This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Yields Rise Across the Curve

December 16, 2024

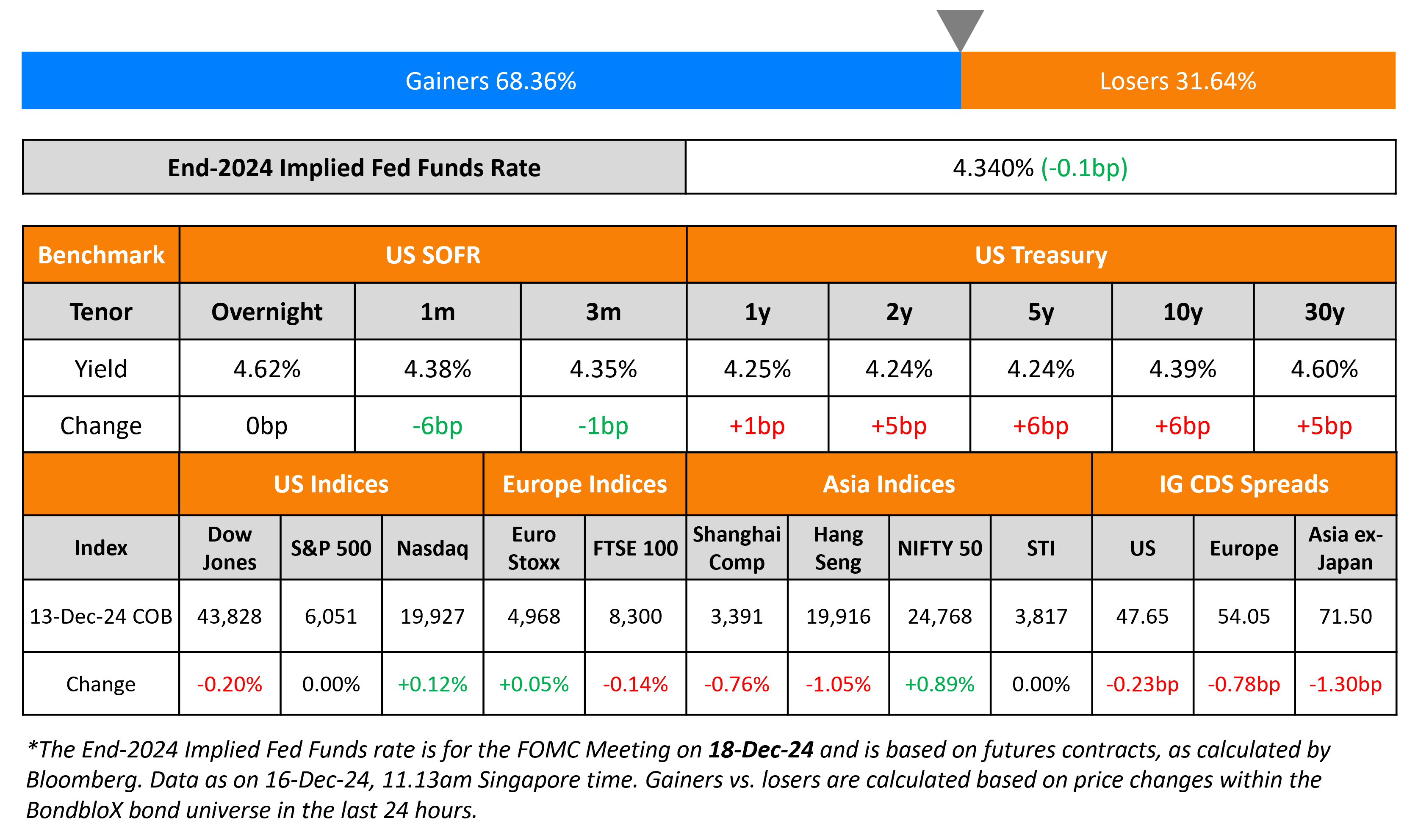

US Treasury yields continued to march higher, rising by 5-6bp across the curve. The Import Price Index rose by 0.1%, better than expectations of -0.2%. With no major data points on Friday and the FOMC meeting due later this week, markets are pricing-in a 93% probability of a 25bp rate cut.

US IG and HY CDS spreads widened by 0.2bp and 2.4bp respectively. Looking at US equity markets, the S&P ended flat while the Nasdaq closed 0.1% higher. European equities ended mixed. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.8bp and 5.8bp respectively. Asian equities have opened broadly lower this morning. Asia ex-Japan CDS spreads were 1.3bp wider.

New Bond Issues

Rating Changes

-

Fitch Upgrades San Marino to ‘BB+’; Outlook Stable

-

Fitch Upgrades Banco Comercial Portugues to ‘BBB’; Outlook Positive

-

Fitch Upgrades Caixa Geral de Depositos’ to ‘BBB+’; Outlook Stable

-

Cyprus Upgraded To ‘A-‘ On Economic And Fiscal Outperformance; Outlook Stable

-

Fitch Downgrades Sisecam to ‘B’; Outlook Negative

-

Moody’s Ratings downgrades France’s ratings to Aa3; changes outlook to stable

-

Cheplapharm Arzneimittel GmbH Downgraded To ‘B’ From ‘B+’ On Continued Operational Issues; Outlook Stable

-

Fitch Affirms Canary Wharf Group Investment Holdings’ IDR at ‘B’/Negative; Off Rating Watch Negative

New Bonds Pipeline

- Scor hires for € PerpNC10 RT1 bond

Term of the Day

Restricted Tier 1 (RT1) Bonds

Restricted Tier 1 (RT1) bonds are junior subordinated securities issued by insurers that qualify as capital under Europe’s insurance regulation (known as Solvency II). To qualify as Tier 1 capital, the bonds must be perpetual with a minimum 10-year non-call, no step-up in coupon and a contractual trigger to principal write-down or equity conversion. According to the Solvency II directive, RT1s will automatically convert into equity or be written down upon three events:

– Breach of the Solvency Capital Requirement (SCR), which defines the capital required to ensure that the insurance company can meet its obligations over the next 12 months, for more than three months

– Drop of solvency ratio below 75% of the SCR

– Breach of the Minimum Capital Requirement (MCR), which is the threshold below which the national regulator would intervene

Talking Heads

On Bond Sales to Spike in Emerging Asia as Covid-Era Debt Comes Due

Danny Suwanapruti, Goldman Sachs

“Next year will be somewhat challenging… expect relatively shallow easing cycles, heavy bond supply across most markets, and a weaker currency versus the US dollar.”

Frederic Neumann, HSBC

“The dollar remains strong, capital flows into emerging markets don’t seem to be returning as much as one would have hoped”

On Massive Interest Burden Haunts $29tn Emerging Debt Pile

Roberto Sifon-Arevalo, S&P Global

“Interest burdens are massive. There’s a lot of muddle through, but there’s a tremendous amount of risk”

Anthony Kettle, RBC

“Default risk is lower in the short term”

On Strong Dollar, Trump Risks Shaping Asia Investors’ Top 2025 Bets

Vis Nayar, Eastspring Investments

“Ongoing reforms, rising urbanization, and supply chain shifts are expected to support India’s economic and earnings growth over the longer term”

Shamaila Khan, UBS Asset

“We are positioned in credits right now that would not be directly impacted by any tariff headlines”

Top Gainers and Losers- 16-December-24*

Go back to Latest bond Market News

Related Posts:

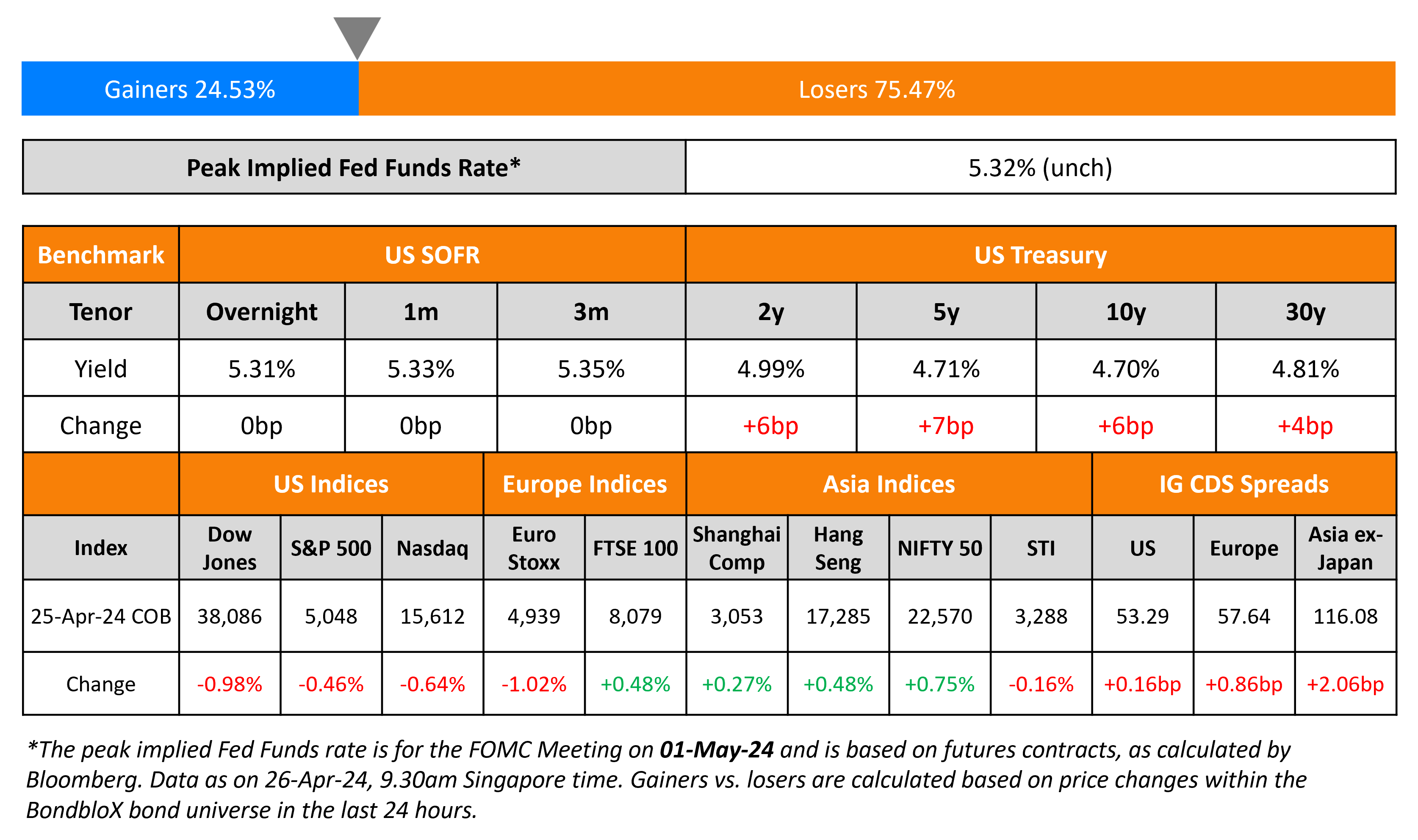

US GDP Softens; KIB Prices $ AT1

April 26, 2024

Turkey, FAB, Astrea Price Bonds; Muthoot Taps 2028s

July 10, 2024