This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Curve Steepens Over the Shortened Trading Week

April 21, 2025

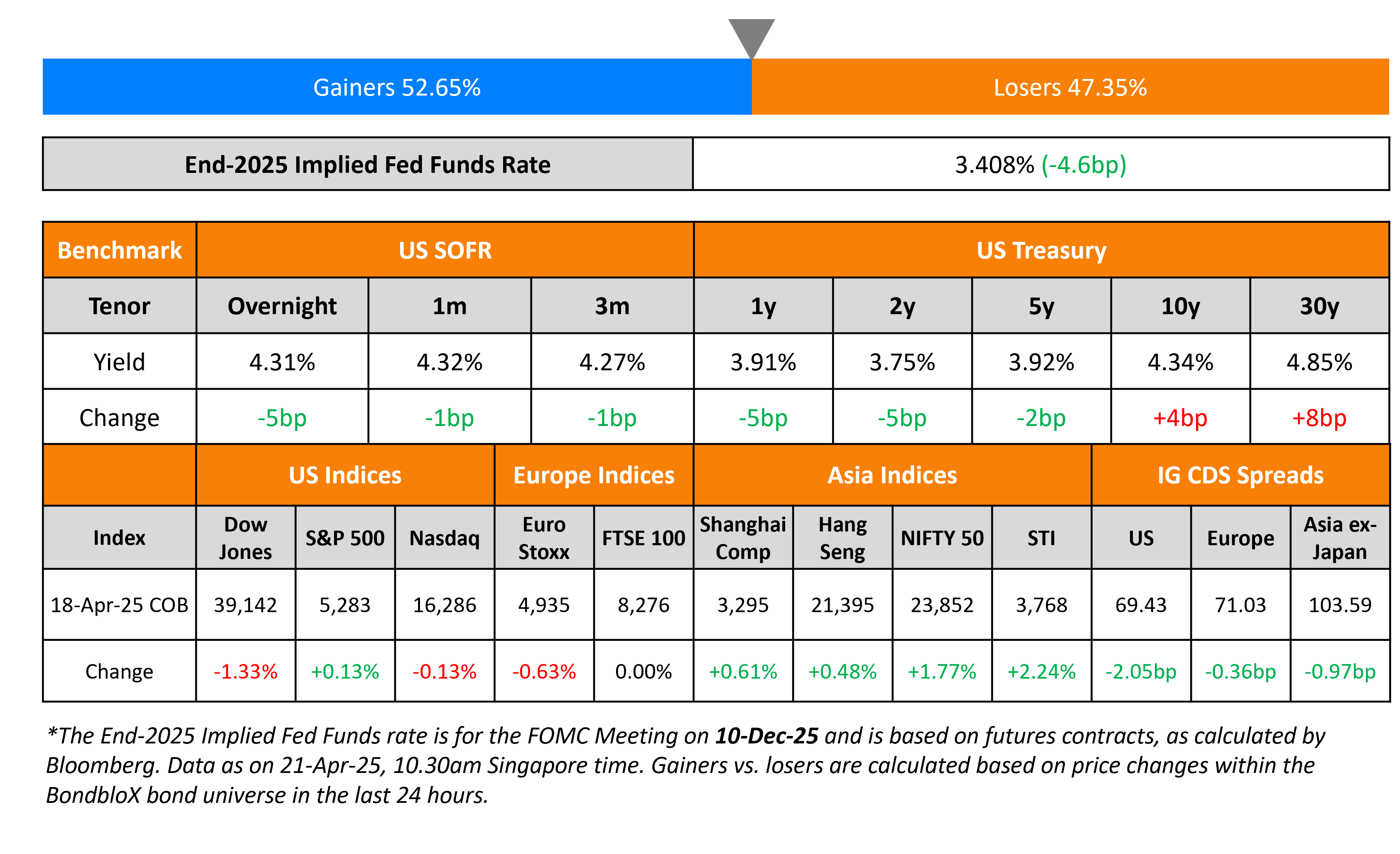

US Treasury yields were marginally lower on Wednesday, by 1-2bp. The US administration unveiled plans to impose new port fees on Chinese ships last Thursday. Also, the White House said that the President was exploring options to fire Fed Chairman Jerome Powell.

The S&P and Nasdaq ended broadly stable on Thursday during the shortened trading week. Looking at credit markets, US IG and HY CDS spreads tightened by 2.1bp and 10.6bp respectively. European equity markets ended mixed. The iTraxx Main and Crossover CDS spreads tightened by 0.4bp and 0.6bp respectively. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were tighter by 1bp.

New Bond Issues

Rating Changes

-

Italian Insurer Allianz SpA Upgraded To ‘A+’ From ‘A’ On Similar Sovereign Action; Outlook Stable

-

Various Rating Actions Taken On 15 Italian Banks On Sovereign Upgrade And More Resilient Industry Dynamics

-

Fitch Upgrades Vistra’s IDR to ‘BB+’; Outlook Stable

-

Fitch Upgrades Seplat to ‘B’; Outlook Stable

-

Fitch Upgrades Seven Nigerian Banks to ‘B’ on Sovereign Upgrade

-

Fitch Upgrades Bausch Health to ‘CCC+’

-

Greece Upgraded To ‘BBB/A-2’ On Unwavering Fiscal Discipline; Outlook Stable

-

Moody’s Ratings upgrades Mongolian Mining’s ratings to B2; outlook stable

-

Moody’s Ratings downgrades Bolivia’s ratings to Ca from Caa3; maintains stable outlook

-

Tullow Oil PLC Rating Lowered To ‘CCC+’ Due To May 2026 Debt Maturity; Outlook Negative

Term of the Day: Revolving Credit

Revolving credit is a form of borrowing where the credit line has a maximum limit but the borrower can access it in any quantum based on their funding needs. In a normal borrowing, once the loan has been repaid, the borrower must take a new loan to borrow more. In revolving debt, the borrower can re-access any funds that have been paid back too. Revolving debt generally comes with a higher interest rate and does not necessarily have a fixed coupon.

Talking Heads

On Finding Tariff Haven in Asian Consumer Stocks – Fidelity, Goldman

Charu Chanana, Saxo Markets

“Investors are starting to price in a more fragmented, protectionist world… shift in investor mindset from chasing global growth and exports to seeking shelter in domestic demand resilience”

Hironori Akizawa, Tokio Marine Asset

“Consumer staples is not an industry where demand fluctuates greatly. A positive scenario would be that central banks will move to cut interest rates, stimulating consumption”

On Firing Powell Would Hurt the Dollar and US Economy – France Finance Minister Eric Lombard

“Donald Trump has hurt the credibility of the dollar with his aggressive moves on tariffs — for a long time… this credibility will be harmed even more, with developments in the bond market”

On China’s US envoy urging end to trade war, but warns Beijing ready to fight

“The earth is big enough to accommodate both China and the US… We should pursue peaceful coexistence rather than collide head-on, and help each other succeed rather than get caught in a lose-lose scenario.”

Top Gainers and Losers- 21-April-25*

Go back to Latest bond Market News

Related Posts: