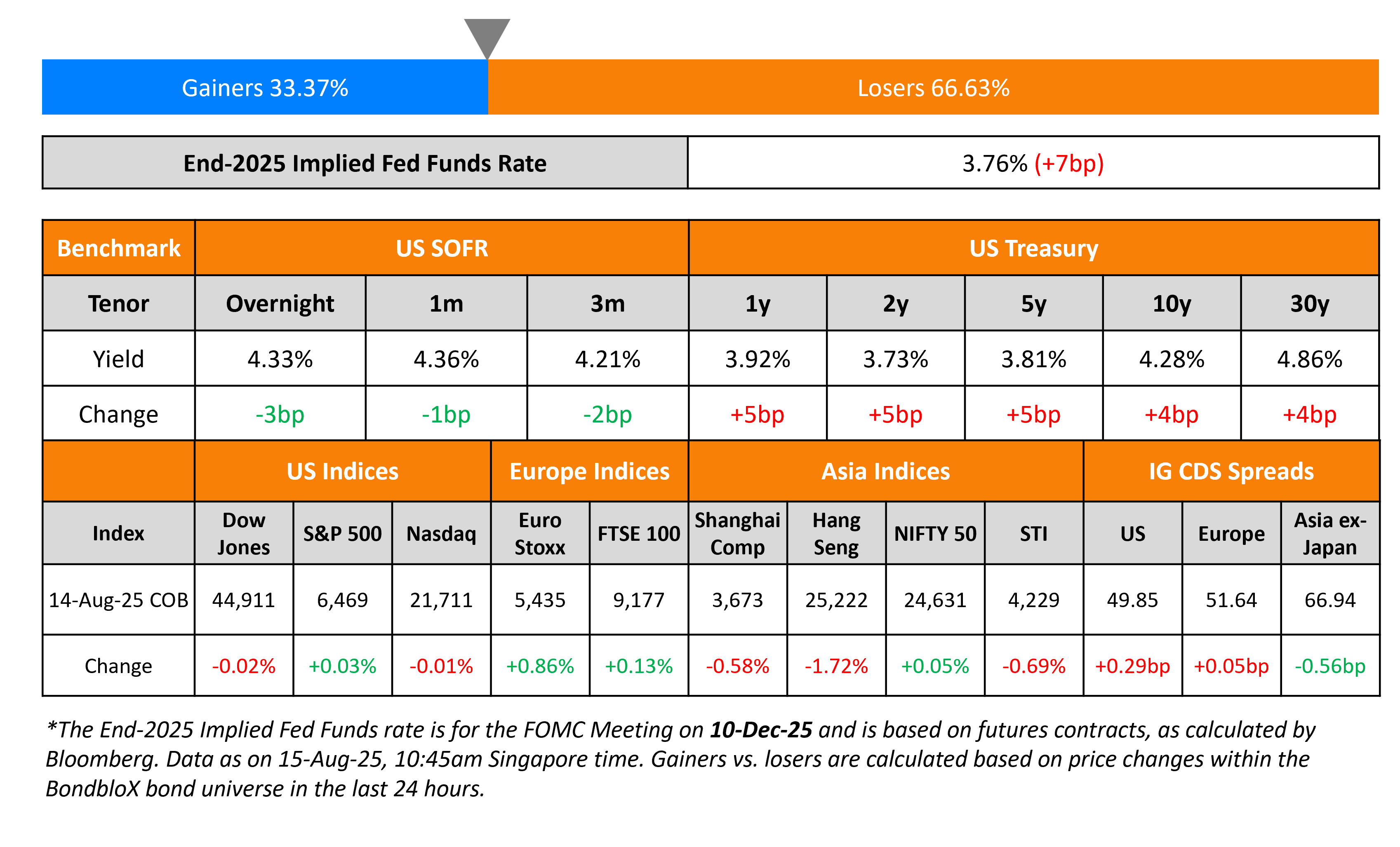

US Treasury yields rose by 5bp across the board after the US Producer Price Index (PPI) reading surprised market expectations. The Headline PPI print jumped by 3.3% YoY in July, stronger than the surveyed 2.5%. Core PPI rose 3.7%, again much stronger than the surveyed 3.0%, showing that some inflationary pressure still persist. Besides, initial jobless claims for the prior week rose by 224k, slightly better than expectations of 225k. Among Fed speakers, San Francisco Fed President Mary Daly said that she does not see a need for a 50bp rate cut in September noting that it might “send off an urgency signal”. In related news, St. Louis Fed President Alberto Musalem said that it was “too early” to say what policy he might support in the September meeting. However, he did note that a 50bp cut in September would be “unsupported by the current state of the economy”.

Looking at US equity markets, the S&P and Nasdaq ended flat on Thursday. US IG CDS spreads were 0.3bp wider and HY CDS spreads widened by 1.5bp. European equity markets ended higher. The iTraxx Main CDS spreads were almost flat while Crossover spreads tightened by 0.7bp. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were 0.6bp tighter.

New Bond Issues

Rating Changes

- Rolls-Royce PLC Upgraded to ‘BBB+’ On Continuing Profitability And Cash Flow Improvements; Outlook Stable

-

Spirit Airlines LLC Downgraded To ‘CCC’ On Going-Concern Doubt, Outlook Negative

-

Liverpool Victoria Financial Services Outlook Revised To Positive; Affirmed At ‘BBB’

Term of the Day: Gearing

Gearing refers to the financial leverage a company takes in the form of debt. While gearing ratio is typically calculated as a company’s debt divided by its equity, it could also be measured as a company’s debt divided by its total assets, since it ultimately shows leverage. Companies typically define gearing as the ratio of net debt to net debt plus equity. Within this adjustments may occur, like reducing cash and cash equivalents.

Talking Heads

On Sensing Consumer Spending May Have Improved in July – Tom Barkin, Fed Richmond President

“I am getting a smell of a stronger July on the consumer side…If you look at weekly credit-card data, for example, it looks a lot healthier…Maybe it was just a temporary air pocket, and people will be spending in a more healthy base going forward…The underlying dynamics still feel very healthy to me. People have jobs. Real wages are going up.”

On Private Debt Funds Finding Fewer Deals to Deploy Capital

Mark Birkett, Configure Partners

“We’re hearing things have picked up since June…A slowdown in deal flow reduces churn and the realization of fees.”

Blue Owl spokesperson

“In the second quarter originations across the Blue Owl platform were in line with recent averages, with a recent uptick in new deal inquiries that we hope will translate into increased M&A-driven supply”

Matthew Schernecke, Hogan Lovells

“A lot of lenders aren’t set up to do deals beyond the new money leverage financing since that is their bread-and-butter…There is activity, it’s just in a different segment than is typical for direct lending”

On Junk-Rated Debt Boom Facing Investor Fatigue as Some Deals Stall

David Rosenberg, Oaktree Capital Management,

“Generally, when you have to sell to buy, people get a little pickier,” said “so when there’s a lot of deals to do they tend to be a little more open to pushing back.”

Top Gainers and Losers- 15-Aug-25*

Go back to Latest bond Market News

Related Posts: