This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Yield Rise on Hawkish FOMC Minutes

February 19, 2026

US Treasury yields moved higher by 3-4bp across the curve on Wednesday. This came on the back of a hawkish tilt in the FOMC’s January meeting minutes. In particular, it stated “several participants indicated that they would have supported a two-sided description of the Committee’s future interest rate decisions”. It added that the possibility of “upward adjustments to the target range for the federal funds rate could be appropriate if inflation remains at above-target levels”. It also noted that several participants cautioned about the fact that easing policy further amid elevated inflation readings “could be misinterpreted as implying diminished policymaker commitment” to the 2% inflation objective. On the data front, December’s preliminary Durable Goods Orders fell by 1.4%, albeit better than expectations of a 2% drop. Core Durable Goods Orders rose by 0.9%, beating expectations of 0.3%.

Looking at US equity markets, the S&P ended 0.6% higher and the Nasdaq closed 0.8% higher. US IG CDS spreads tightened by 1.3bp and HY CDS spreads were 3.6bp tighter. European equity indices ended higher too. The iTraxx Main CDS spreads were 1.1bp tighter and the Crossover CDS spreads were 5.4bp tighter. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were flat.

New Bond Issue

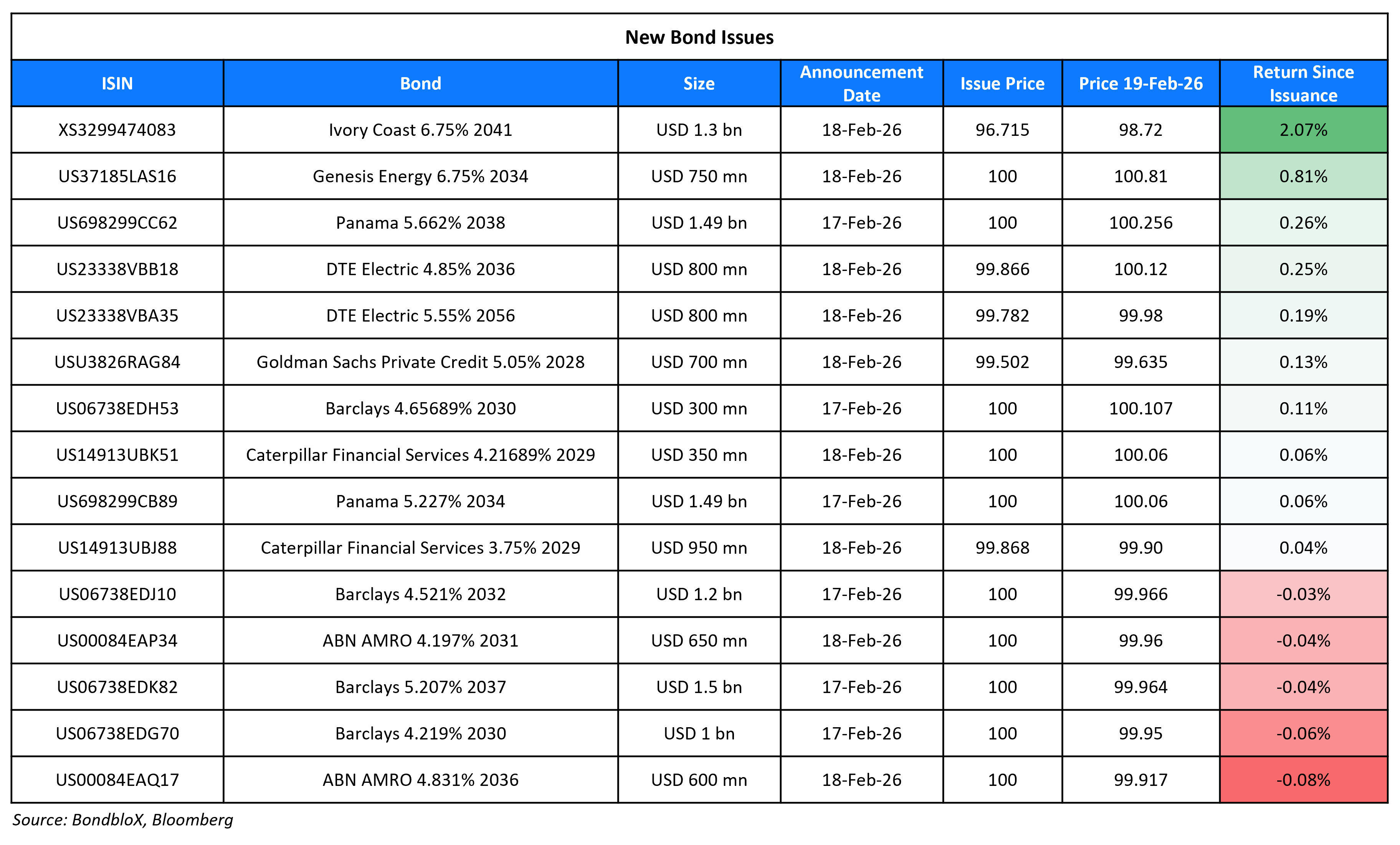

Cote d’Ivoire raised $1.3bn via a 14Y amortizing bond at a yield of 7.125%, 62.5bp inside initial guidance of 7.75% area. The senior unsecured note is rated Ba2/BB/BB, and received orders of over $3.3bn, 2.5x issue size. The issuance features an amortizing structure with a 14-year weighted average life, repaying principal in three equal installments between 2039 and 2041. Proceeds will be used for general budgetary purposes.

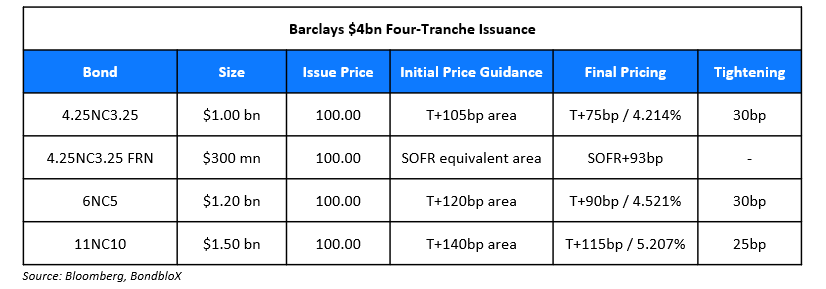

Barclays raised $4bn via a four-tranche offering:

The senior unsecured notes are rated Baa1/BBB+/A. Proceeds will be used for general corporate purposes.

The Republic of Panama raised $2.98bn via a dual-tranche offering. It raised $1.49bn via an 8Y bond at a yield of 5.227%, 35bp inside initial guidance of T+175bp area. It also raised $1.49bn via a 12Y bond at a yield of 5.662%, 35bp inside initial guidance of T+195bp area. The senior unsecured notes are rated Baa3/BBB- (Moody’s/S&P). Both tranches feature a soft bullet amortization structure with equal principal installments in the final two years. The 8Y and 12Y notes have a weighted average life of 7.5 years and 11.5 years respectively. Proceeds will be used to fund a concurrent tender offer for its outstanding global bonds and for general budgetary purposes.

Cameroon raised $100mn via a tap of its 8.875% 2033s at a yield of 9.7%. The senior unsecured note is rated B-/B (S&P/Fitch). Proceeds will be used for general budgetary purposes. The bond has a weighted average life of 5 years.

ABN AMRO Bank raised $1.25bn via a dual-tranche offering. It raised $650mn via a 5Y bond at a yield of 4.197%, 25bp inside initial guidance of T+80bp area. It also raised $600mn via a 10Y bond at a yield of 4.831%, ~22.5bp inside initial guidance of T+95/100bp area. The senior preferred notes are rated Aa3/A/A+ (Moody’s/S&P/Fitch). Proceeds will be used for general corporate purposes.

Goldman Sachs Private Credit Corp raised $1.1bn via a two-tranche offering. It raised $700mn via a 2Y bond at a yield of 5.316%, 30bp inside initial guidance of T+215bp area. It also raised $400mn via a tap of its 5.875% 2031s at a yield of 6.252%, 15bp inside initial guidance of T+275bp area. The senior unsecured notes are rated Baa3/BBB-/BBB-. Proceeds will be used to repay a portion of outstanding debt under the company’s credit facilities and for general corporate purposes.

Caterpillar Financial Services Corp (CAT) raised $1.3bn via a two-tranche offering. It raised $350mn via a 3Y bond at a yield of 3.797%, 25bp inside initial guidance of T+55bp area. It also raised $950mn via a 3Y FRN at SOFR+49bp, vs. initial guidance of SOFR equivalent area. The senior unsecured notes are rated A2/A/A+. Proceeds will be used for general corporate purposes.

Genesis Energy LP (GEL) raised $750mn via an 8NC3 bond at a yield of 6.75%, 12.5bp inside initial guidance of 6.875% area. The senior unsecured note is rated B2/B/BB-. Proceeds will be used to purchase or redeem up to $490mn of its outstanding 7.75% 2028s and to repay revolving borrowings under the company’s senior secured credit facility. The offering was upsized from an original $500mn target.

New Bonds Pipeline

- Kenya plans two-part dollar issuance

Rating Changes

- Piramal Finance Ltd. Upgraded To ‘BB/B’ On Improving Business Stability; Outlook Stable

- Moody’s Ratings upgrades Michael’s CFR to B2

- Moody’s Ratings upgrades Danske Bank A/S’s Baseline Credit Assessment to a3; upgrades long-term deposit ratings to Aa3

- Dow Chemicals Ratings Lowered One Notch To ‘BBB-‘ On Intensifying Petrochemical Downturn; Outlook Negative

- Olin Corp. Downgraded To ‘BB’ On Weak Merchant Chlorine And Derivatives Demand, Outlook Negative

- Westlake Corp. Downgraded To ‘BBB’ On Weaker Chemical Segment Performance, Higher Debt, Outlook Negative

- Clorox Co. Ratings Lowered To ‘BBB’ From ‘BBB+’, Removed From CreditWatch Negative; Outlook Stable

- The Michaels Cos. Inc. Outlook Revised To Positive From Stable; Rating Affirmed; New Debt Rated

- Nomura Outlooks Revised To Positive On Improving Prospect Of Stable Earnings; Ratings Affirmed

- Fitch Places Schroders on Rating Watch Positive on Planned Acquisition by Nuveen

Term of the Day: Weighted average life (WAL)

Weighted average life (WAL) is a feature of amortizing bonds, which are different from straight bonds in that they payback principal through the life of the bond rather than a one-time payment of the full principal at maturity. WAL refers to the average time, stated in years, in which the bond’s unpaid principal remains outstanding. WAL is calculated as follows with an example of a 3Y bond with a $100 face value where P1 refers to principal repayment in year one, P2 in year two and P3 in year three:

WAL = [(P1 x 1) + (P2 x 2) + (P3 x 3)] / $100

Talking Heads

On US Treasuries Declining as Fed Minutes Temper Rate-Cut Outlook

Guneet Dhingra, BNP Paribas

“The Fed minutes are supportive of our view that we’re not going to get any cuts this year. There may be elements pulling inflation down in the second half, but the actual level of inflation is still far from 2%”

Priya Misra, JPMorgan Investment Management

“Rates reacted to the better-than-expected data on durable goods, housing and IP by bear flattening”

John Canavan, Oxford Economics

“The 10-year rally has stalled around the nice round number of 4%. What’s needed for a breakout is some shift in sentiment about the economy and some shift in inflation.”

On AT1s Hitting New Frontier With Tightest-Ever Euro Spread

Jeremie Boudinet, Credit Mutuel Asset Management

“All-in yield for AT1 and credit overall is the only thing that matters. Spreads are just a secondary metric… much less exposed to software, private debt and trade barriers than high-yield bonds”

On Urging Japan to Avoid Fiscal Risk of Cutting Sales Tax – IMF

“The authorities should avoid reducing the consumption tax, an untargeted measure that would erode fiscal space and add to fiscal risks… High and persistent debt levels, together with a deteriorating fiscal balance, leave Japan’s economy exposed to a range of shocks “

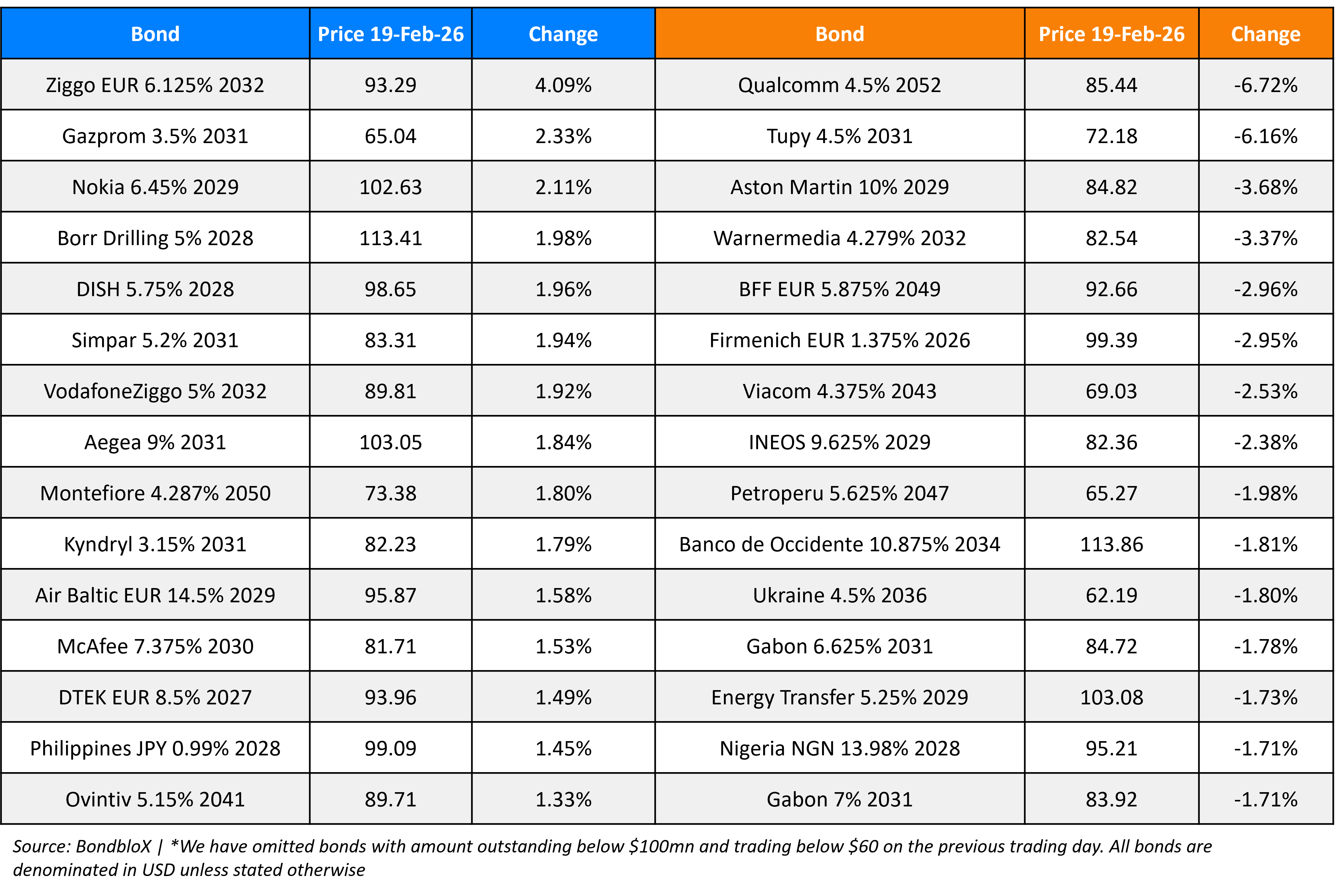

Top Gainers and Losers- 19-Feb-26*

Go back to Latest bond Market News

Related Posts: