This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Curve Steepens; PCE Reading inline with Expectations

September 1, 2025

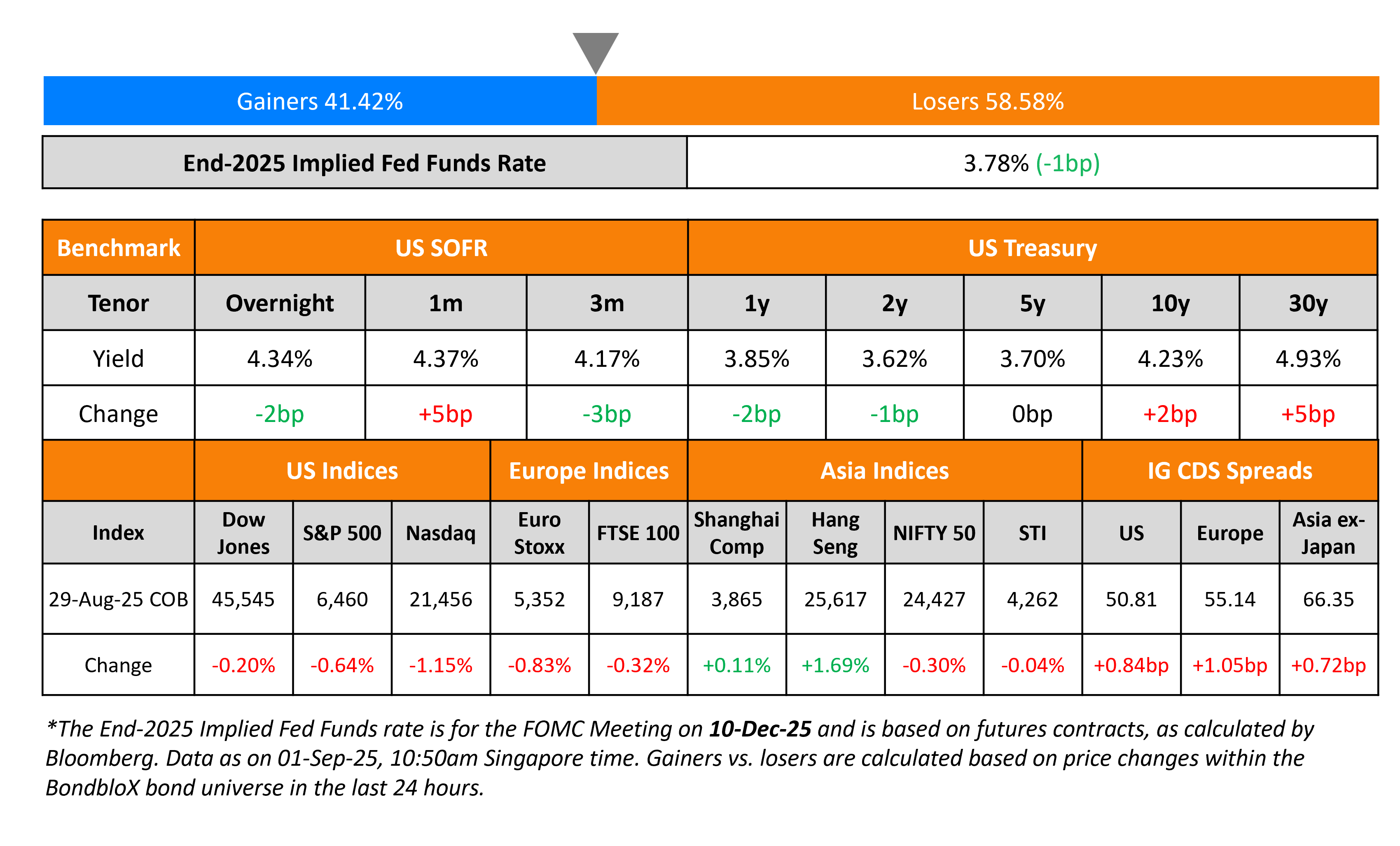

The US Treasury curve steepened with short-end yields lower by 1-2bp while long-end yields rose by ~2bp. The headline and Core PCE readings for July were inline with expectations at 2.6% and 2.9% YoY respectively. The final reading of the Michigan Consumer Sentiment Index for August came-in at 58.2, slightly softer than the prior reading and expectations of 58.6. San Francisco Fed President Daly said that it will “soon be time to recalibrate policy to better match our economy”, indicating a possible rate cut in September. Separately, a US Appeals Court noted that Donald Trump’s tarrifs were not legal. US Trade Representative Jamieson Greer however, noted that their administration was continuing its talks with trading partners.

Looking at US equity markets, the S&P and Nasdaq ended 0.6% and 1.2% lower respectively. US IG CDS spreads were 0.8bp wider and HY spreads widened by 4.8bp. European equity markets ended lower too. The iTraxx Main and Crossover CDS spreads widened by 1.1bp and 5.7bp respectively. Asian equity markets have opened in the red today. Asia ex-Japan CDS spreads were 0.7bp wider.

New Bond Issues

SocGen raised €1.25bn via an 8NC7 bond at a yield of 3.861%, 25bp inside initial guidance of MS+165bp area. The senior non-preferred note is rated Baa2/BBB/A-, and received orders of ~€4bn, 3.2x issue size.

New Bond Pipeline

- PTT Global Chem $ PerpNC5.25/PerpNC10

- Kyushu Electric $ 10Y bond

- Fubon Life $ 10.25Y Tier 2 bond

Rating Changes

- Fitch Affirms Delta Air Lines at ‘BBB-‘; Revises Outlook to Positive

- Fitch Downgrades Celanese’s IDR to ‘BB+’; Outlook Negative

- Fitch Revises Ryanair’s Outlook to Positive; Affirms IDR at ‘BBB+’

- Fitch Affirms and Withdraws GLP’s ‘BB’ Rating; Outlook Stable

Term of the Day: Mid-Swaps

Mid-Swaps are essentially the mid-rate or the average of the bid-ask rates on a swap corresponding to the maturity of the bond. Whilst bonds are generally priced as a spread over Treasuries, some issuers price them over the Mid-Swaps rate. Many euro denominated bonds are priced as a spread over the Mid-Swaps rate. The ‘swap rate’ is essentially the fixed-rate that the receiver gets in exchange for paying the floating rate in a Swap contract with the Mid-Swaps being the average of the bid-ask swap rates.

Talking Heads

On US Corporate Leverage Poised to Rise With $1tn Deals Deluge

Hans Mikkelsen, TD Securities

“We had a tremendous amount of uncertainty in the first part of the year… that’s really what’s unleashing all this M&A”

Ryan Morrell, PNC Financial Services

“Particularly if we see a gap lower in rates, there’ll be more incentive for those companies to de-risk the debt component of those acquisition financings”

Piers Ronan, Truist Securities

“Now a few months after that fear episode in April, we are getting a restart of animal spirits… will continue into 2026 and hopefully beyond”

On Brazil’s Lula in “no rush” to retaliate against US tariffs

Brazil President, Lula da Silva

“This is a process that takes a bit of time. We have to tell the United States that we also have actions we can take against them. But I am in no rush. What I want is to negotiate.

On Fed’s balance sheet drawdown entering new stage as reverse repos largely drained

Scott Skyrm, Curvature Securities

“Something changed… Massive bill issuance dumped a lot of new Treasury supply into the market, the (reverse repo) facility is close to zero, and bank reserves are declining… repo market is starting to experience more bouts of funding pressure”

Top Gainers and Losers- 01-Sep-25*

Go back to Latest bond Market News

Related Posts: