This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

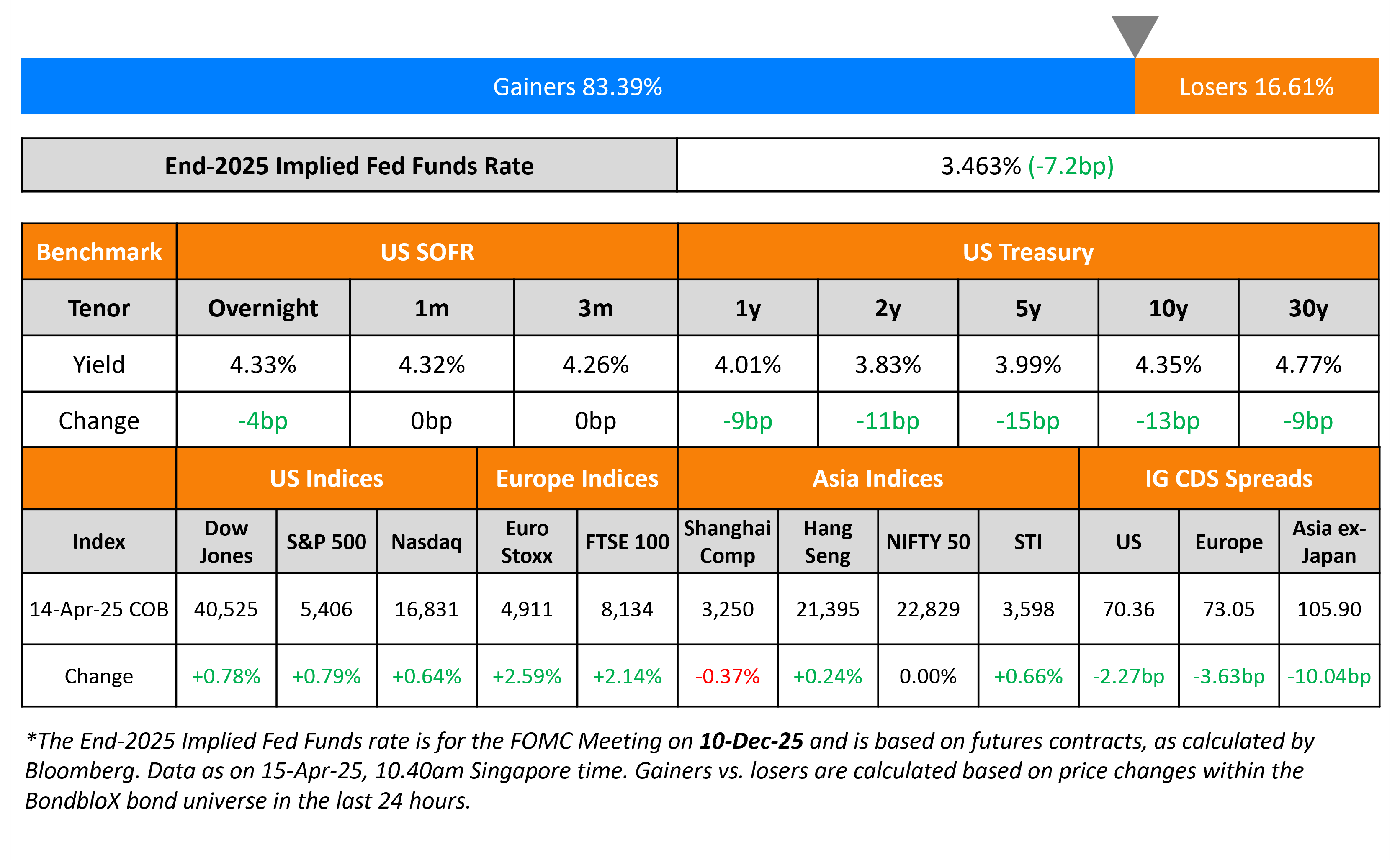

Treasury Yields Drop Over 10bp; MS, JPMorgan, BNY, HP Price $ Bonds

April 15, 2025

US Treasury yields dropped sharply across the curve, by as much as 15bp. While US President Donald Trump said that smartphones and electronics will get a temporary tariff relief, he added that he would be announcing the tariff rate on imported semiconductors over the next week. Separately, Atlanta Fed President Raphael Bostic said that the Fed must be patient and wait for more clarity on the current administration’s policies before adjusting rates.

Looking at US equity markets, the S&P and Nasdaq rallied, closing 0.8% and 0.6% higher. Looking at credit markets, US IG and HY CDS spreads widened by 2.3bp and 5bp respectively. European equity markets ended higher. The iTraxx Main and Crossover CDS spreads tightened by 3.6bp and 16bp respectively. Asian equity markets have opened in the green this morning. Asia ex-Japan CDS spreads were tighter by 10bp.

New Bond Issues

- China Great Wall AMC $ 3Y at T+195bp area

Morgan Stanley raised $8bn via a four-trancher.

The senior unsecured notes are rated A1/A-/A+. Proceeds will be used for general corporate purposes.

JPMorgan raised $6bn via a two-trancher. It raised $2.5bn via a 6NC5 bond at a yield of 5.103%, 25bp inside initial guidance of T+135bp area. It also raised $3.5bn via a 11NC10 bond at a yield of 5.572%, 25bp inside initial guidance of T+145bp area. The senior unsecured notes are unrated. Proceeds will be used for general corporate purposes.

BNY Mellon raised $2.5bn via a three-trancher. It raised:

- $750mn via a 2NC1 bond at a yield of 4.587%, 25bp inside initial guidance of T+100bp area.

- $500mn via a 2NC1 FRN at SOFR+71bp vs. initial guidance of SOFR equivalent area

- $1.25bn via a 4NC3 bond at a yield of 4.729%, 33bp inside initial guidance of T+120bp area.

The senior medium-term bank notes are unrated. Proceeds will be used for general corporate purposes.

HP Inc raised $1bn via a two-trancher. It raised $500mn via a 5Y bond at a yield of 5.462%, 25bp inside initial guidance of T+175bp area. It also raised $500mn via a 10Y bond at a yield of 6.13%, 25bp inside initial guidance of T+200bp area. The senior unsecured notes are rated Baa2/BBB/BBB+, and have a change of control put at 101. Proceeds will be used for general corporate purposes, which may include, without limitation, repayment and refinancing of debt.

New Bonds Pipeline

- Mashreq hires for $ 500mn 5Y WNG Sukuk bond

Rating Changes

-

OTP Bank PLC Upgraded To ‘BBB/A-2’ On Higher Resilience Against Potential Sovereign Stress; Outlook Negative

-

Moody’s Ratings upgrades Barbados’ ratings to B2 from B3, maintains stable outlook

-

Moody’s Ratings Downgrades Newell Brands’ CFR to Ba3; outlook remains negative

-

JD.com Outlook Revised To Positive On Strengthening Retail Business And Greater Contribution From Logistics; ‘A-‘ Rating Affirmed

Term of the Day: Regulation S

A Regulation S or Reg S bond is one that is issued in the international bond market and is usually cleared through Euroclear and Clearstream. These bonds cannot be sold in the US, except to qualified institutional buyers (QIBs) under the SEC 144A Rule. The 144A Rule, issued in 1990, modified a two-year holding period rule on privately placed securities by permitting (Qualified Institutional Buyer) QIBs to trade in these securities among themselves. Thus, a 144A bond, with a unique identifier, is privately placed to US based QIBs and usually clears through DTCC.

Talking Heads

On More Positive on Bonds on Fed, Reserve Data – JPMorgan’s Bob Michele

“I feel pretty good that we’re putting in a low in price and a high in yield here.. In our conversations with overseas investors, they’re not being shaken out of Treasuries”

On Credit Market Rout Has Ways to Go Before Fed Steps In – UBS

“Current indicators suggest no immediate justification for intervention… Spread widening tends to stabilize after emergency Fed cuts and spreads trade sideways. Quantitative and credit easing cause credit spreads to tighten, but direct purchases are more effective.”

On Seeing the Fed Buying Bonds If 10-Year Treasury Tops 5% – Vincent Mortier, Amundi

See the Fed stepping to buy the notes at 5%, while on the 30Y segment, expect action once yields surpass 5.25%… “The only way for the US to continue to refinance itself with twin deficits and an economy under pressure will be to nationalize its debt like Japan”

Top Gainers and Losers- 15-April-25*

Go back to Latest bond Market News

Related Posts: