This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

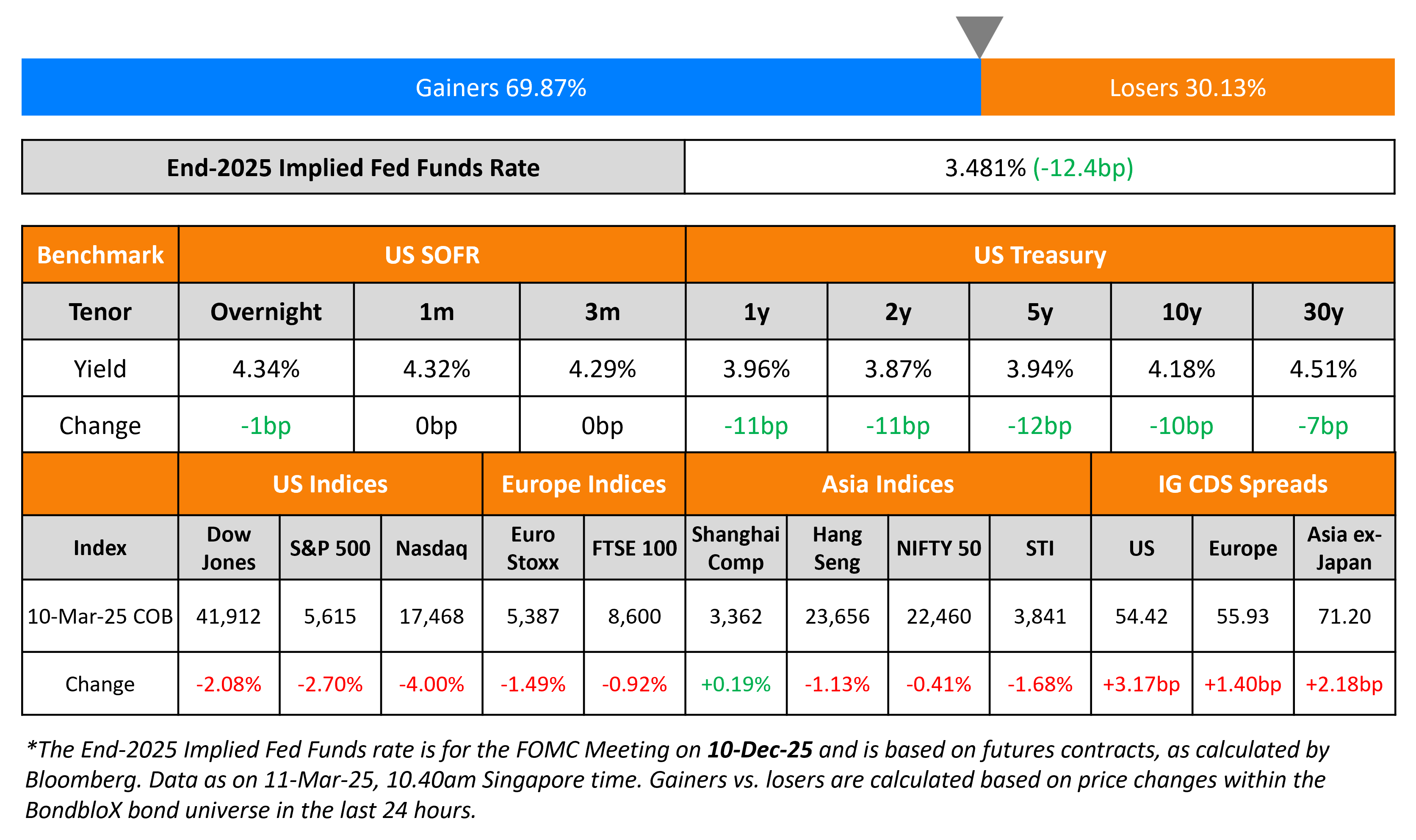

Treasuries Yields Drop Over 10bp

March 11, 2025

US Treasury yields dropped by 10-12bp across the curve as investors flocked to haven assets amid the risk-off sentiment. Markets reacted negatively to US President Donald Trump’s comments that the economy was facing a “period of transition”, whilst also not directly ruling out the possibility of a recession. This was despite earlier comments by Fed Chairman Jerome Powell who said that the economy was in a good place.

US equity markets saw the S&P and Nasdaq drop sharply by 2.7% and 4% respectively. Looking at credit markets, US IG and HY spreads CDS spreads widened 3.2bp and 3.1bp respectively. European equity markets ended lower. The iTraxx Main and Crossover CDS spreads widened by 1.4bp and 7.9bp respectively. Asian equity markets have opened in the red this morning. Asia ex-Japan CDS spreads were wider by 2.2bp.

New Bond Issues

New Bonds Pipeline

- Tata Capital hires for $ long 3Y bond

- Shinhan Bank hires for $ bond

- Aldar hires for $ 10Y Green WNG Sukuk bond

- Credit Agricole hires for € PerpNC10.75 RT1 bond

- AfDB hires for $ 5Y bond

- BTN Indonesia hires for $ 5Y Tier 2

Rating Changes

- Moody’s Ratings downgrades Telefonica del Peru to C on filing for bankruptcy procedures; outlook stable

-

Fitch Downgrades PizzaExpress to ‘CCC+’

-

Moody’s Ratings downgrades Polaris Newco to Caa1; stable outlook

-

Fitch Affirms Adani Energy at ‘BBB-‘; Off Rating Watch Negative; Outlook Negative

-

Fitch Affirms Adani Electricity Mumbai’s Note Ratings at ‘BBB-‘; Off Watch Negative

-

Fitch Revises KUO’s Outlook to Positive; Affirms IDRs at ‘BB’

Term of the Day: Chapter 11

There are different types of bankruptcies in the US. Chapter 11 is know as the “reorganization” bankruptcy and is available to individuals, sole proprietorship, partnerships and corporations. Corporations file for chapter 11 so that they can continue to operate while being protected from creditors claims to collection activities and property repossession.

Petitions to file for Chapter 11 can be voluntary or involuntary. In the case of a voluntary filing, the debtor must provide a schedule that provides details of its financial position. Upon filing a voluntary petition for relief under Chapter 11 or, in an involuntary case, the entry of an order for relief, the debtor automatically assumes an additional identity as the “debtor in possession.” Once the petition is filed, there is an automatic stay order that suspends all judgments, foreclosures, collection activities, and property repossessions by creditors that arose before the petition.

The bankruptcy court requires debtors to propose a restructuring plan within 120 days from the date of filing, which then grants the debtor another 180 days to obtain confirmation of the restructuring plan. The plan is deemed to have been accepted by courts if it is accepted by creditors with at least two-thirds in amount and at least half of the number of allowed claims.

Talking Heads

On the forecasted boost in the Euro area’s economic growth

Economists, JP Morgan

“[The forecasted economic growth in the Euro area] is primarily driven by Germany, but we also anticipate slightly stronger growth across the rest of the region from spillovers and slightly looser fiscal policy”

On the effect of nationalistic US policies on the economy

Larry Fink, BlackRock

“I think if we all are becoming a little more nationalistic…[we are going] to have elevated inflation”

“[If mass deportations occur, we may not] have enough workers to harvest [in the agricultural industry]…we’re going to run out of electricians that we need to build out AI data centers. We just don’t have enough.”

On Hedge funds unwinding risk as in early days of COVID – Goldman Sachs

James Koutoulas, Typhon Capital Management

“It was a classic de-leveraging crunch”

Goldman Sachs

Hedge funds’ sale of single name stocks was the biggest in over two years

Top Gainers and Losers- 11-March-25*

Go back to Latest bond Market News

Related Posts: