This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Yields Ease Further; GM Prices $2.25bn Three-Trancher

February 28, 2025

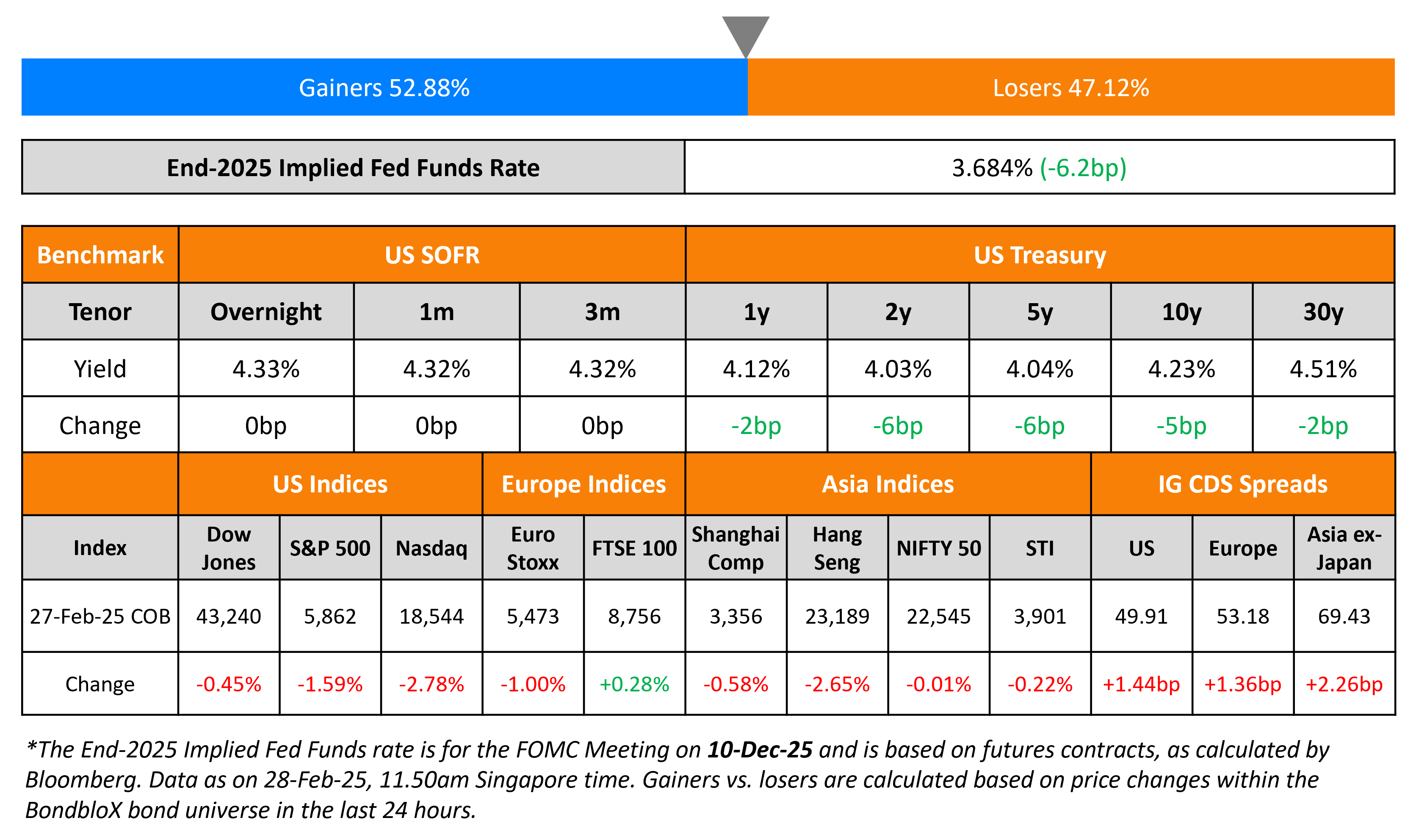

US Treasury yields eased further, down by 5-6bp across the curve again, with the 2Y yield now near the 4%-mark. The second reading for US GDP in Q4 was unchanged from the initial estimate, coming-in at 2.3% QoQ, largely helped by a 4.2% rise in consumer spending. Separately, preliminary Durable Goods Orders rose by 3.1% MoM in January, higher than the surveyed 2.0% print. Initial jobless claims for the previous week rose by 22k, its largest increase in five months to 242k.

US equity markets saw the S&P and Nasdaq end sharply lower by 1.6% and 2.8% respectively, following Nvidia’s weaker forecasts. Looking at credit markets, US IG and HY spreads CDS spreads were wider by 1.4bp and 8bp respectively. European equity markets ended mixed. The iTraxx Main and Crossover CDS spreads widened by 1.4bp and 5bp respectively. Asian equity markets have opened in the red this morning. Asia ex-Japan CDS spreads were wider by 2.3bp.

New Bond Issues

GM Financial raised $2.25bn via a three-part issuance. It raised:

- $1.2bn via a 3Y bond at a yield of 5.055%, 25bp inside initial guidance of T+100bp area. The new bonds are priced at new issue premium of ~9bp over its existing 2.4% 2028s that yield 4.97%.

- $300mn via a 3Y FRN at SOFR+117bp vs. initial guidance of SOFR equivalent area.

- $750mn via a 7Y bond at a yield of 5.636%, 25bp inside initial guidance of T+170bp area.

The senior unsecured notes are rated Baa2/BBB/BBB. Proceeds will be used for general corporate purposes.

CaixaBank raised €1bn via a 12NC7 Tier 2 bond at a yield of 4.02%, 30bp inside initial guidance of MS+205bp area. The subordinated note is rated Baa3/BBB-/BBB, and received orders of over €3bn, 3x issue size. Proceeds will be used for general corporate purposes.

Lloyds Bank raised €1.75bn via a two-trancher. It raised €750mbn via a 3NC2 FRN at 3m Euribor+63bp, ~24.5bp inside initial guidance of 3m Euribor+85/90bp area. It also raised €1bn via a 11NC10 bond at a yield of 3.632%, ~29.5bp inside initial guidance of MS+155/160bp area. The green bonds are rated A3/BBB+/A+. Proceeds will be used to finance and/or refinance eligible green assets as defined in its sustainable bond framework.

Rating Changes

-

Moody’s Ratings upgrades CommScope’s CFR to Caa1; outlook stable

-

mBank S.A. Upgraded To ‘BBB+’ On Improved Profitability And Capitalization; Outlook Stable

-

Moody’s Ratings downgrades Champion REIT’s ratings to Baa3; outlook remains negative

-

Mars Inc. Downgraded To ‘A’ On Kellanova Acquisition; Off CreditWatch Negative; Outlook Stable

-

Moody’s Ratings downgrades Petra Diamonds’ CFR to Caa2, PDR to Caa3-PD/LD and senior secured second lien notes to Caa3; outlook remains negative

-

Fitch Revises Instituto Costarricense de Electricidad’s Outlook to Positive, Affirms ‘BB’ IDR

-

Fitch Revises Bahraini Ahli United Bank’s Outlook to Negative; Affirms IDR at ‘BB+’

Term of the Day: Sinking Fund

Sinking Fund is a fund created so that money can be set aside for specific purposes regarding meeting future obligations including the likes of large expenses, loan repayments, refinancing etc. Regular deposits are made to the sinking fund, so that sufficient funds are available when the obligations arise so that the company need not take new loans to meet these dues.

Talking Heads

On Fed Rates Being Restrictive Enough to Lower Inflation

Patrick Harker, Federal Reserve Bank of Philadelphia

“The policy rate remains restrictive enough to continue putting downward pressure on inflation over the longer term, as we need it to, while not negatively impacting the rest of the economy.”

On US-Russia Talks Fueling Demand for Local Russian Bonds

Tatiana Orlova, Oxford Economics

“Many market participants believe that an end of the Ukraine war is near, and this belief is fueling expectations of further ruble appreciation…Perhaps there’s an expectation that Trump’s administration won’t police adherence to the last round of sanctions.”

On Resurgence of NYC Office Buildings as Investors Pile Into Office Bonds

Zachary Aronson, MacKay Shields

“Investors are eager to buy bonds backed by newer buildings with lots of amenities while older properties continue to struggle, especially if they’re in less desirable locations.”

Top Gainers and Losers- 28-February-25*

Go back to Latest bond Market News

Related Posts: