This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Yields Ease After CPI Data; Seazen Launches First Private Chinese Property $ Bond Since 2023

June 12, 2025

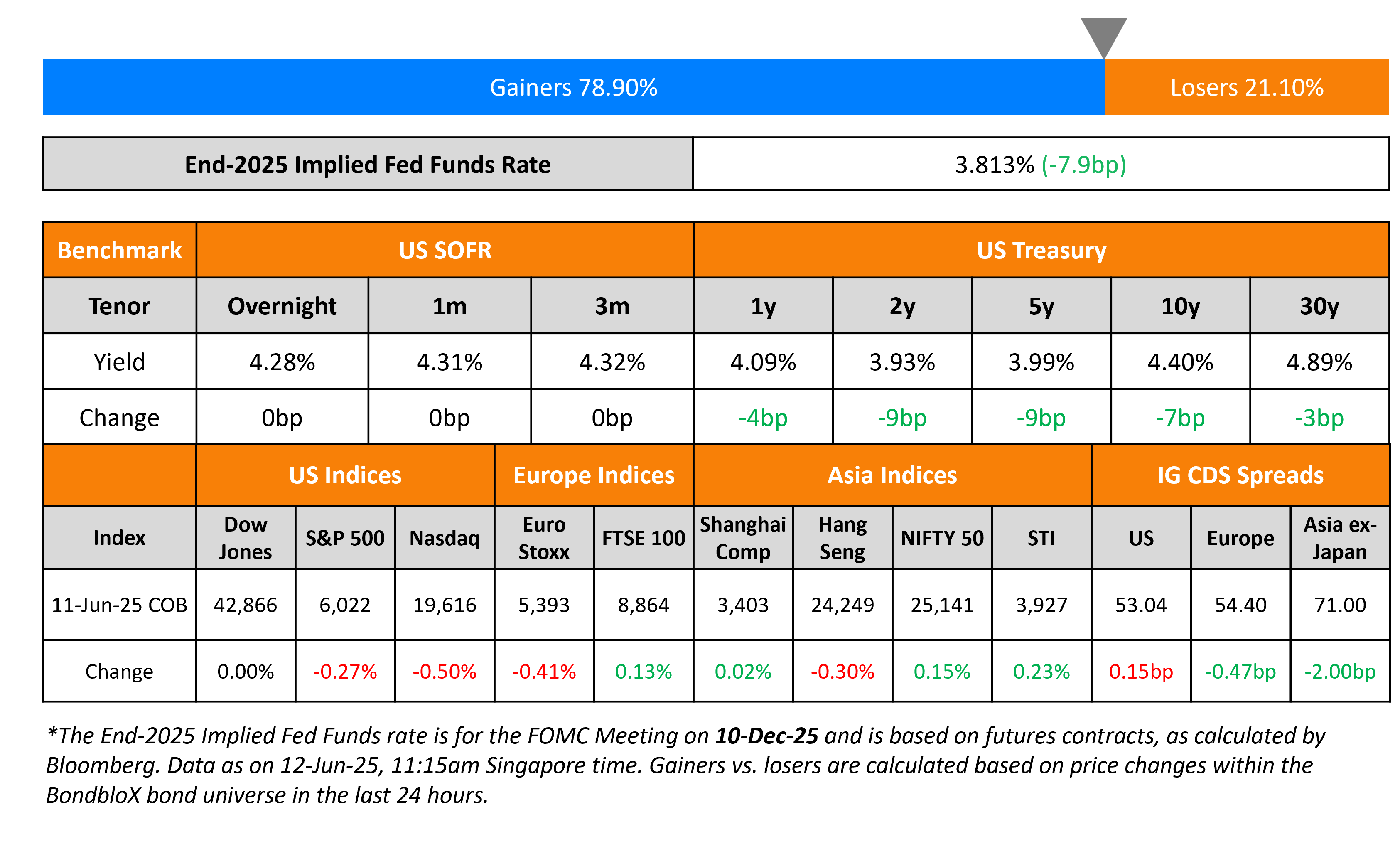

US Treasury yields eased by 7-9bp across the curve on Wednesday. US CPI YoY for May came-in at 2.4%, in-line with expectations, albeit marginally higher than the prior month’s reading of 2.3%. Core CPI came-in at 2.8%, softer than expectations of 2.9% but in-line with the prior month’s reading. US President Donald Trump said that a deal with China was “done”. A White House spokesperson said that the US will impose a 55% tariff on Chinese goods, while China will impose 10% levies. Trump is also said to apply unilateral tariff rates for trading partners in two weeks.

Looking at equity markets, the S&P and Nasdaq were both lower by 0.3% and 0.5% respectively. In credit markets, US IG CDS spreads were wider by 0.2bp and HY CDS spreads widened by 0.4bp. European equity markets ended mixed. The iTraxx Main CDS spreads tightened by 0.5bp and Crossover CDS spreads tightened by 1.2bp. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were tighter by 2bp.

New Bond Issues

- Seazen $ 3NCNP2 at 13.25% area

- ABN Amro $ 5Y FRN at SOFR+120bp area

- Tai Fung Bank $280mn PerpNC5 at 8.375% area

Rating Changes

- Moody’s Ratings downgrades Altice International to Caa2; outlook negative

- Care New England, RI Bond Rating Raised To ‘BB-‘ On Improved Earnings And Positive Margins; Outlook Is Stable

- Fitch Upgrades Shandong Guohui to ‘A-‘; Outlook Stable

- Fairfax Financial Holdings Ltd.’s Re/Insurance Subs Upgraded To ‘AA-‘ On Strengthened Capitalization; Outlook Stable

- Enbridge Gas Inc. Outlook Revised To Stable From Negative On Supportive Rate Order, Ratings Affirmed

Term of the Day: Dividend Stopper

Dividend stopper is a common covenant seen in perpetual bond structures that requires the bond issuer to not pay a dividend, if it decides to stop coupon payments on the perpetual bonds. Some contingent convertible (CoCo) perpetual bonds have a clause that allows the issuer to skip a coupon payment at their discretion, if the financial situation of the issuer is stressed. In such cases, a dividend stopper covenant is beneficial to the CoCo bondholders as it restricts the issuer from paying dividends on its equity in times when it has not paid coupon to its CoCo bondholders. This is why the presence (or absence) of a dividend stopper covenant is seen as the determining factor on whether the CoCo perpetual bonds are not (or are) subordinated to its equity.

Suntec REIT’s newly priced SGD Perp includes a dividend stopper but not a dividend pusher.

Talking Heads

On Investors Pulling Out of US Stocks and Into Europe and Emerging Markets

Michael Field, Morningstar

“With investors rattled by the U.S. administration’s actions and worried about the potential drag on equity markets, this may mark the start of a medium-term trend.”

Manish Raychaudhuri, Emmer Capital Partners

“While Italy, France and the UK face rising debt burdens, many Asian economies carry lighter fiscal loads, keeping bond yields stable and investor confidence intact.”

On Economists’ Take on US CPI Data

Citibank

“CPI data should give Fed officials further confidence that underlying inflation has been easing more rapidly this year…the risk of more persistent inflation resulting from tariffs is low…we continue to pencil in 125 basis points of consecutive rate cuts from the Fed starting in September.”

Skanda Amarnath, Employ America

“we are likely to see a material acceleration in goods inflation and electricity inflation later this summer, both of which threaten to keep interest rates higher for longer and raise recession risk as a result.”

On Late-Day Credit Trades Surging as Index Boom Reshapes Market

Alex Zhou, Southern Methodist University

“But when trading becomes one-sided, this concentration of one-sided ‘sell’ actually exacerbates the liquidity problem.”

Inés de Trémiolles, BNP Paribas Asset Management

“If I don’t automate around the close with auto execution, that means that I would need to maybe triple my trading team”

Top Gainers and Losers- 12-Jun-25*

Go back to Latest bond Market News

Related Posts: