This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

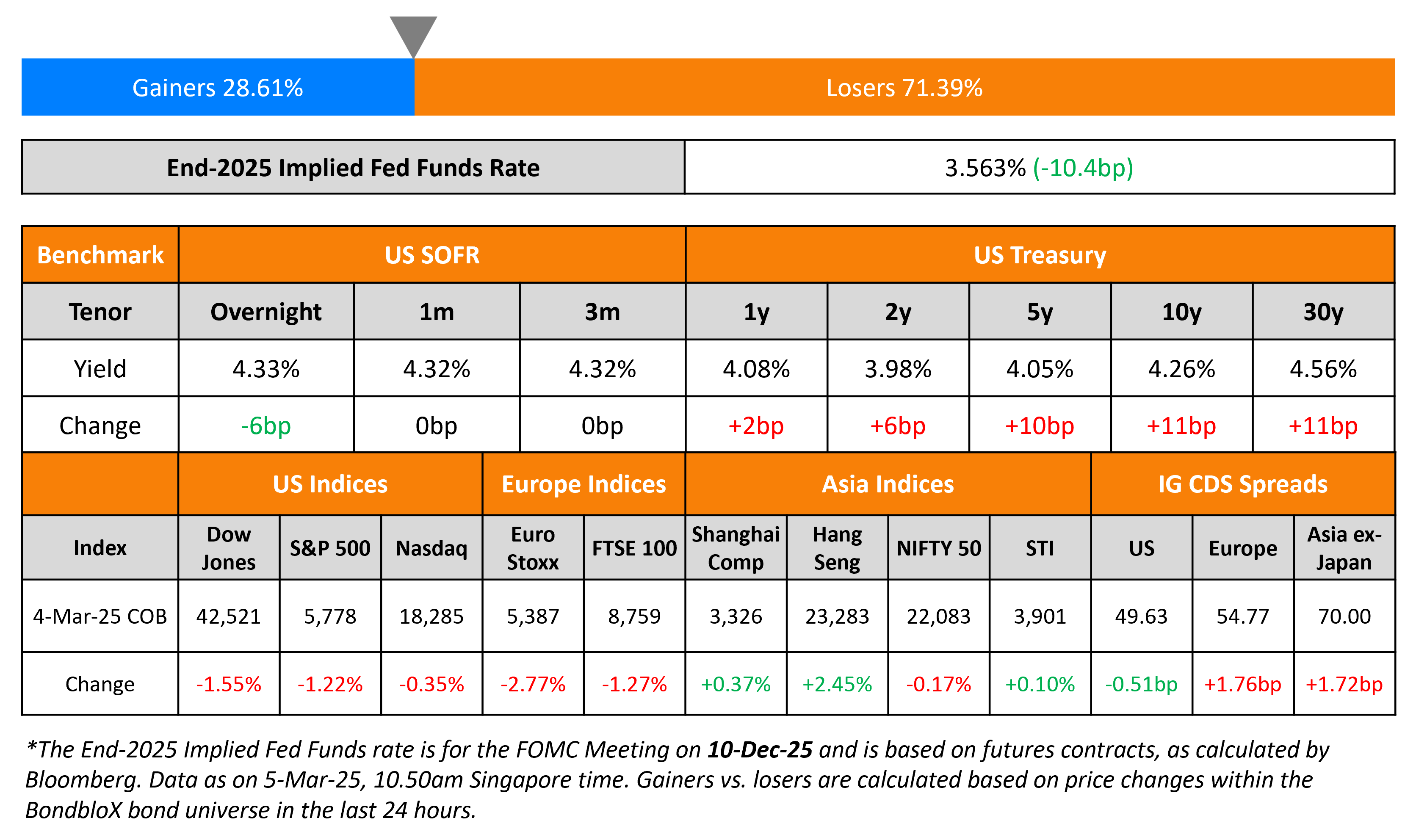

Treasury Yields Jump 10bp; Hysan, Meiji Yasuda Price $ Bonds

March 5, 2025

US Treasury yields rose across the curve, with the 2Y up by 6bp and the 10Y higher by 10bp. US Commerce Secretary Howard Lutnick said that the US could announce some relief on tariffs for Mexican and Canadian goods. Details regarding what it might be were not revealed. Separately, China announced retaliatory tariff measures against the US. Also, Ukrainian President Zelenskyy said that the meeting with US President Trump was regrettable and that he was ready to negotiate for a peace deal.

US equity markets saw the S&P and Nasdaq end lower by 1.2% and 0.4% respectively. Looking at credit markets, US IG and HY spreads CDS spreads tightened 0.5bp and 2.8bp respectively. European equity markets witnessed a sea of red. The iTraxx Main and Crossover CDS spreads widened by 1.8bp and 7.3bp respectively. Asian equity markets have opened in the green this morning. Asia ex-Japan CDS spreads were wider by 1.7bp.

New Bond Issues

-

Cikarang Listrindo $350mn 10Y at 6.125% area

Hysan Development raised $750mn via a PerpNC5.5 bond at a yield of 7.2%, 40bp inside initial guidance of 7.6% area. The subordinated note is rated Baa3. If not called by 11 September 2030, the coupon will reset to the US 5Y Treasury yield plus 327.7bp. If not called by 11 September 2035, the coupon will reset with a step-up of 100bp equating to the US 5Y Treasury yield plus 427.7bp. Proceeds will be used for onward lending to its guarantor group and its subsidiaries for general corporate purposes and refinancing existing debt. The notes have a dividend stopper and a dividend pusher.

Meiji Yasuda raised $2.1bn via a 30.25NC10.25 bond at a yield of 6.1%, 40bp inside initial guidance of 6.5% area. The subordinated note is rated A3/A-. The company will defer payment of all accrued interest if (a) a capital deficiency event has occurred and is continuing (b) any payment in relation to notes or liquidation parity security has been deferred and continues to be in deferral.

IIFL Finance raised $100mn via a tap of its 8.75% 2028s at a yield of 8.35%, 22bp inside initial guidance of 8.57% area. The secured notes are rated B+/B+ (S&P/Fitch).

New Bonds Pipeline

-

Equinix Asia hires for S$ 5Y or 7Y Green bond

-

Ras Al Khaimah hires for $ 10Y Sukuk

Rating Changes

-

Moody’s Ratings upgrades Lumen’s CFR to B3; outlook changes to stable

-

Fitch Upgrades Carpenter Technology to ‘BB+’; Outlook Stable

-

New Gold Inc. Upgraded To ‘B+’ From ‘B’ On Improved Metrics; Outlook Positive; Proposed $400 Million Unsecured Notes Rated ‘BB-‘ (Recovery Rating: ‘2’)

-

Fitch Downgrades Mineral Resources’ IDR to ‘BB-‘; Outlook Negative

-

LG Chem, LG Energy Solution Downgraded To ‘BBB’ On High Investments, Weak Battery Demand; Outlook Stable

-

Moody’s Ratings downgrades Mars to A2; outlook stable

-

Moody’s Ratings changes Genesis Energy’s outlook to positive; affirms B2 CFR

Term of the Day: Dividend Pusher

Dividend pushers are a common covenant seen in perpetual bonds issued by both banks and corporates that require the issuer to make a coupon payment if it has paid a dividend on its shares. These covenants can be found in a bond’s prospectus or offering circular. Dividend pushers are included in a bond’s terms to provide confidence to bond investors that they would be paid coupons if the issuer’s stockholders are paid a dividend. Dividend pushers are sometimes used along with dividend stoppers, which prohibit issuers from paying a dividend on its stock if it has not made a coupon payment on its perpetual bonds.

Talking Heads

On Bank of Thailand Rates given Trump Tariffs

Piti Disyatat, Bank of Thailand

“Our latest cut is calibrated to be robust to many scenarios including the escalation of tariffs…It will take a quite substantial further negative shock for us to reconsider our stance.”

On the Possibility of Defence as an Issuer of New Bond Deals

Alexandre Fade, Fisch Asset Management

“Europe is [realizing] the US may be not so inclined to assist militarily as in the past…[therefore] European defense-exposed convertibles bonds are an excellent vehicle to finance growth-driven companies, and investors more than often are getting nicely rewarded.”

On US Growth Risks on Account of Trump’s Policies

Mark Zandi, Moody’s Analytics

“If all of the announced and threatened tariffs are actually implemented…the typical American family will need to shell out as much as $1,300 more a year to purchase the same goods they did last year.”

Glen Calder, The Greenville

“These tariffs really punish the small US manufacturer…There’s a lot of concern over what’s going to happen to pricing on a lot of things.”

Claudia Sahm, New Century Advisors

“[Musk’s DOGE] amplifies the recession risks in two key ways…First, it concentrates the economic effects temporally, and second, it creates uncertainty that can weigh on growth and employment.”

Top Gainers and Losers- 05-March-25*

Go back to Latest bond Market News

Related Posts: