This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Yields Jump on Jobs Data, Trump’s Bill Passage

July 4, 2025

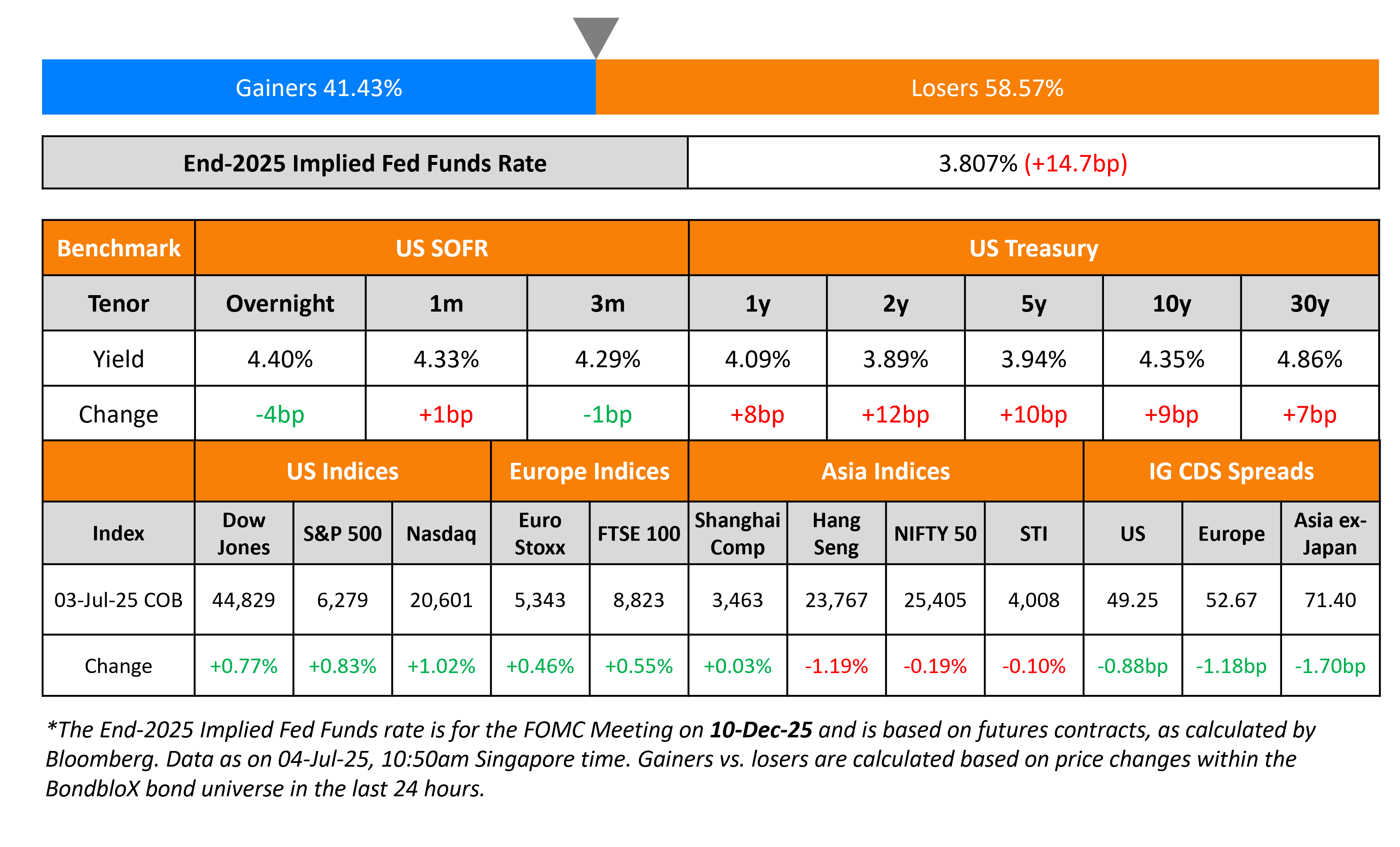

US Treasury yields rose by nearly 10bp across the curve on Thursday following several positive developments. Firstly on the data front, NFP for June came-in higher at 147k vs. expectations of 106k. NFP for May was revised higher to 144k from 139k. The unemployment rate improved to 4.1% from 4.2%, better than expectations of 4.3%. Average Hourly Earnings (AHE) YoY rose by 3.7%, softer than expectations and the prior month’s revised reading of 3.8%. Markets have priced out a July rate cut. The ISM Services PMI came-in at 50.8, marginally better than expectations of 50.5. Initial jobless claims for the prior week also came-in better, at 233k vs. expectations of 241k.

Separately, the House of Representatives passed US President Donald Trump’s tax and spending cut bill with a 218-214 vote split. The bill is now set to being enacted as a law with the Congressional Budget Office estimating that it may add $3.3tn to federal deficits over the next decade.

Looking at equity markets, the S&P and Nasdaq ended higher, up by 0.8% and 1.0% respectively. In credit markets, US IG CDS spreads were tighter by 0.9bp and HY CDS spreads tightened 6bp. European equity markets ended higher too. The iTraxx Main CDS spreads tightened by 1.2bp while Crossover CDS spreads tightened by 5.2bp. Asian equity markets have opened lower today. Asia ex-Japan CDS spreads were tighter by 1.7bp.

New Bond Issues

New Bonds Pipeline

-

Trafigura hires for $ 5Y bond

- Shinhan Bank hires for $ 5Y bond

- Port of Newcastle hires for A$ 8Y/10Y bond

Rating Changes

- Formosa Plastics Companies Downgraded To ‘BBB’ On Weakened Leverage And Profitability; Outlook

- NegativeXPO Inc. Downgraded To ‘BB’ From ‘BB+’ On Prolonged Market Weakness; Outlook Revised To Stable From Negative

- Fitch Revises Georgia Global Utilities’ Outlook to Positive; Affirm IDR at ‘BB-‘

- Fitch Revises Centene’s IDR Outlook to Negative from Stable

Term of the Day: Formosa Bonds

A Formosa bond is a bond that is issued in Taiwan by a foreign issuer that is denominated in a currency other than the New Taiwanese Dollar. It is a way for foreign issuers to raise capital in Taiwan. To qualify as a Formosa, borrowers must have credit ratings of BBB or higher. Formosa bonds are listed and traded on the Taipei Exchange. Qatar Commercial Bank priced a $300mn 5Y Formosa FRN at SOFR +130bp.

Talking Heads

On Trump Tax Bill Complicating Cutting Debt in Medium Term – Julie Kozack, IMF Spokeswoman

“The tax bill appears to run counter to reducing federal debt over the medium term…The sooner that process starts to reduce the deficit, the more gradual the deficit reduction can be over time.”

On Private Credit Lenders Facing More Pressure From Rising Debt Costs

Andrew Milgram, Marblegate

“No one should be the least bit surprised when returns suffer…Too much capital has come in too quickly to the private credit market…where there is an overallocation of capital, there will be mistakes.”

On Fed Has Room to Cut Interest Rates Now – Anne Walsh, Guggenheim

“Real rates are very high right now relative to history…The Fed doesn’t want to lower rates and appear to be kowtowing…On the other hand, I think there’s actually room for them to lower rates…We are already, in some parts of the US economy, seeing recessionary pressures”

Top Gainers and Losers- 04-Jul-25*

Go back to Latest bond Market News

Related Posts: