This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

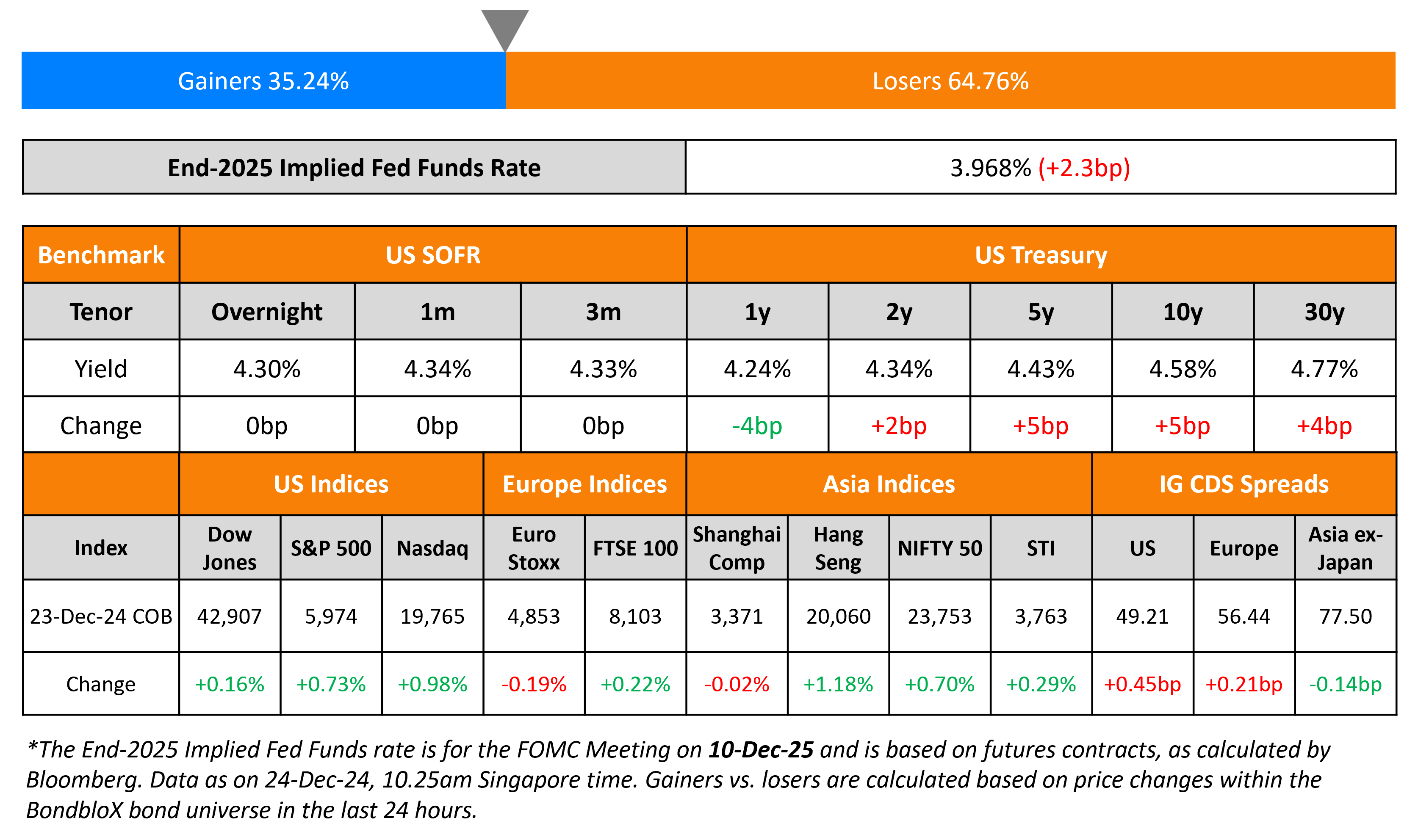

Treasury Curve Bear Steepens, Reversing Friday’s Move

December 24, 2024

The US Treasury curve bear steepened yesterday, reversing the bull flattening move seen on Friday, with the 10Y yield up ~5bp. The preliminary US Durable Goods Orders for November saw a 1.1% decline, worse than expectations of a 0.3% decline. Capital Goods Orders however, came-in at 0.7%, higher than expectations of 0.1%.

US IG and HY CDS spreads widened by 0.5bp and 2.6bp respectively. Looking at US equity markets, the S&P and Nasdaq closed 0.7% and 1% higher respectively. European equities ended mixed. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.2bp and 2bp respectively. Asian equities have opened broadly higher this morning. Asia ex-Japan CDS spreads were 0.1bp tighter.

New Bond Issues

Rating Changes

-

Moody’s Ratings upgrades Sri Lanka to Caa1 and assigns definitive Caa1 ratings to the new USD-denominated issuances; outlook stable

-

Fitch Upgrades Total Play to ‘B-‘; Outlook Stable

-

Argentine Conglomerate CLISA Upgraded To ‘CCC’ On Improved Capital Structure Following Debt Restructuring

-

Fitch Downgrades Televisa’s Ratings to ‘BBB-‘; Outlook Negative

-

iHeartCommunications Inc. Rating Lowered To ‘SD’ From ‘CC’ On Debt Restructuring

-

AIA Group Ltd. And Subsidiaries Outlook Revised To Positive On Accounting Treatment Transparency; Ratings Affirmed

-

Carnival Corp. Outlook Revised To Positive On Favorable Bookings And Expected Deleveraging; ‘BB’ Rating Affirmed

-

Fitch Revises OQ S.A.O.C’s Outlook to Positive; Affirms IDR at ‘BB+’

Term of the Day: Crossover CDS Spreads

The iTraxx Crossover Index is a credit default swap (CDS) based index compiled by IHS Markit (now part of S&P Global) which consists of the 75 most liquid sub-investment grade entities in Europe. The index helps track credit risk in the European high yield market, akin to the Markit HY CDS Index in the US. Performance is tracked in terms of the index’s value and the move in the spreads of the index. A tightening (a move lower) in its CDS spreads implies an easing of credit conditions in the European junk-bond markets which leads to an increase in the value of the index. On the other hand, a widening in its spread (a move higher) implies a worsening in credit conditions, which would lead to a fall in the index’s value. While the iTraxx Crossover Index helps track European high yield spreads, the iTraxx Main index helps track European investment grade spreads. The iTraxx Main index consists of 125 of the most liquid European entities with IG-ratings as published by Markit from time to time.

Talking Heads

On Limited Downside for Chinese Stocks – Goldman Sachs

While Donald Trump’s planned tariffs on Chinese imports will impact earnings, “the market has already given companies vulnerable to these risks a discount in valuation”… current levels can be well supported by potentially improving fundamentals… In the scenario of a 60% US tariff hike on Chinese goods, expect a 10% valuation downside.

On ECB Very Close to Meeting 2% Inflation Target – Christine Lagarde, ECB President

“We’re getting very close to that stage when we can declare that we have sustainably brought inflation to our medium-term 2%… I still believe that we should be very vigilant about services”

On Dollar firms as US rates outlook dominates

Vishnu Varathan, Mizuho Bank

“The shifts in Fed-BOJ policy divergence are now more likely to weaken the JPY. JPY carry trades could, in defiance of a step-up in volatility or uncertainty, remain in play as two critical factors – supported ‘carry returns’ and mitigated capital risks of JPY squeeze – conspire favorably”

Jonas Goltermann, Capital Economics.

“Our base case is that the dollar will make some further headway next year as the U.S. continues to outperform, the interest rate gap between the U.S. and other G10 economies widens a little further, and the Trump administration brings in higher U.S. tariffs”

Top Gainers and Losers- 24-December-24*

Go back to Latest bond Market News

Related Posts: