This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Yields Ease by 8bp; 30Y Treasury Auctions at 4.844%; Seazen, Tai Fung, BNP Price Bonds

June 13, 2025

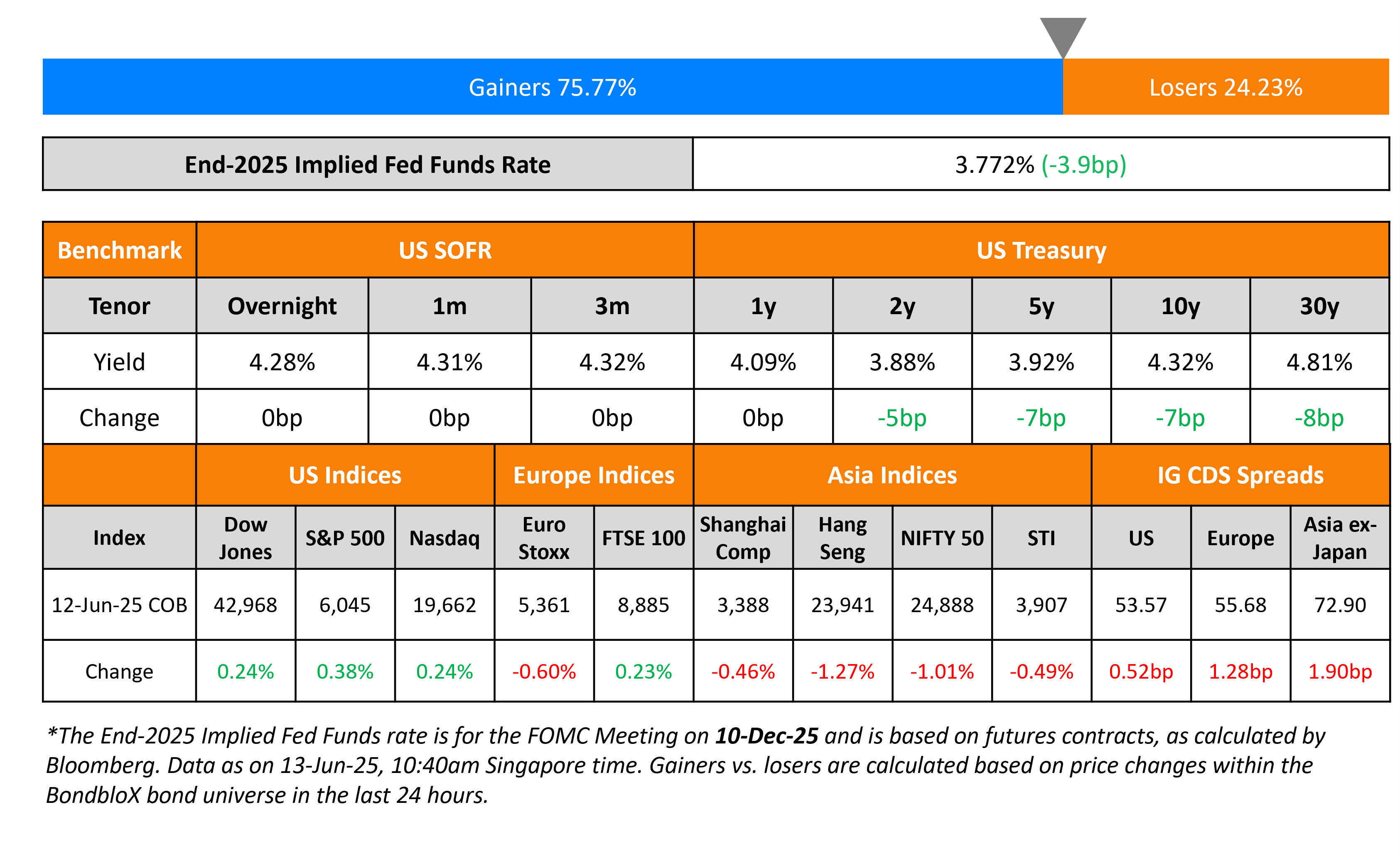

US Treasury yields eased by 7-8bp, particularly in the long-end of the curve on Thursday. This came on the back of softer economic data. The US Producer Price Index (PPI) MoM for May came-in weaker at 0.1% vs. expectations of 0.2%. The YoY reading was in-line with expectations at 2.6%. However, the core reading came-in at 0.1% MoM and 3.0% YoY, both of which were softer then the surveyed 0.3% and 3.1% prints. Initial jobless claims for the prior week continued to worsen at 248k vs. expectations of 242k. Separately, the US 30Y Treasury auction saw solid demand, drawing a yield of 4.844%, stopping through the when-issued yield. The bid-to-cover ratio was at 2.43x, better than the three-month moving average 2.36x. The notes saw an indirect take-up of 65.2%, better than the prior auction’s 58.9%. Oil prices jumped by over 9% after Israel targeted Iran’s nuclear sites amid a major escalation.

Looking at equity markets, the S&P and Nasdaq were both higher by 0.4% and 0.2% respectively. In credit markets, US IG CDS and HY CDS spreads widened by 0.5bp and 2.3bp respectively. European equity markets ended mixed. The iTraxx Main and Crossover CDS spreads widened by 1.3bp and 6.5bp respectively. Asian equity markets have opened lower today. Asia ex-Japan CDS spreads were wider by 1.9bp.

New Bond Issues

Seazen Group raised $300mn via a 3NCNP2 bond at a yield of 12.95%, 30bp inside initial guidance of 13.25% area. The senior unsecured note is rated B- by S&P, a notch lower than its issuer rating of B, and received orders of over $880mn, ~2.9x issue size. The note is both callable and puttable. The issuer can call back the bond at any time on or after 26 June 2027 at par plus one-fourth of the coupon. The put option is effective for investors on 26 June 2027 at par. The note also has a change of control put at 101. Proceeds will be used for funding concurrent offers to purchase:

- Any and all of its 4.45% 2025s at 100. The bond is currently trading at 99.67

- Its 4.625% 2025s at 98.50 subject to a maximum acceptance amount (to be announced) with a priorty acceptance in the tender offer. The bond is currently trading at 98.13

The issuance marks the first such dollar bond deal by a private property developer from China since 2023 where the real estate crisis worsened.

BNP Paribas raised €1bn via a 10.5NC5.5 Tier 2 bond at a yield of 3.783%, 25bp inside initial guidance of MS+180bp area. The subordinated note is rated Baa2/BBB+/A-, and received orders above €1.65bn, 1.65x issue size. If not called before 19 Jan 2031, coupon resets to 5Y MS plus 155bp.

Tai Fung Bank raised $280mn via a PerpNC5 AT1 bond at a yield of 7.750%, 62.5bp inside initial guidance of 8.375%. The subordinated note is rated B by Fitch. If not called before 18 June 2030, the coupon will reset to the 5Y UST plus 379.2bp then and every five years thereafter. The notes have a dividend stopper. Proceeds would be used to strengthen the bank’s capital adequacy.

Rating Changes

- Moody’s Ratings downgrades Sunnova’s PDR to D-PD following bankruptcy filing; ratings to be withdrawn

- Moody’s Ratings downgrades Delek US Holdings, Inc. CFR to B1; negative outlook

- Fitch Upgrades Intercorp Financial Services to ‘BBB’

- Saxo Bank Outlook Revised To Stable On Risk Management Enhancements; ‘A-‘ Rating Affirmed

New Bonds Pipeline

Saudi National Bank $ 10NC5 Tier 2 investor calls

Term of the Day: Put Option

A put option gives the buyer of the option the right but not the obligation to sell the underlying instrument at a particular price known as the strike price at expiration. Put options in bonds are in the hands of the bondholders unlike call options, which lie with the issuer. Exercising a put would require the issuer to redeem the bonds, leading to a cash outflow.

Talking Heads

On Rally in Indian Bonds Losing Momentum After RBI’s Surprise Moves

Suyash Choudhary, Bandhan AMC Limited

“Given the backdrop of the aggressive policy easing of the past few months, the shift in stance has led some market participants to question the sustainability of yield levels”

VRC Reddy, Karur Vysya Bank

“The market hopes that the reverse repos start only when the cash-reserve ratio cuts come into effect from September.”

On Fed seen on track to resume rate cuts after inflation, job market data

Pantheon Macroeconomics

“The near-term trend remains favorable, enabling the (Fed) to signal next week that it still intends to begin easing policy again later this year,”

Heather Long, Navy Federal Credit Union

“Americans, especially recent graduates, are worried about how hard it is to find a job…If layoffs worsen this summer, it will heighten fears of a recession and consumer spending pullback.”

On July forecasts to take into account trade deals, uncertainty – IMF

“So taken together such announcements combined with the April 9 pause on the high level of tariffs, these could support activity relative to the forecast that we had in April…But nonetheless, we do have an outlook for the global economy that remains subject to heightened uncertainty, especially as trade negotiations continue”

Top Gainers and Losers- 13-Jun-25*

Go back to Latest bond Market News

Related Posts: