This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Sell-off on Strong Jobs Print

June 10, 2024

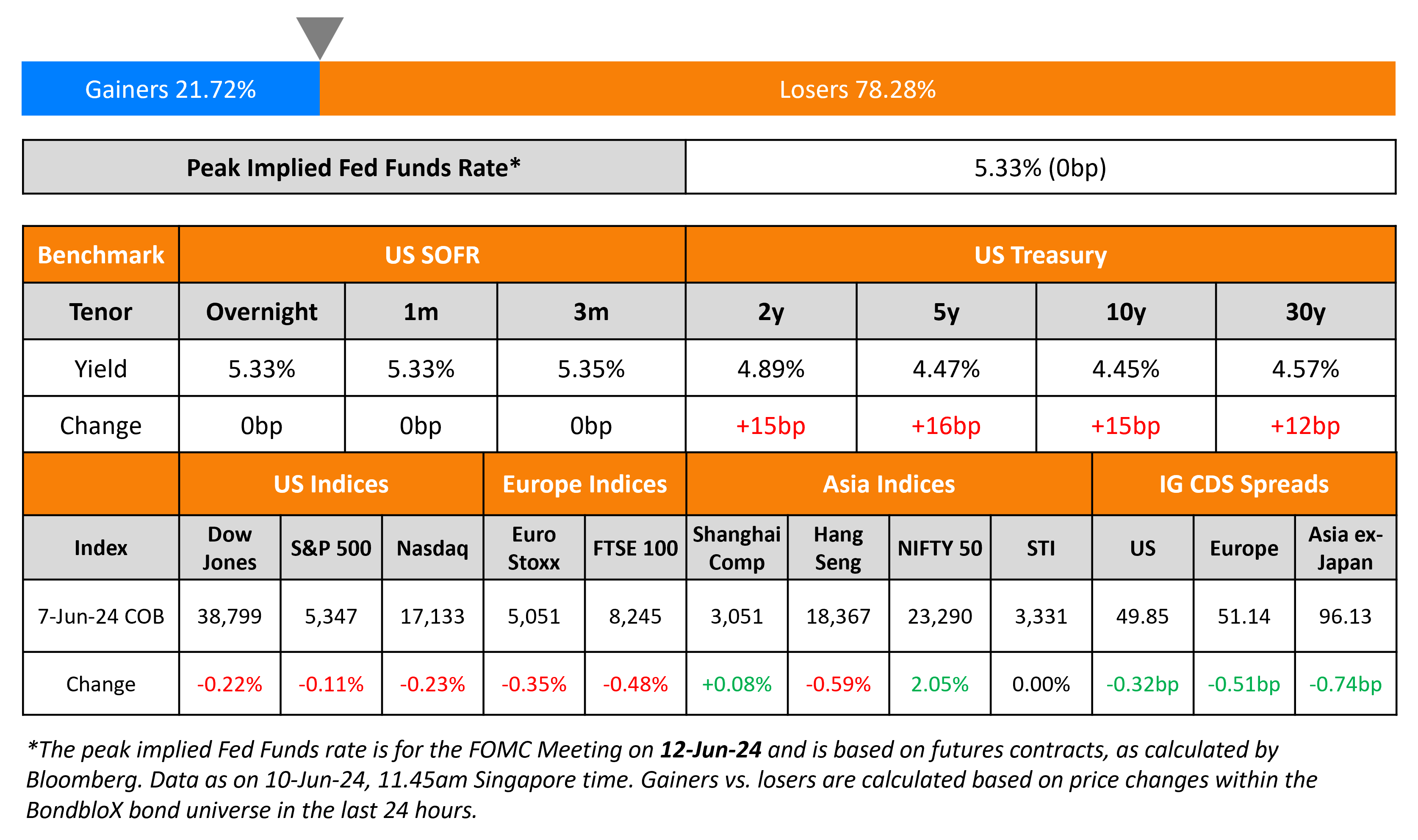

US Treasury yields surged higher by 15-16bp on Friday after a strong jobs report. US Non-Farm Payrolls (NFP) rose by 272k, significantly higher than expectations of 180k. Average Hourly Earnings (AHE) YoY grew by 4.1%, higher than expectations of 3.9%. The unemployment rate was slightly higher at 4.0% vs. expectations of 3.9%. US equity markets ended lower by 0.1-0.2%. US IG CDS spreads tightened 0.3bp and HY spreads were 0.5bp wider.

European equity markets ended lower. Europe’s iTraxx main CDS spreads were 0.5bp tighter and crossover spreads were tighter by 2.4bp. Separately, in Europe, political risk has risen after French President Emmanuel Macron dissolved the French parliament to announce snap elections beginning later this month. This comes after the far-right’s strong performance in the EU polls. The first round of elections would happen on June 30 and the second round on July 7. Asian equity indices have opened broadly higher this morning. Asia ex-Japan CDS spreads tightened 0.7bp.

New Bond Issues

New Bonds Pipeline

- REC Limited hires for $ Long 5Y Green bond

Rating Changes

- Fitch Downgrades Lippo Malls Indonesia Retail Trust to ‘RD’ on DDE; Upgrades to ‘CCC’

- Fitch Upgrades Cyprus to ‘BBB+’; Outlook Positive

- Fitch Upgrades Eleving to ‘B’; Outlook Stable

- Fitch Revises the Outlook on Fidelity Bank to Positive; Affirms Long-Term IDR at ‘B-‘

- Moody’s Ratings revises Toyota Motor’s outlook to positive from stable, affirms A1 ratings

Term of the Day

144A Bonds

144A bonds refer to privately placed debt instruments that can be traded among qualified institutional buyers (QIBs) and with a shorter holding period of six months. These bonds get their name from Rule 144A, which exempts the securities from SEC registration that typically requires extensive documentation and a two-year holding period. 144A bonds can be issued with a lesser amount of documentation as the underlying assumption is that QIBs are sophisticated investors who do not need the same level of information and protection as individual investors. The SEC defines a QIB as institutional investors that have at least $100mn in assets under management.

Talking Heads

On Fed Dot Plot Set to Offer Glimpse of Rate-Cut Resolve

Thomas Simons, senior US economist at Jefferies

“The Fed will opt to keep rates steady for longer. They will want to see a renewed run of more favorable data in line with an inflation trend closer to 2% before they feel comfortable cutting rates”

On Fed Seen Curbing Rate-Cutting Plans With Inflation Staying High

Ryan Sweet, chief US economist at Oxford Economics

“The Fed is waiting for a string of data that strengthens its confidence that inflation is on sustained path toward its 2% target… balance of risks to our forecast for inflation are still weighted to the upside”

Luke Tilley, chief economist at Wilmington Trust

“The FOMC is likely to say there has been some encouraging data, but that it needs to see more evidence for confidence to return”

On ECB Divergence From Fed Would Fuel Inflation – ECB GC Member, Robert Holzmann

“If the original assumption of three rate cuts were to materialize, and the Federal Reserve didn’t respond, it would certainly have an impact on the exchange rate, and with it inflation”

Top Gainers & Losers- 10-June-24*

Go back to Latest bond Market News

Related Posts: