This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Yields Lower by 3-4bp; Royal Caribbean Prices $ Bond

September 17, 2024

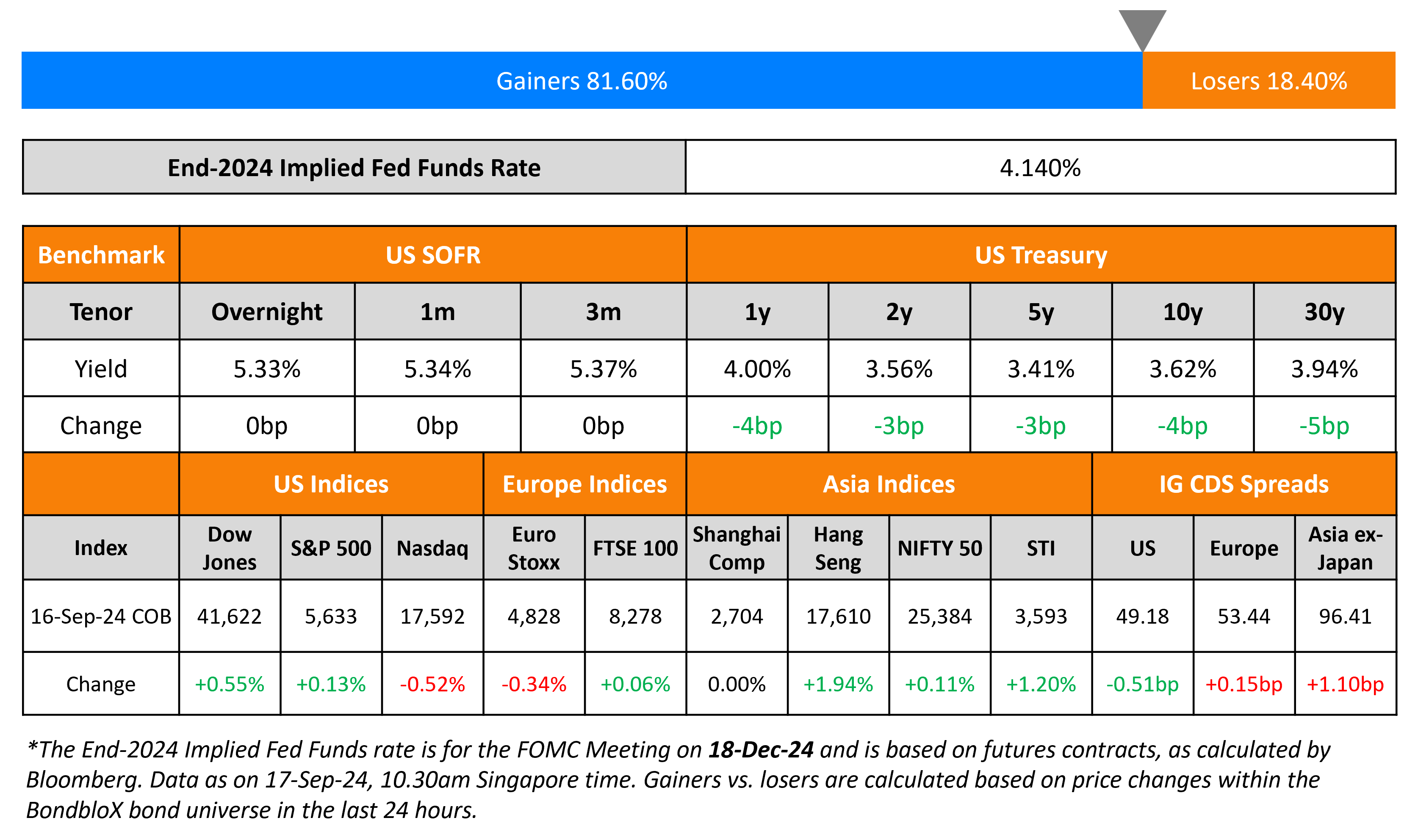

US Treasury yields moved lower across the board yesterday by 3-4bp. Reports noted that the Fed Reverse Repo Facility usage shrunk below $250bn for the first time since 2021, a steep decline from the $2.5tn seen in December 2022. Some analysts suggest that this reduction is a sign that excess liquidity is being drained from the financial system, placing an additional strain on prevailing money market rates. Separately, the two-day FOMC meeting begins today and concludes tomorrow with the Dot Plots and the press conference. US IG spreads tightened by 0.5bp, while HY CDS were flat. Looking at US equity markets, there were mixed moves with the S&P up 0.1% and Nasdaq down 0.5%.

European equity markets also ended mixed. Looking at Europe’s CDS spreads, the iTraxx Main and Crossover spreads were wider by 0.2bp. Asian equity indices have opened broadly lower. Asia ex-Japan IG CDS spreads saw a 1.1bp widening.

New Bond Issues

Royal Caribbean raised $1.5bn via a 7NC3 bond at a yield of 5.625%, 12.5bp inside initial guidance of 5.75% area. The senior unsecured bonds are rated Ba2/BB+. Proceeds will be used to redeem and/or repay a portion of its debt, including redeeming all of its outstanding 7.25% 2030s and to repay all outstanding obligations under its Silver Dawn finance lease in full. The new bonds are priced roughly in-line with its 6.25% 2032 (callable on 15 March 2027) that yields 5.61%.

Rating Changes

- Fitch Upgrades Tunisia to ‘CCC+’

- Talen Energy Supply LLC Upgraded To ‘BB-‘ From ‘B+’ On Improving Leverage; Outlook Stable

- Meituan Upgraded To ‘BBB+’ On Strong Business And Improved Profitability Prospects; Outlook Stable

- Fitch Upgrades Diamondback and Endeavor to ‘BBB+’ Post Merger; Outlook Stable

- Fitch Places Boparan on Rating Watch Positive on Debt Reduction Announcement

Term of the Day

Fiscal Deficit

Fiscal balance is the difference between a government’s total revenue (total taxes and non-debt capital receipts) and its total expenditure. A fiscal deficit is when the government’s expenditure exceeds its income. Fiscal deficits are typically stated as a percentage of the economy’s GDP. A deficit or gap is generally filled by borrowing from the central bank of the country or by raising money from capital markets through debt instruments. A recurring high fiscal deficit implies that the government is spending beyond its means and could lead to a default in an extreme case.

Talking Heads

On Investors Piling Into Fixed Income – Pimco CEO Emmanuel Roman

“What I think is exciting about fixed income right now is you can built a portfolio and get a return of 6 to 6.5% with a mix of different instruments… There’s a big real estate cycle and that should be exciting and there will be cheap investment both in debt and equity”

On Fed rate cuts will not be as deep as the market expects – BlackRock

“As the Fed readies to start cutting, markets are pricing in cuts as deep as those in past recessions. We think such expectations are overdone… An aging workforce, persistent budget deficits and the impact of structural shifts like geopolitical fragmentation should keep inflation and policy rates higher over the medium term”

On Banks’ Bond Strength Bolstering Case for Their Stocks – Mike Mayo, Wells Fargo

“The $7 trillion investment-grade bond market now says banks are less risky than corporates, shrugging off the recent brouhaha in bank stocks from recession and rate concerns”

On US inflation at turning point, focus should shift to jobs – White House’s Lael Brainard

“Today, we are at an important turning point. Inflation is coming back down close to normal levels, and it is important to safeguard the important labor market progress we have made”

Top Gainers & Losers-17-September-24*

Go back to Latest bond Market News

Related Posts:

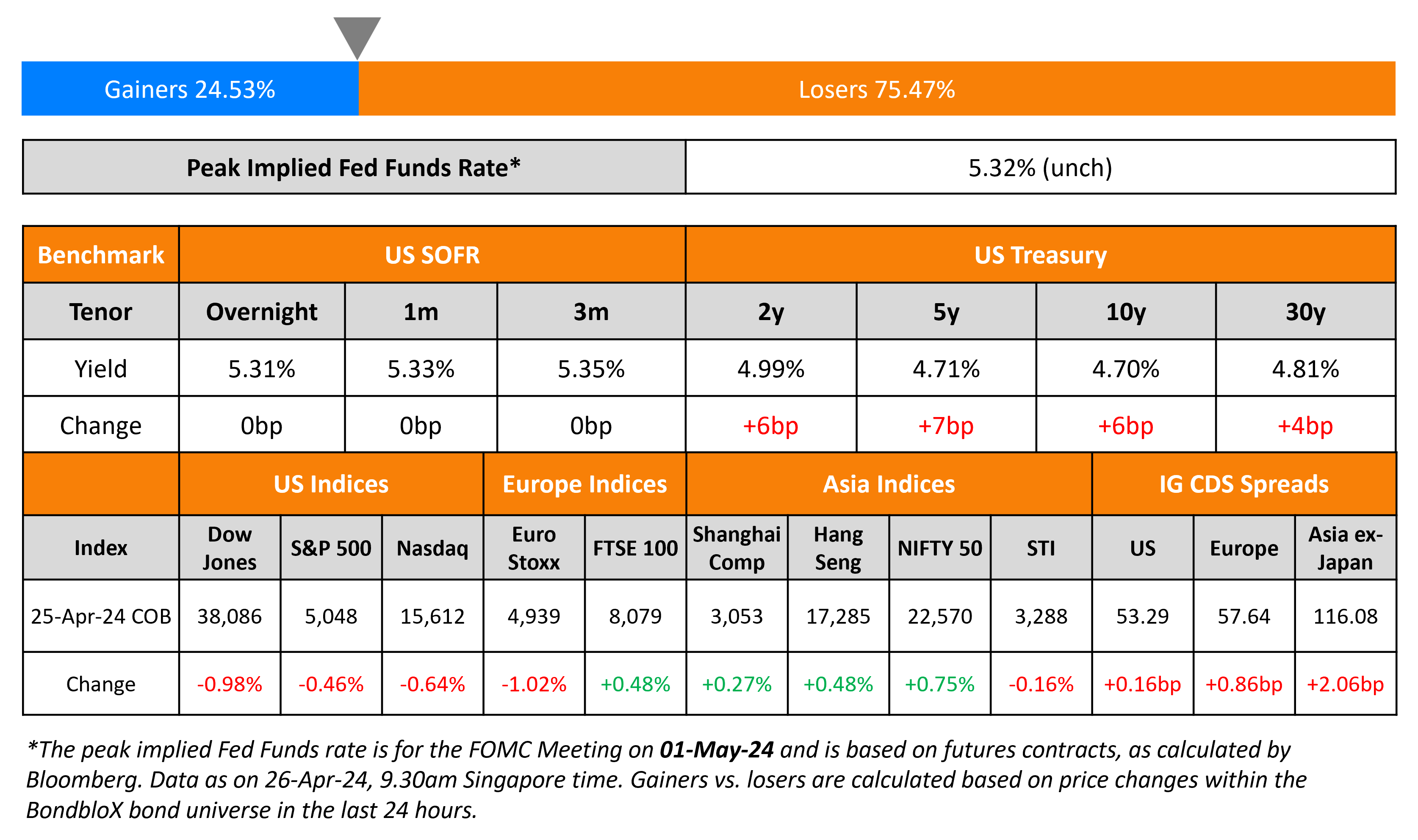

US GDP Softens; KIB Prices $ AT1

April 26, 2024

Turkey, FAB, Astrea Price Bonds; Muthoot Taps 2028s

July 10, 2024