This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

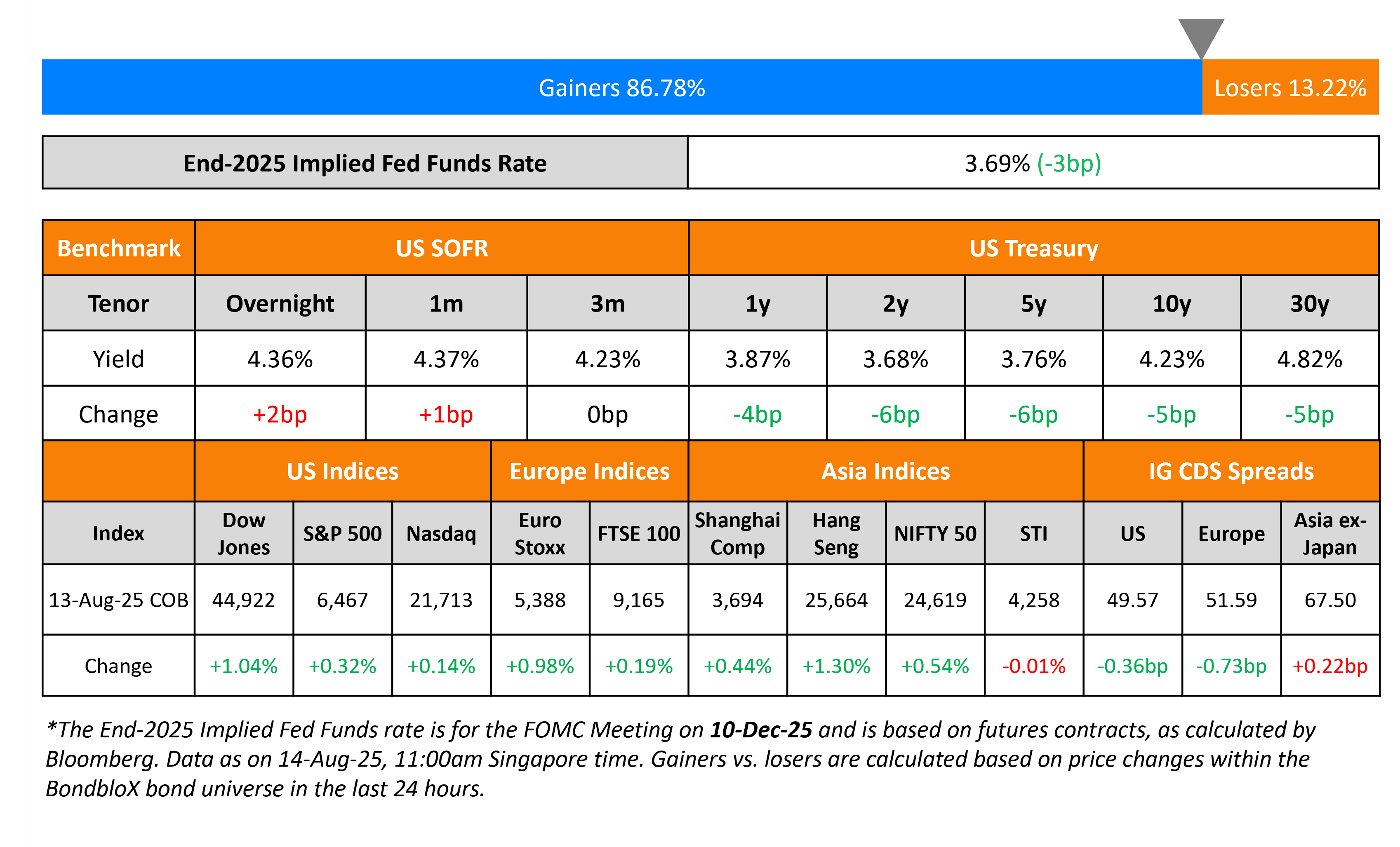

Treasury Yields Ease by 5-6bp; Temasek, ING Groep Price Bonds

August 14, 2025

US Treasury yields fell by 5-6bp across the board with markets now pricing-in a 96% probability of a 25bp rate cut in September. Atlanta Fed President Raphael Bostic said that he continues to see one rate cut as being appropriate this year, if the labour market remains solid. Meanwhile US Treasury Secretary Scott Bessent said that the benchmark rates ought to be at least 150bp lower than its current level.

Looking at US equity markets, the S&P and Nasdaq closed higher by 0.3% and 0.1% respectively. US IG CDS spreads were 0.4bp tighter and HY CDS spreads tightened by 2.7bp. European equity markets ended higher too. The iTraxx Main CDS spreads were 0.7bp tighter and Crossover spreads tightened by 2.3bp. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were 0.2bp wider.

New Bond Issues

Temasek Financial(1) raised $1.5bn via a two-part offering. It raised $750mn via a 2Y bond at a yield of 3.841%, in-line with final guidance of T+15bp. It also raised $750mn via a 2Y FRN at SOFR+38, in-line with final guidance. The senior unsecured notes are rated Aaa/AAA. Net proceeds will be provided by the issuer to the guarantor Temasek Holdings (Private) Ltd and its investment holding companies to fund their ordinary course of business.

ING Groep raised €1.25bn via a 12NC7 Tier 2 bond at a yield of 3.969%, 25bp inside initial guidance of MS+175bp area. The subordinated note is rated Baa2/BBB/A- and received orders of about €4.4bn, 3.5x the issue size. Proceeds will be used for general corporate purposes.

Rating Changes

- Roblox Corp. Upgraded To ‘BBB-‘ On Continued Robust Expansion, Outlook Positive

-

Unigel Participacoes S.A. Downgraded To ‘D’ From ‘CC’ On Expected Missed Debt Payment

- Mondi PLC Downgraded To ‘BBB+’ Due To Credit Metrics; Outlook Stable

Term of the Day: Asset Stripping

Asset stripping refers to the practice of acquiring a company, only to later sell its assets separately. The idea is that the company’s individual assets can be sold at a higher price than the company itself. General targets are those companies that are selling for less than book value and are not in the best financial position. It is considered to be a corporate raider or activist strategy.

Talking Heads

On UAE Banks Outperforming GCC Peers Despite Geopolitical Headwinds – CI Capital

“We flag Abu Dhabi Islamic Bank (ADIB) and Dubai Islamic Bank (DIB) as outperformers on loan growth for 2025 (+19% and +16%, respectively), driven by the former’s strong retail offering and the latter’s healthy retail home finance franchise and diversified corporate loan pipeline”

On Refraining From JGB Buying as More Rate Hikes Seen – Tomotaka Torin, Rakuten Bank

“We’re not going for any aggressive buying of JGBs until we’ve seen at least another rate hike or two…Our focus is on maintaining an operation that won’t suffer setbacks against rising yields.”

On Possible Fed Rate Cut in September as Inflation Cools – Nomura

expects two more 25-bp reductions, in December 2025 and March next year, but said a 50-bp cut next month is unlikely as “The labor market is slowing, but there are few signs of stress, and broader financial conditions remain easy.”

On Fed Cutting Rates Thrice in 2025, Twice More in 2026 – Goldman Sachs

expects the U.S. Federal Reserve to deliver three 25-basis-point interest rate cuts this year and two more in 2026, putting the terminal rate at between 3% and 3.25%, down from the current 4.25%-4.50% level.

Top Gainers and Losers- 14-Aug-25*

Go back to Latest bond Market News

Related Posts: