This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Yields Drop on Dovish Powell; Alsea Upgraded; Spirit Airlines, Worldline Downgraded

August 25, 2025

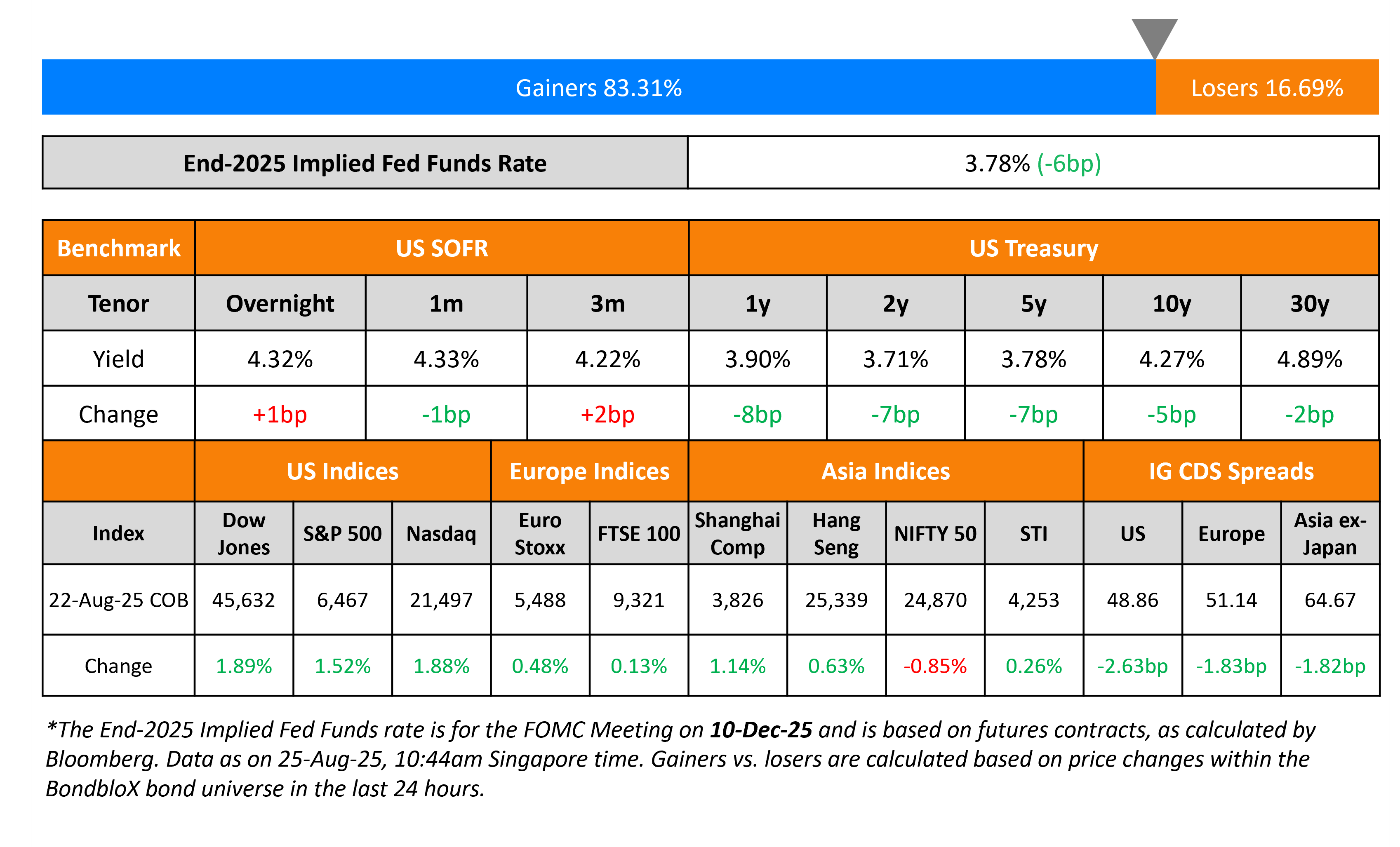

US Treasury yields dropped, with the curve bull steepening after Fed Chairman Jerome Powell’s Jackson Hole address. The 2Y yield fell 7bp while the 10Y was down 5bp. Markets took Powell’s comments to be a dovish signal after he said that the downside risks to the labor market may “warrant adjusting” their policy stance. However, he did not commit to any action. Separately, the CBO said that US President Trump’s tariffs could reduce the deficit by $4tn over the next decade.

Looking at US equity markets, the S&P and Nasdaq ended 1.5% and 1.9% higher respectively. US IG and HY CDS spreads tightened by 2.6bp and 15bp respectively. European equity markets ended higher too. The iTraxx Main CDS spreads were 1.8bp tighter and Crossover spreads tightened by 7.5bp. Asian equity markets have opened in the green today. Asia ex-Japan CDS spreads were 1.8bp tighter.

New Bond Issues

New Bond Pipeline

- Mitsui & Co. hires for $ 5Y

- JERA Co hires for $ 5Y

- Fukoku Life hires for $ 30NC10

Rating Changes

-

Moody’s Ratings downgrades Spirit Airlines’ CFR to Caa3; outlook changed to negative

-

Moody’s Ratings changes Austria’s outlook to negative from stable, affirms Aa1 ratings

-

Moody’s Ratings affirms Chemours’ Ba3 rating; changes outlook to negative

-

Moody’s Ratings changes Cenovus’ outlook to negative; affirms Baa1 ratings

Term of the Day: Dovish

A dovish stance is a central banking policy stance which is accommodative, in favour of maintaining interest rates at low levels and generally not worried about inflation. This stance is generally taken to ease financial conditions from the monetary policy side to stimulate the economy. Reuters reported that US Treasury yield fell with fresh dovish comments from Federal Reserve Chair Jerome Powell who said that while price may go up, inflation may not.

Talking Heads

On Emerging Assets Set to Pull Ahead of Developed Peers

George Efstathopoulos, Fidelity

“EM equities are likely to outperform as they enjoy the tailwinds of easing local monetary policy across most markets boosting domestic lending and consumption but also a weaker dollar”

Archie Hart, Ninety One

“If we look at policymakers in emerging markets, they’re conservative, they’re disciplined by the market, they’re pragmatic, so we don’t see these huge unsustainable fiscal deficits that you see in developed markets”

On Powell’s Management of Fractious FOMC – Austan Goolsbee, Chicago Fed President

“I think he’s a first ballot hall-of-fame Fed chair, and he has great judgment…He has also navigated a pretty diverse set of worldviews on that committee. That’s what makes me feel it’s less the first thing.”

On Powell’s Dovish Pivot Brightening Analyst Views on Asian Markets

Gerald Gan, Reed Capital

“Asian equities across the board will certainly be boosted if expectation of a cut rise further as the September FOMC approaches…As long as the appreciation of Yen is moderated, it will not be too problematic towards Japanese risky assets.”

Priyanka Kishore, Asia Decoded

“A weaker dollar would temporarily lift Asian currencies with Powell signaling a September rate cut. But unless the Fed commits to a deeper easing cycle, any rally is likely to be short-lived.”

Jamie Halse, Senjin Capital:

“This is likely positive for global markets in the short term, as it implies capital leaving the US for better return opportunities elsewhere, and a falling dollar.”

Top Gainers and Losers- 25-Aug-25*

Go back to Latest bond Market News

Related Posts: