This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

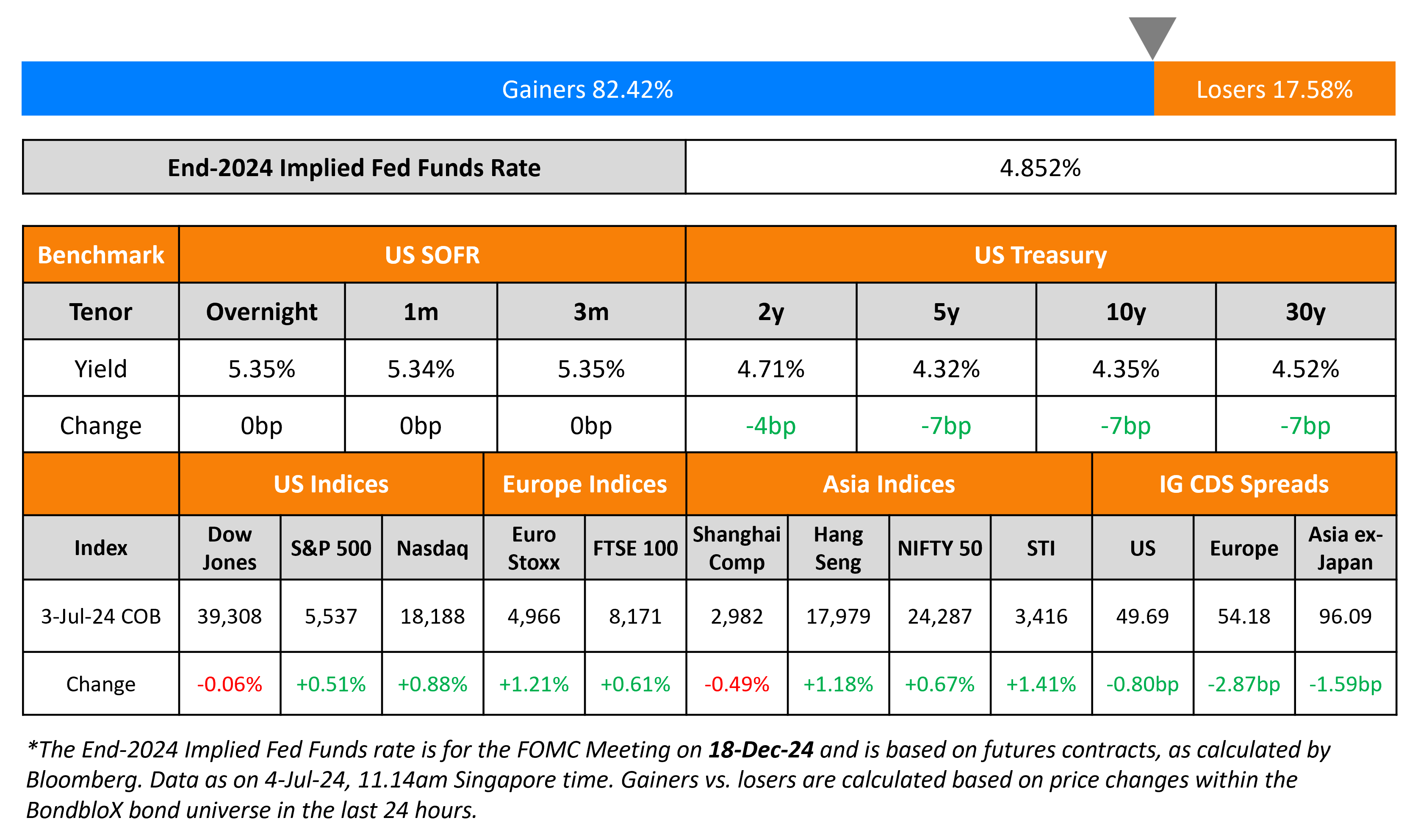

Treasury Yield Drop After Weak ISM Services

July 4, 2024

US Treasury yields fell by nearly 7bp across the curve following a negative surprise to economic data. The US ISM Non-Manufacturing Index for June came at 48.8 vs. the surveyed 52.7, its second contractionary reading in three months. Among its subcomponents, both the Employment and New Orders indexes fell further to 46.1 and 47.3 vs. expectations of 49.5 and 53.6. Also, US ADP Payrolls for June also came softer than expected at 150k vs. the surveyed 165k.. Separately, the FOMC’s June meeting minutes indicated that they did not expect to cut rates until “additional information had emerged to give them greater confidence” that inflation was moving sustainably towards 2%. Looking at equity markets, S&P and Nasdaq were up 0.5% and 0.9%, respectively. US IG spreads were 0.8bp tighter and while HY CDS spreads tightened by 3bp.

European equity indices ended higher. In credit markets, the iTraxx Main and Crossover spreads were tighter by 2.9bp and 12bp respectively. Asian equity indices have opened broadly higher this morning. Asia ex-Japan CDS spreads were 1.6bp tighter. The China Caixin Services PMI fell to 51.2 in June vs. expectations of 53.4 and the prior 54.0 print The services sector continued its eighteenth month of expansion, albeit at its slowest pace since October 2023.

New Bond Issues

- Ho Bee Land S$ 5Y Green at 4.6% area

Samvardhana Motherson raised $350mn via a 5Y bond at a yield of 5.724%, 35bp inside initial guidance of T+175bp area. The senior secured bond is rated Baa3/BBB- (Moody’s/Fitch). Proceeds will be used for repayment and refinancing of existing indebtedness. The issuer is SMRC Automotive Holdings Netherlands BV and Samvardhana Motherson International Ltd is the guarantor. This is the debut dollar issuance by the company, prior to which it raised €300mn via a 1.8% bond due July 2024. The notes have the benefit of a pledge of all of the capital stock of the issuer, held by its guarantor and subsidiaries from time to time.

Warba raised $500mn via a 5Y green sukuk at a yield of 5.351%, 35bp inside initial guidance of T+140bp area. The senior unsecured notes are rated A by Fitch, and received orders of over $1.4bn, 2.8x issue size.

CapitaLand raised S$300mn via a 10Y green bond at a yield of 3.75%, 10bp inside initial guidance of 3.85% area. The issuer is CMT MTN Pte Ltd and HSBC Institutional Trust Services Singapore Ltd will act as a guarantor in its capacity as trustee of and CapitaLand Integrated Commercial Trust (CICT). Proceeds will be used to finance/refinance in whole/part, eligible green projects undertaken by CICT and its subsidiaries in accordance with CICT’s green finance framework.

New Bonds Pipeline

- Astrea 8 Pte. hires for S$ bond

- NongHyup Bank hires for $ 3Y/5Y bond

Rating Changes

-

Swedish Real Estate Company SBB Downgraded To ‘SD’ On Accepted Below Par Exchange Offer

- Fitch Revises Amkor Technology’s Outlook to Positive; Affirms Ratings at ‘BB+

-

‘CAS Holding No.1. Ltd. Outlook Revised To Negative On Sustained Cash Flow Deficit At Parent PCCW; Ratings Affirmed

Term of the Day

Consent Solicitation

Consent solicitation is an offer by the issuer to change the terms of the security agreement. These are applicable for changes to bonds or shares issued and can range from distribution payment changes and covenant changes in bonds to changes in the board of directors with regard to equities.

Talking Heads

On Global Markets on Alert for Biden Exit as Trump-Win Trades Mount

Goldberg, head of US rates strategy at TD Securities

“Markets have already been repricing election odds since the debate… past 24 hours has really only added fuel to the fire”

Rodrigo Catril, a strategist at National Australia Bank

“Either way, the market is betting on Trump winning the election”

On Seeing Only One More Rate Cut This Year – ECB’s Makhlouf

“I am comfortable with expectations of another cut. I think two cuts today, at the beginning of July, is probably going a little bit too far. I’m not saying I’d rule it out.”

On India’s Long Bonds a Crowded Trade – Dhawal Dalal, Edelweiss

“We believe there won’t be a secular decline in India’s bond yields in the medium term… We don’t know whether there’ll be a parallel shift downward or there’ll be a widening of the spread between the 10 and 30”

Top Gainers & Losers- 04-July-24*

Go back to Latest bond Market News

Related Posts: