This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Yields Inch Higher; PCE YoY at 2.6%

September 2, 2024

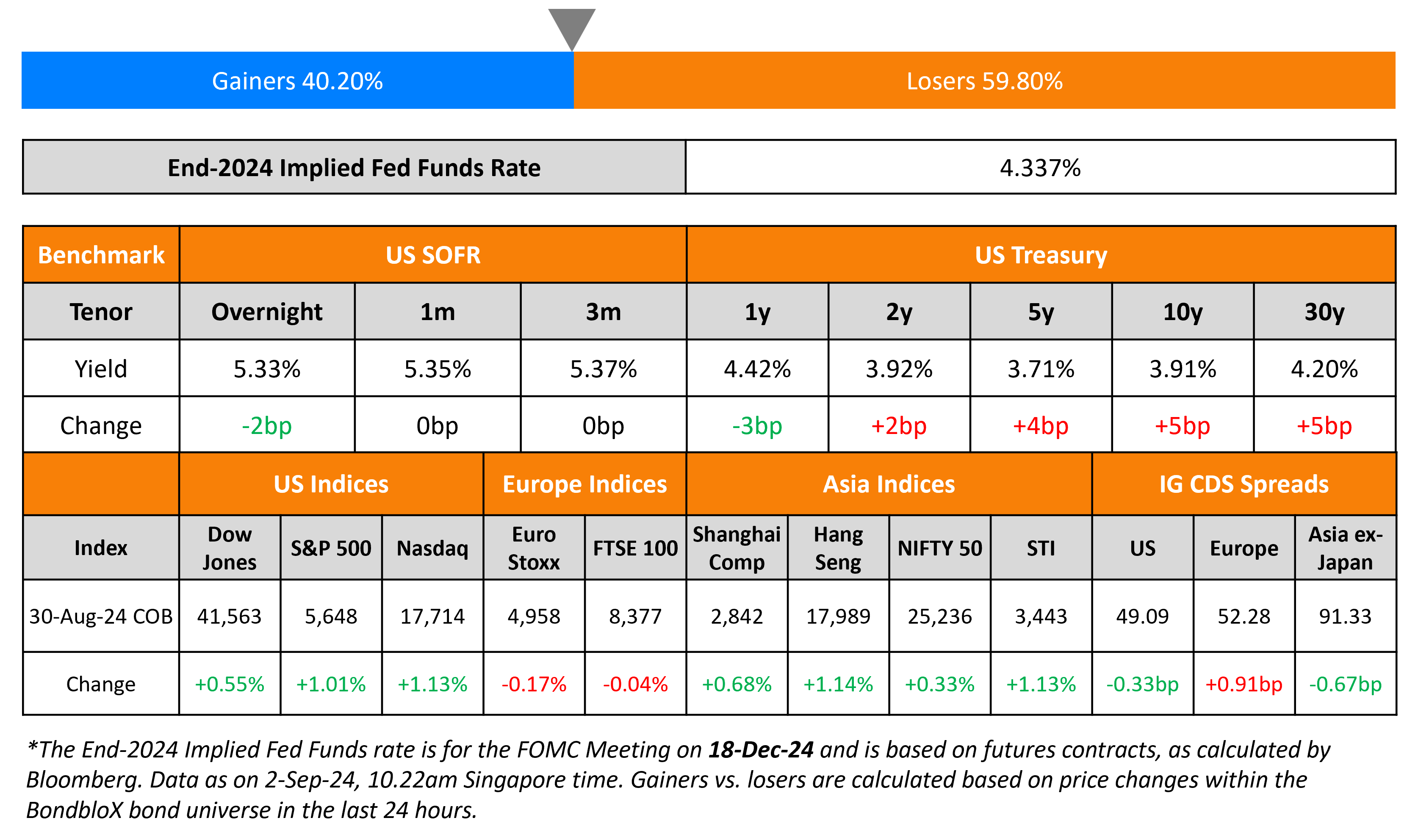

US Treasury yields moved higher across the curve by 2-5bp. US Core PCE YoY for July rose 2.6%, lower than the expected 2.7%. Also, the final reading of the Michigan Consumer Sentiment Index for August came at 67.9, lower than the surveyed 68.1. US IG CDS spreads tightened by 0.3bp and HY CDS spreads tightened by 3bp. Looking at US equity indices, the S&P and Nasdaq ended higher by 1-1.1%.

European equity markets ended lower. Looking at Europe’s CDS spreads, the iTraxx Main spreads widened 0.9bp and Crossover spreads were wider by 3.4bp. Asian equity indices have opened broadly lower this morning. Asia ex-Japan CDS spreads were 0.7bp tighter.

New Bond Issues

New Bonds Pipeline

-

Canara Bank hires for $ 5Y bond

-

Bank of Sharjah hires for $ 5Y bond

-

Nan Shan Life Insurance hires for $ 10Y T2 bond

-

Wuhan Metro hires for $ bond

-

Power Construction hires for $ Green bond

Rating Changes

- Montenegro Upgraded To ‘B+’ On Stronger External And Fiscal Positions; Outlook Stable

- Moody’s Ratings downgrades Longfor’s ratings to Ba3/B1; outlook negative

- Ukraine FC Ratings Affirmed At ‘SD/SD’, LC Ratings At ‘CCC+/C’; Issue Ratings Lowered To ‘D’ After Debt Restructuring

- Moody’s Ratings downgrades Bell Canada and BCE Inc.’s ratings by one notch; outlook is stable

- Moody’s Ratings changes Mondelez’s outlook to positive, affirms the Baa1 and other ratings

- Moody’s Ratings changes Serbia’s outlook to positive from stable, affirms Ba2 ratings

Term of the Day

Short Selling

Short selling is a trading strategy where one borrows a security, sells it on the open market and then buys the same security back later, hoping that the price has fallen since initially sold for. The short-seller essentially borrows and sells the security that he/she may not own, expecting its price to fall. Short selling is a leveraged trade since no initial capital is employed by the short-seller.

Talking Heads

On Fed seen poised for September rate cut as inflation cools

Ben Ayers, Nationwide

“The recent price trends confirm that the end of the Fed’s inflation fight is coming into view. The further cooling of inflation could give the Fed leeway to be more aggressive with rate declines at coming meetings”

On Pimco, GMO Refining EM Playbook as Fed Cuts Set to Shake Up Market

Pramol Dhawan, Pimco

“You have to sort of pick and choose. If you just own the local bonds currency unhedged, you are wearing the full volatility of this index… If you’re well diversified within EMFX, it’s been quite a profitable trade”

Tina Vandersteel, GMO

“Local markets still have a big relative valuation tailwind embedded in them… still a lot of scope for returns and for spreads to compress”

On Hunt for Fed-Pivot Winners Sparking a Rush to Indonesia, Malaysia

John Lin, AllianceBernstein

“Indonesia and Malaysia will benefit more from their responsible fiscal behavior… you need because the Fed pivot in theory is a boon”

Vivian Lin Thurston, William Blair

“Malaysia is looking more interesting than it has in a long time. A couple of our EM strategies have started to invest in Malaysia in recent times”

Top Gainers & Losers-02-September-24*

Go back to Latest bond Market News

Related Posts: