This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Yields Jump Higher; Aldar, Prudential, BAT Capital Price $ Bonds

March 12, 2025

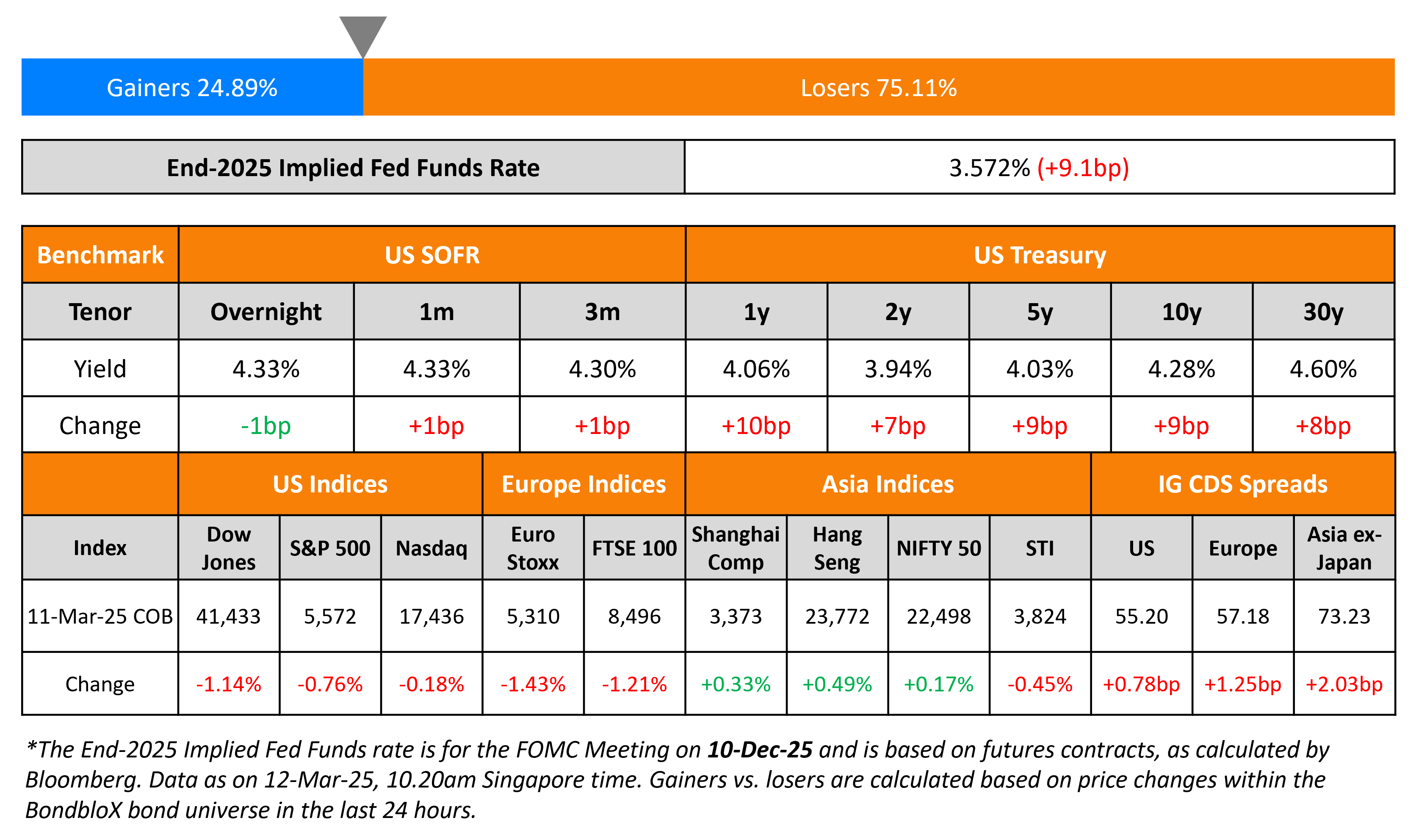

US Treasury yields recovered yesterday, moving higher by 7-9bp. White House trade advisor Peter Navarro indicated that US President Donald Trump has ceased plans to raise tariffs on Canadian steel and aluminum imports to 50%. However the 25% tariff will continue to take effect. Separately, Ukraine said that it is ready to accept a US proposal for an immediate 30-day proposed ceasefire.

US equity markets continued to edge lower with the S&P and Nasdaq down by 0.8% and 0.2% respectively. Looking at credit markets, US IG and HY spreads CDS spreads widened 0.8bp and 2.9bp respectively. European equity markets ended lower. The iTraxx Main and Crossover CDS spreads widened by 1.3bp and 5.3bp respectively. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were wider by 2bp.

New Bond Issues

Aldar raised $500mn via a 10Y green sukuk at a yield of 5.33%, 30bp inside initial guidance of T+140bp area. The senior unsecured note is rated Baa1, and received orders of over $3.1bn, 6.2x issue size. Proceeds will be used to finance, refinance and/or invest, in whole or in part, eligible green projects as set out in its framework.

Prudential Financial raised $750mn via a 10Y bond at a yield of 5.239%, 25bp inside initial guidance of T+120bp area. The senior unsecured bond is rated A3/A/A-. Proceeds will be used for general corporate purposes, which may include refinancing its medium-term notes maturing through 2026.

Nordea Bank raised $1bn via a two-part deal. It raised $600mn via a 3Y bond at a yield of 4.525%, ~22.5bp inside initial guidance of T+70/75bp area. It also raised $400mn via a 3Y FRN at SOFR+70bp vs. initial guidance of SOFR equivalent area. The senior preferred notes are rated Aa3/AA-/AA. Proceeds will be used for general corporate purposes.

BAT Capital raised $2.5bn via a three-trancher. It raised:

- $1bn via a long 7Y bond at a yield of 5.364%, 20bp inside initial guidance of T+140bp area

- $1bn via a long 10Y bond at a yield of 5.632%, 20bp inside initial guidance of T+155bp area

- $500mn via a 30Y bond at a yield of 6.287%, 27bp inside initial guidance of T+195bp area

The senior unsecured notes are rated Baa1/BBB+/BBB+. British American Tobacco, Reynolds American Inc., B.A.T. International Finance, B.A.T. Netherlands Finance B.V. are the guarantors. Net proceeds will be used for general corporate purposes, including the potential repayment of existing debt.

New Bonds Pipeline

- Tata Capital hires for $ long 3Y bond

- Shinhan Bank hires for $ bond

- Credit Agricole hires for € PerpNC10.75 RT1 bond

- BTN Indonesia hires for $ 5Y Tier 2

Rating Changes

-

Fitch Upgrades Aruba to ‘BBB-‘; Outlook Remains Positive

-

Fitch Revises Dillard’s Outlook to Positive; Affirms IDR at ‘BBB-‘

- Renault Outlook Revised To Positive On Strong Free Cash Flow Prospects; ‘BB+’ Rating Affirmed

Term of the Day: Technical Default

A technical default is a non-compliance with technical requirements or covenants in the bond’s offer document or credit agreements. This need not have anything to do with missing a scheduled payment but have more to do with breaching specified conditions. These could include not adhering to negative covenants which require not to dispose of any assets, changing the nature of business, delaying results etc. Thus, a technical default need not have to deal with missing a payment and may still result in a full repayment. S&P analysts in a note mention that “If Huarong International fails to deliver the results by the deadline stipulated in the bond terms, it will be in technical default.”

Talking Heads

On the Increasing Attractiveness of EMs

Bob Michele, JP Morgan

“A possible catalyst to get money moving into these markets might come now as we’ve seen the peak in the US exceptionalism — with investors possibly looking to rotate out of the US.”

“We’ve been buyers of lower-rated credits in EM, particularly over the last couple of days…You have to give Argentina credit for the way it’s managing its finances.”

On the Prospect of Recession this Year

Lawrence Summers, Fmr. US Treasury Secretary

“We’ve got a real uncertainty problem, it’s going to be hard to fix that…We’re looking at a slowdown relative to what was forecast, almost for sure, and a serious, near 50% prospect of recession.”

On US Junk Bonds Riskier than European Counterparts

Dominique Toublan, Barclays

“Recent economic news have surprised to the upside in Europe and to the downside in the US…The recent tariff news and the European defense spending announcement have an asymmetric impact on spreads on each side of the Atlantic”

Catherine Braganza, Insight Investment

“There are a number of European companies which benefit from the multiplier effect from fiscal spending on defense”

Top Gainers and Losers- 12-March-25*

Go back to Latest bond Market News

Related Posts: