This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Yields Drop after Weak ADP; Giti Tire Launches S$ 5Y Bond; Bahrain Prices $ Notes

October 2, 2025

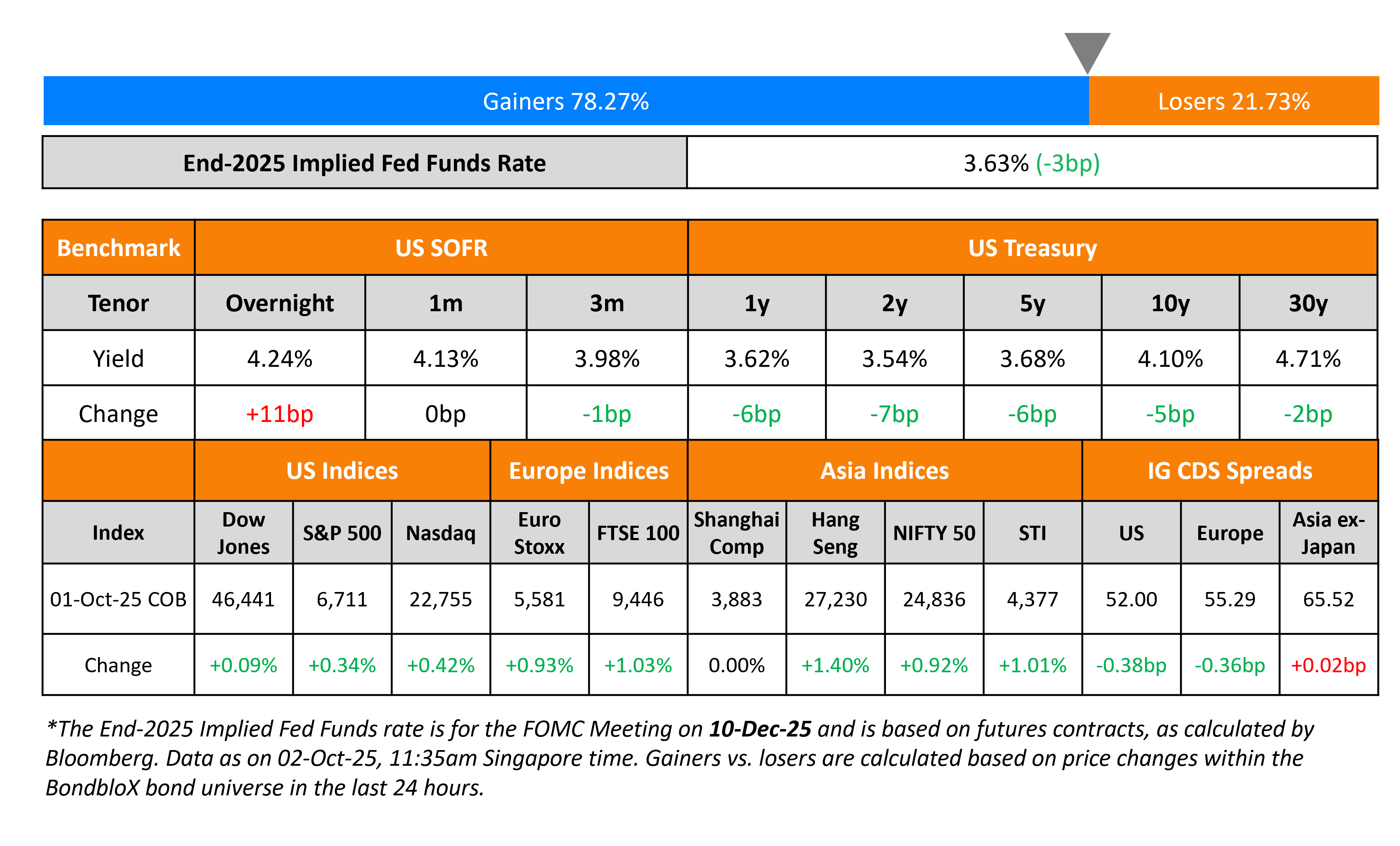

US Treasury yields fell by 5-7bp across the curve on Wednesday. This came on the back of weaker than expected ADP employment data. ADP private payrolls fell by 32k in September vs. expectations of a 51k rise. With the Bureau of Labor Statistics (BLS) not releasing the NFP report on Friday due to the government shutdown, the ADP print gained prominence, thereby swaying Treasuries. Separately, the ISM Manufacturing Index contracted for a seventh straight month, coming-in at 49.1 vs. expectations of 49.0.

Looking at equity markets, both the S&P and Nasdaq ended 0.4% and 0.3% higher respectively. US IG CDS spreads were tighter by 0.4bp while HY CDS spreads were flat. European equity markets ended higher too. The iTraxx Main CDS and Crossover CDS spreads tightened by 0.4bp and 1.4bp respectively. Asian equity markets have opened higher today. Asia ex-Japan CDS spreads were stable.

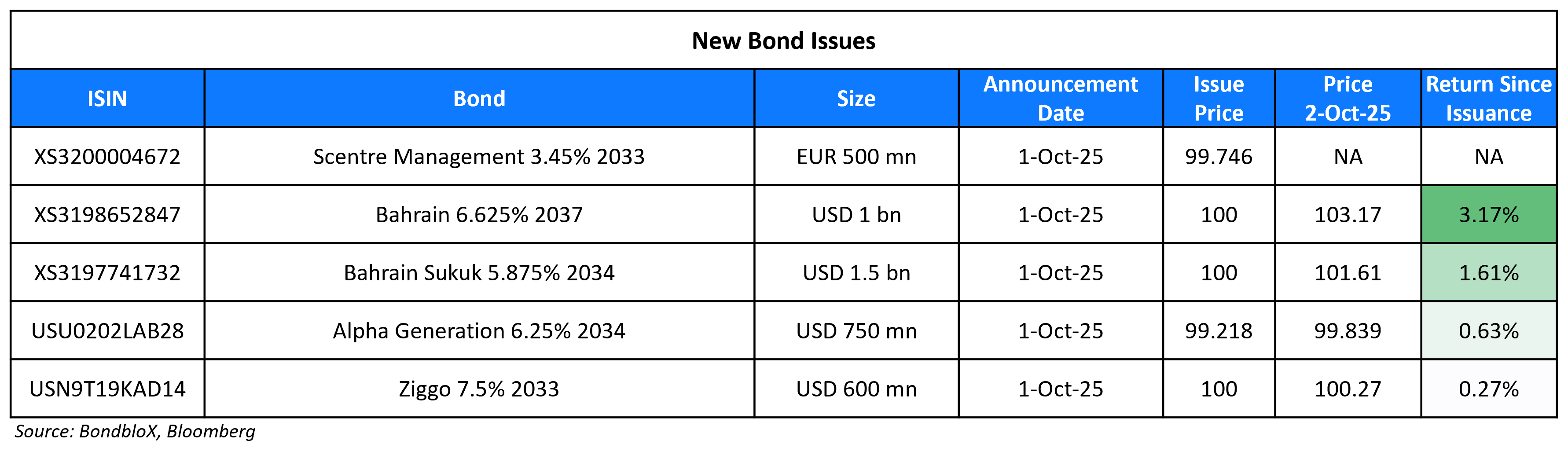

New Bond Issues

- Giti Tire S$ 5Y FPG at 5.75% area

Bahrain raised $2.5bn via a two-part deal. It raised $1.5bn via a long 8Y sukuk at a yield of 5.875%, inline with initial guidance. It also raised $1bn via a 12Y bond at a yield of 6.625%, inline with initial guidance. The senior unsecured notes are rated B+/B+ (S&P and Fitch), and recevied orders of over $8.4bn, 3.4x issue size. The new long 8Y sukuk was priced ~15bp tighter to its existing 5.625% 2034 (non-sukuk) that currently yield 6.02%. However, the new 12Y bond was priced at a new issue premium of ~30bp over its existing 7.5% 2037s that currently yield 6.33%.

Rating Changes

- Fitch Upgrades Carnival Corporation’s IDR to ‘BBB-‘; Outlook Stable

- Moody’s Ratings upgrades Antero Midstream’s CFR to Ba1

- Moody’s Ratings takes actions on Monte dei Paschi di Siena S.p.A. and Mediobanca S.p.A.’s ratings

- Moody’s Ratings changes JSW Steel’s rating outlook to positive; affirms Ba1 ratings

- Moody’s Ratings affirms Banamex’s Baa1 deposit ratings, changes outlook to negative

- Fitch Places Electronic Arts on Ratings Watch Negative

- Fitch Places Victoria on Rating Watch Negative on Potential Distressed Debt Exchange

Term of the Day: Sukuk

A Sukuk is a sharia-compliant fixed income instrument that essentially works similar to bonds. In a Sukuk, key differentiators vs. conventional bonds are:

– Investors share partial ownership of an asset rather than it being a debt obligation by the issuer

– The pricing is based on the underlying value of assets rather than credit worthiness

– The holder receives a share of underlying profits rather than interest payments (considered ‘riba’)

Sharia compliance broadly implies that any profits derived from these funding arrangements must be derived from commercial risk-taking and trading only; that interest income is prohibited on lending activities and; that the assets must be halal. To learn more about sukuk, click here

Talking Heads

On Bond Returns Set to Outpace Cash Due to Rate Cuts – Tiffany Wilding, Andrew Balls at Pimco

“With rates on cash-like investments likely to decline alongside central bank policy rates, we expect bonds to outperform… Locking in today’s attractive starting bond yields can support strong returns and income potential in the years ahead across a variety of economic scenarios”

On Miran Gave Weakest Fed Governor Speech in Memory – Fmr. US Treasury Secy., Larry Summers

“I cannot remember an analytically weaker speech given before the New York Economic Club or given by a Fed governor… If this was the best case for the radical reduction in interest rates that President Trump has been advocating, then that case is even weaker than I had previously supposed”

On Being Surprised by September’s Record Corporate-Bond Binge

“We were a bit surprised with how busy September turned out to be… were expecting a busy month but not a record-setting month…. corporate America is shifting to more of a growth story and that will likely lead to perhaps additional CapEx that is further driving the debt financing needs of our issuers

Top Gainers and Losers- 02-Oct-25*

Go back to Latest bond Market News

Related Posts: