This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

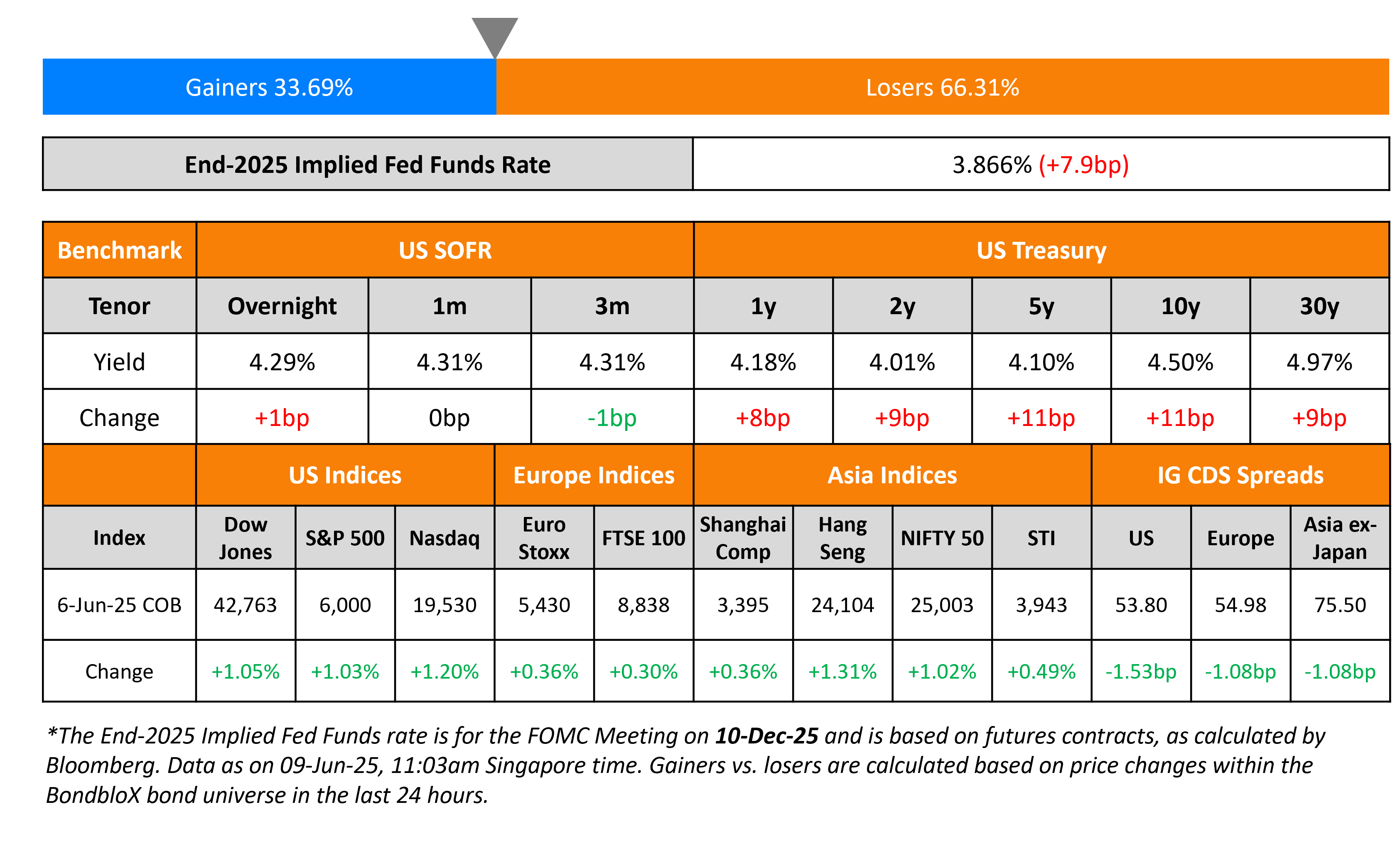

Treasury Yields Rise by 10bp After Jobs Reports; NFP at 139K vs 126K

June 9, 2025

US Treasury yields rose by ~10bp across the curve on Friday. NFP for May came-in higher at 139K, vs. expectations of 126K. NFP for April was revised lower from 177K to 147K. The unemployment rate held steady at 4.2%, in-line with expectations. Average Hourly Earnings (AHE) YoY rose by 3.9%, higher than expectations of 3.7%. April’s reading was revised higher to 3.9% from 3.8%. Markets are still pricing-in two 25bp rate cuts for 2025.

Looking at US equity markets, S&P and Nasdaq jumped higher by over 1%. Looking at credit markets, US IG and HY CDS tightened by 1.5bp and 8.5bp respectively. European equity markets closed higher by about 0.3%. The iTraxx Main and Crossover CDS spreads tightened by 1.1bp and 3.5bp respectively. Asian equity markets have opened higher today, with Nikkei and HSI up by about 1% at the time of writing. Asia ex-Japan spreads tightened by 1.1bp.

New Bond Issues

.png)

Rating Changes

- Fitch Upgrades Uber’s IDR to ‘BBB+’, Rates CP ‘F1’; Outlook Positive

-

Moody’s Ratings downgrades Nissan’s CFR to Ba2; outlook remains negative

- Fitch Downgrades Austria to ‘AA’; Outlook Stable

- Air Baltic Corp. Downgraded To ‘B’ On Tightening Liquidity; Outlook Negative

- Suzano Outlook Revised To Positive On Acquisition Of Majority Stake In Kimberly-Clark’s International Tissue Assets

- Fitch Revises Encore’s Outlook to Negative; Affirms IDR at ‘BB+’

- Slovenia Long-Term Ratings Raised To ‘AA’ On Strong Public Finances And Sustained Growth; Outlook Stable

Term of the Day: Fiscal Balance

Fiscal balance is the difference between a government’s total revenue (total taxes and non-debt capital receipts) and its total expenditure. A fiscal deficit is when the government’s expenditure exceeds its income and a surplus is when the income exceeds expenditure. Fiscal balances are typically stated as a percentage of the economy’s GDP. A deficit or gap is generally filled by borrowing from the central bank of the country or by raising money from capital markets through debt instruments. A recurring high fiscal deficit implies that the government is spending beyond its means and could lead to a default in an extreme case.

Talking Heads

On Corporate Cash Levels Starting to Fall

Michael Contopoulos, Richard Bernstein Advisors

“It’s actually a dangerous position to be in…If you bring down cash balances and you find yourself having to deal with higher inflation and higher volatility, your debt is going to get punished.”

Maulik Bhansali, Allspring Global

“You still want to be positioned in companies that have the ability to weather a range of scenarios, but at the same time, I don’t think you want to price your entire portfolio to the worst possible outcome”

On Yield Hunters Fuelling a $331bn Wave of EM Bond Sales

Omotunde Lawal, Barings Investment Services

“If you’re a CFO or treasurer you go when the window is open…If US fiscal concerns keep on the top of minds then US yields will push higher — so maybe best to issue now rather than later.”

Stefan Weiler, JP Morgan

“From a borrower perspective, the incentive of being patient has gone…It’s really more about accessing the market when it’s available.”

Samy Muaddi, T. Rowe Price Associates, Inc.

“Higher Treasury yields, trade uncertainty, and lower oil prices place many lower-rated frontier countries at a distance from market access,”

Carmen Altenkirch, Aviva Investors

“EM has proved to be a comparative safe haven over this period…Fundamentals have continued to improve, and sovereigns are getting rewarded for their prudence.”

On Bond Traders Consulting Risk Bosses to Prep for Next Storm

Diederik Visser, ABN Amro

“We’re in for quite a wild ride…One of the challenges the market is facing is that it’s unclear what the reaction is going to be once we move into a period of more significant stress.”

Kal El-Wahab, Bank of America

“My engagement with our market risk function has increased quite dramatically…There isn’t really a good predictor of the current state of the world.”

Jared Noering, NatWest

“We’re running the business with light risk…The beginning of April was a real taster”

Top Gainers and Losers- 09-Jun-25*

Go back to Latest bond Market News

Related Posts:.png)