This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Curve Bear Steepens

April 9, 2025

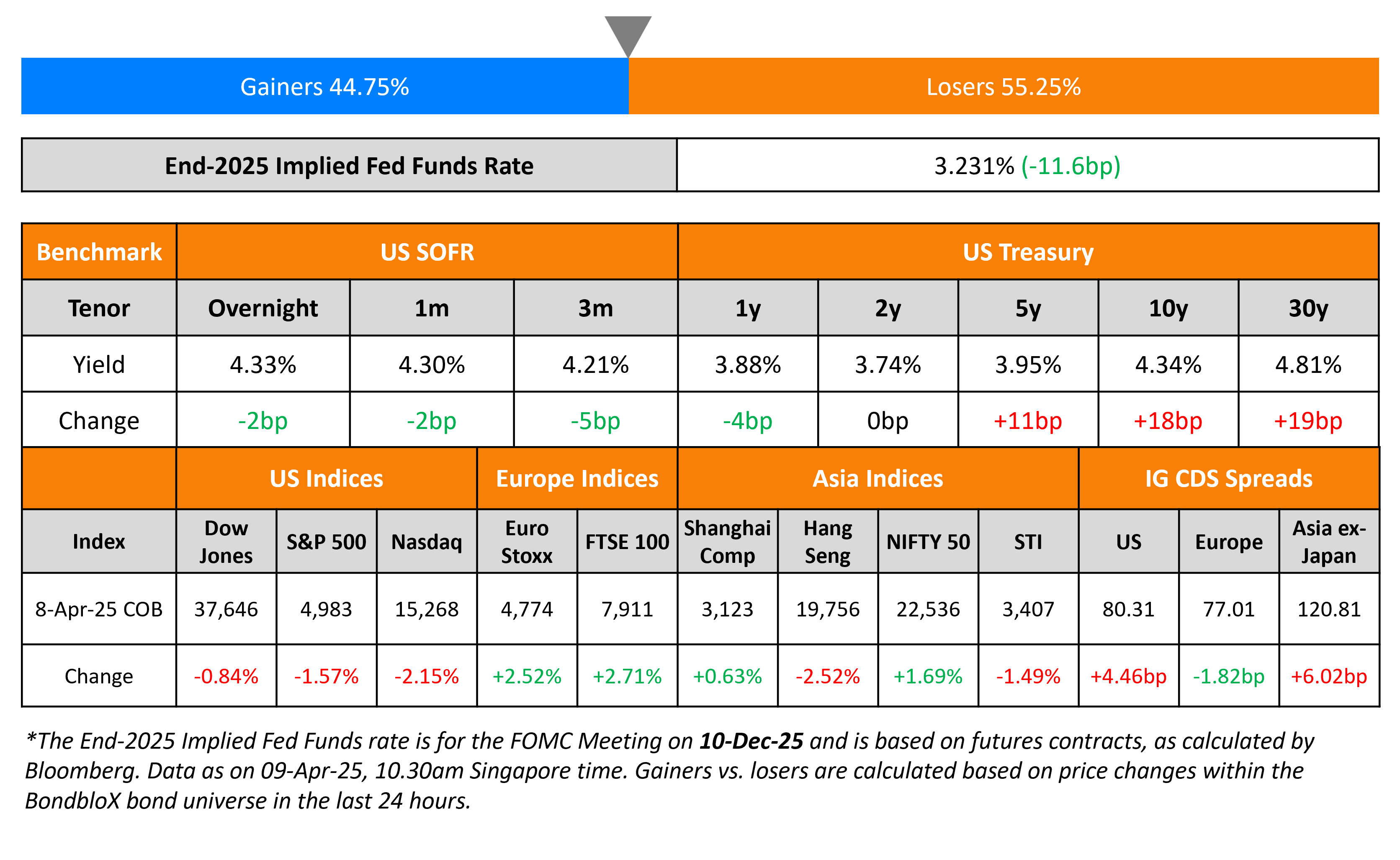

The US Treasury curve bear steepened yesterday with the 10Y and 30Y yields rising by 18-19bp while the 2Y yield held steady. The US NFIB small business optimism index declined to 97.4 from 100.7 previously. This was also below the five decade average of 98. Separately, US President Donald Trump’s tariff roll-out is expected to take place, including a 104% tariff on imports from China.

Looking at US equity markets, the S&P and Nasdaq closed 1.6% and 2.2% lower. Looking at credit markets, US IG and HY CDS spreads widened by 4.5bp and 16bp respectively. European equity markets rebounded sharply. The iTraxx Main and Crossover CDS spreads tightened by 1.8bp and 12bp respectively. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were wider by 6bp.

New Bond Issues

Rating Changes

-

Canacol Energy Downgraded To ‘CCC+’ From ‘B-‘ On Weaker Growth Prospects

- Fitch Downgrades Six Chinese Banks to ‘A’; Outlooks Stable

- Fitch Downgrades PTT Global Chemical to ‘BBB-/AA-(tha)’; Outlook Stable

Term of the Day

Treasury Basis Trade

The Treasury Basis Trade is a trade which involves buying/selling a treasury bond and simultaneously taking the opposite position in a corresponding treasury futures contract. When a trader buys the bond and sells the futures, it is considered to be a ‘long basis’ trade and when he/she sells the bond and buys the futures, it is a ‘short basis’ trade.

Talking Heads

On Treasury-Yield Surge Stokes Fear of Next Big Basis-Trade Unwind

James Athey, Marlborough Investment

“It looked like in March 2020 when we got these wild moves, possibly relating to the basis trade. Last week we had not seen any signs of hedge funds getting stopped out of the bond futures basis, but suddenly you’re seeing yields spike”

Ed Al-Hussainy, Columbia Threadneedle

“That is consistent with the basis trade unwinding at the 30-year point, which is where most of the juice is”

On Predicting No US Recession in 2025 – Nouriel Roubini

“There is, of course, a game of chicken between the Trump put and the Powell put… strike price for the Powell put is going to be lower than the strike price for the Trump put… There’s also a Xi put, meaning at some point Xi decides to give a break to the US”

On More Pain Ahead for Junk and Private Lender Bonds – JPMorgan

“US credit enters this period of slower growth with strong credit metrics and ratings, low default rates, light refinancing needs, ample liquidity/cash in investor hands and supportive technicals… We expect the sector to ultimately trade wide to the broader market (likely sooner rather than later), which could make us reassess”

Top Gainers and Losers- 09-April-25*

Go back to Latest bond Market News

Related Posts: