This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

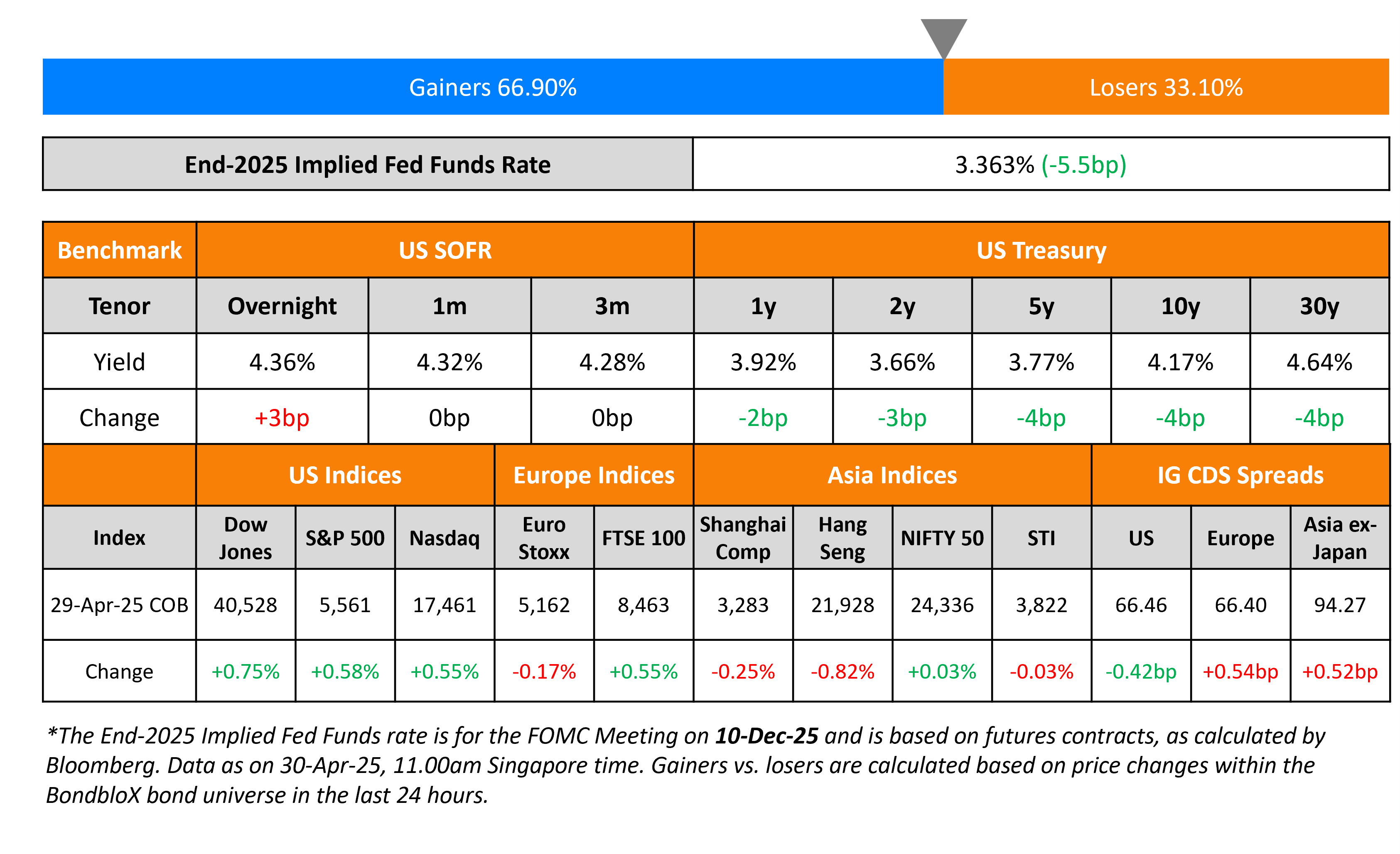

Treasury Yields Ease 3-4bp; ST Engineering Prices $ Bond

April 30, 2025

US Treasury yields continued to ease, with yields lower by 3-4bp across the curve. The US trade deficit for goods in March hit an all-time high of $162bn, led by tariff related stockpiling. Separately, US President Donald Trump in an interview, said that the 145% tariff on China was required, stating that it was “ripping off” the US.

Looking at equity markets, both the S&P and Nasdaq ended ~0.6% higher. The S&P500 index was up for a sixth consecutive day, marking its best streak since March 2022. Looking at credit markets, US IG CDS spreads were tighter by 0.4bp, while HY CDS spreads tightened by 2.9bp. European equity markets ended mixed. The iTraxx Main and Crossover CDS spreads widened by 0.5bp each. Asian equity markets have opened broadly higher this morning. Asia ex-Japan CDS spreads were wider by 0.5bp.

New Bond Issues

ST Engineering raised $750mn via a 5Y bond at a yield of 4.337%, 35bp inside initial guidance of T+85bp area. The senior unsecured note is rated Aaa (Moody’s). Proceeds will be used to refinance debt.

New Bonds Pipeline

- Bahrain hires for $ 8Y Sukuk /12Y bond

Rating Changes

-

Moody’s Ratings places Fibra Uno’s Baa3 ratings on review for downgrade

-

Grand City Properties Downgraded To ‘BBB’ Following Same Action On Parent; Outlook Stable

-

Moody’s Ratings changes Thailand’s outlook to negative from stable; affirms Baa1 ratings

Term of the Day: Blue Bonds

Blue bonds are a type of sustainable debt wherein the proceeds from such issuance are earmarked for marine/water projects related to ocean conservation (hence the name blue bonds). These are similar to green bonds, which are earmarked for green or environmentally-friendly projects. Blue bonds became popular in late 2018 when Seychelles issued the world’s first sovereign blue bond.

Korea Ocean Business issued a $300mn blue bond, the region’s first this year, to finance or refinance projects related to sustainable marine transport and renewable energy.

Talking Heads

On Slow Shift Out of Treasuries Is Likely – German Debt Chief, Tammo Diemer

“The political uncertainty is not appreciated. When US Treasury bonds mature, portfolio managers will ask themselves whether they still need to be in dollars or whether their weight has shifted to another currency… there will be changes and a bias and tendency toward the euro.”

On Trump’s ‘Golden Age’ Is Off to Ugly Start

Mark Malek, Siebert

“It was an extreme, for-the-textbooks, systematic risk in its purest form… volatility has been wholly different from anything we have experienced in the past… fueled by random sound bites and shifting policy moves”

Richard Galvin, DACM

“Trump campaigned on a pro-crypto platform and has largely delivered. The market was quick to price in the pro-crypto environment in November, but since then has been somewhat captive to broader equity and bond market weakness”

On US corporate bond markets betraying caution behind recent rebound

Zachary Griffiths, CreditSights

“Sentiment is still fragile”… demand for bonds on Monday was still “a sign of a risk-off sentiment”… “credit spreads are biased wider”

Edward Marrinan, SMBC Nikko Securities

“Companies should issue bonds now rather than wait because market conditions are relatively stable at present… while funding costs could rise, we do not expect it to be prohibitively expensive to issue bonds”

Top Gainers and Losers- 30-April-25*

Go back to Latest bond Market News

Related Posts: