This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Trade Stable; Biden Drops Out of Presidential Race

July 22, 2024

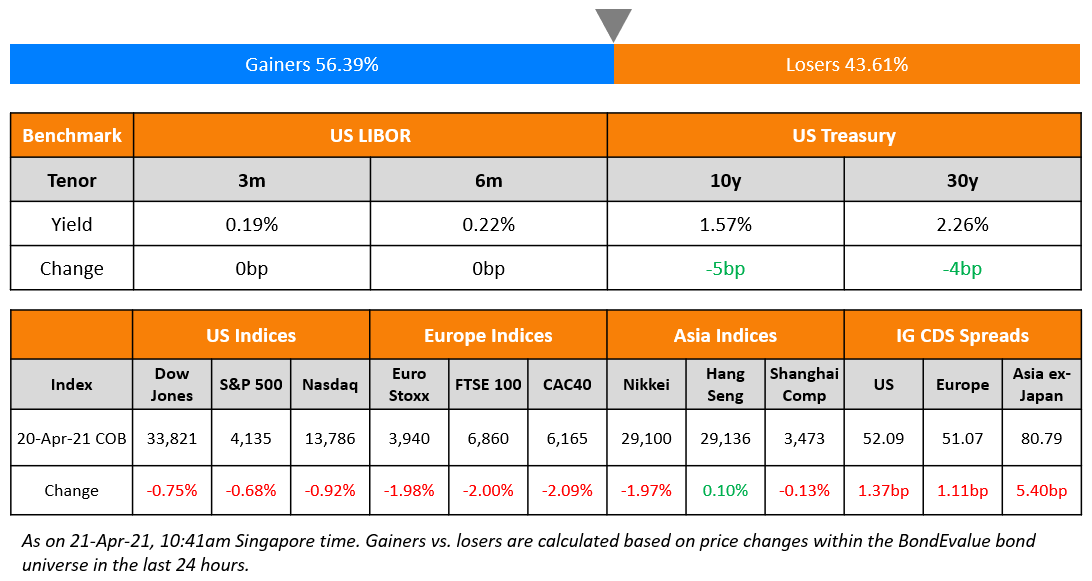

US Treasury yields were 2bp higher across the board. Over the weekend, US President Joe Biden dropped out of the presidential race, endorsing the current vice-president Kamala Harris. Separately, New York Fed President John Williams noted in a speech that the r-star levels are “about the same level as they were before the pandemic”, referring to the long-term neutral rate of interest. Earlier this week, he said that the recent inflation readings were encouraging, but wanted more confidence about it heading back to the 2% target. US equities saw the S&P and Nasdaq continue to drop, by 0.7-0.9%. US IG and HY CDS spreads widened by 0.2bp and 3.3bp respectively.

European equity markets closed lower too. Looking at Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.6bp and 2.9bp respectively. Asian equity indices have opened in the red this morning. Asia ex-Japan CDS spreads were wider by over 1.9bp.

New Bond Issues

- Korea Hydro & Nuclear Power $ 5Y at T+100bp area

- Vista Land $ 5Y at 9.5% area

Rating Actions

- Moody’s Ratings upgrades Turkiye’s ratings to B1, maintains positive outlook

-

Walgreens Boots Alliance Inc. Downgraded To ‘BB’ On Operating Difficulty; Outlook Negative

-

Moody’s Ratings affirms Rizal Commercial Banking Corporation’s Baa3 ratings; changes outlook to stable from positive

Term of the Day

Neutral Rate of Interest

The neutral rate aka natural rate or “R*” is the theoretical federal funds rate at which point the US Federal Reserve monetary policy is neither accommodative nor restrictive. In other words it is the short-term real interest rate that is consistent with the economy maintaining full employment and price stability. This rate is inferred and calculated via models and varies based on economic and financial market factors.

Talking Heads

On Yield Hunters Targeting EM Corporate Debt as Fed

Jeff Grills, head of EM debt at Aegon

“Our focus has been shifting out of lower-rated corporates into either more stable or higher-rated corporates… nervous as we get into the second half of the year, depending on what the Fed does”

Samy Muaddi, head of EM fixed income at T. Rowe Price

“EM corporates are more shielded than sovereigns from tighter financial conditions”… likes BBB and BB-rated corporates in Brazil, Mexico, Colombia, Philippines, India, and eastern Europe.

On Downshifting US Inflation to Help Reassure the Fed

Bloomberg Economics

“The June PCE inflation data will likely offer encouraging news for the Fed…. will likely be consistent with the 2% target for a third consecutive print… we think the stage is set for a September rate cut”

On Trump Trade Seeing Investors Snap Up Junk Debt and Industrials

Al Cattermole, PM at Mirabaud Asset

“US high yield is the trade. It is more domestic-focused and exposed to US economic activity.”

Catherine Braganza, HY PM at Insight Investment

“We have been adding US industrials that would benefit from a pro-business stance from a new government”

Gabriele Foa, PM at Algebris Investments

“We have reduced duration by having shorter-dated bonds, using futures and also using steepener trades”

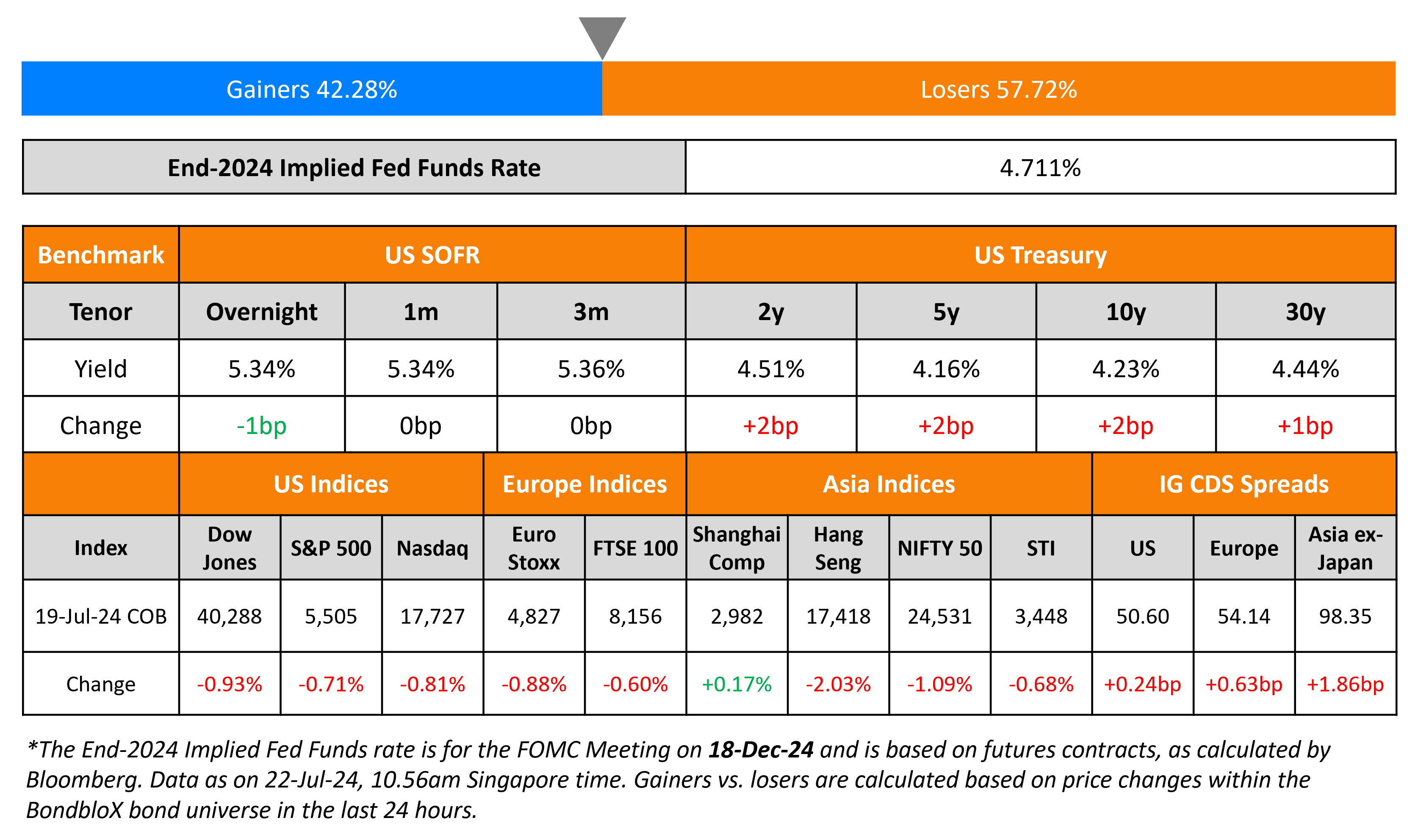

Top Gainers and Losers- 22-July-24*

Go back to Latest bond Market News

Related Posts: