This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Sell Off on Positive US Data; Shandong Hi-Speed, Staples Prices $ Bonds

May 24, 2024

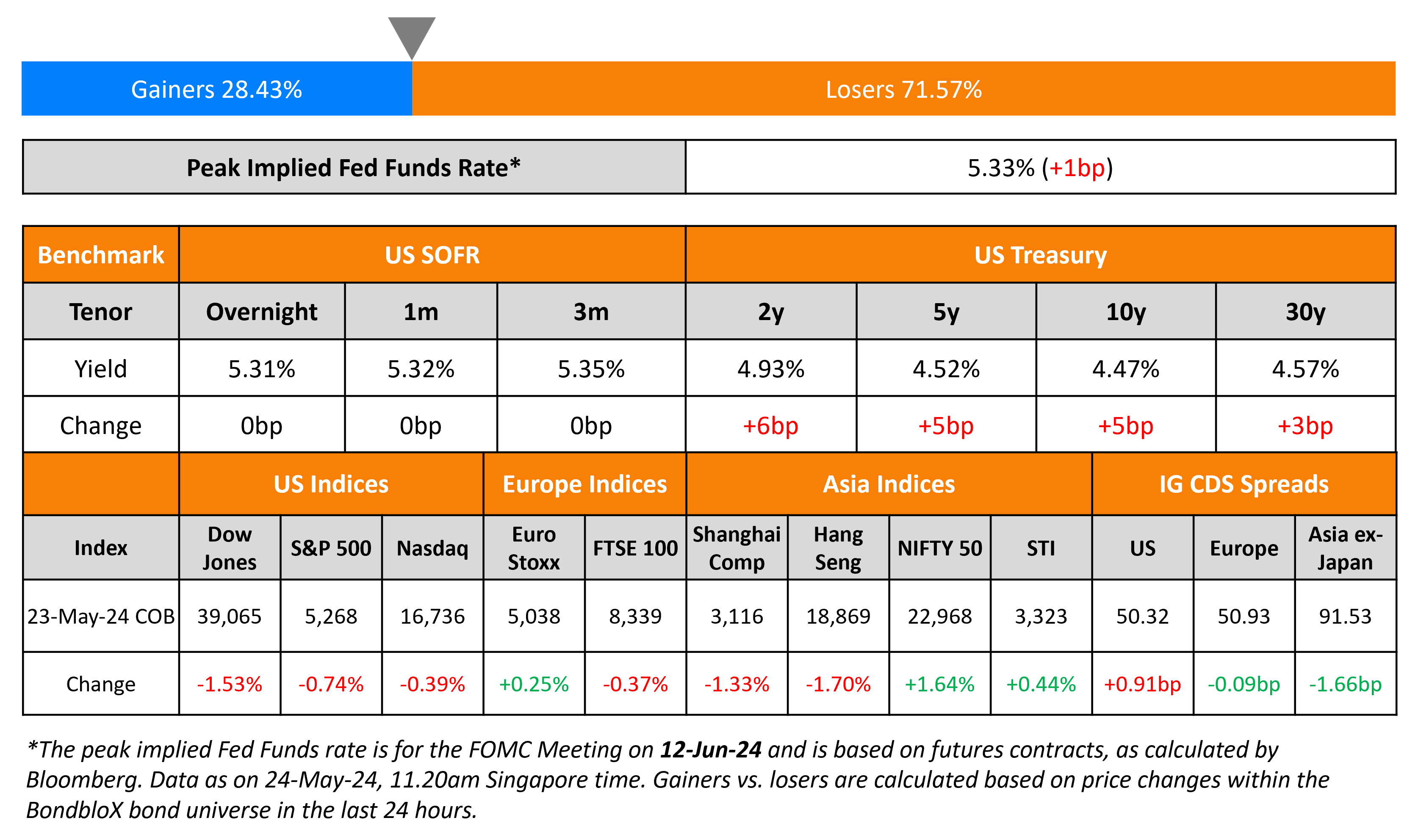

US Treasury yields ticked higher by 5-6bp across the curve amid stronger than expected data. The S&P preliminary PMI readings for the US in May indicated that manufacturing activity expanded to 50.9 vs. expectations of 49.9 and the prior month’s 50.0 print. The Services PMI also expanded to 54.8, above estimates of 51.2 and the prior 51.3 print. The overall Composite PMI rose to 54.4, again above expectations of 51.2 and 51.3 priorly, the highest reading since April 2022. Meanwhile, initial jobless claims for the previous week improved to 215k vs. the expected 220k and the 223k seen a week before that. Separately, the hawkish Atlanta Fed’s President Raphael Bostic, said that the Fed was “not past the worry point in terms of inflation getting back” to their target. Despite the softer April reading, he noted that there was a continued upward pressure on prices. S&P and Nasdaq closed 0.7% and 0.4% lower respectively. US IG CDS spreads widened 0.9bp and HY spreads were 5bp wider.

European equity markets ended mixed. Europe’s iTraxx main CDS spreads were 0.1bp tighter while crossover spreads were wider by 1.2bp. Asian equity indices have opened in the green this morning. Asia ex-Japan CDS spreads tightened 1.7bp.

New Bond Issues

Staples raised $2.375bn via 5.25NC2.25 bond at a yield of 11%, in-line with initial guidance. The senior secured notes are rated B3/B-. Proceeds, together with a term loan facility and an asset-backed loan facility, will be used to refinance its existing term loan and redeem note. Initial price talks were at 11% with an OID of 1-2 points. The deal was upsized from $2.35bn initially.

Shandong Hi-Speed raised $900mn via a PerpNC3 bond at a yield of 6.5%, 45bp inside initial guidance of 6.95% area. The unsubordinated guaranteed notes are rated A3/A- (Moody’s/Fitch). If not called by 20 May 2027, the coupons reset to prevailing 3Y Treasury yield plus the initial spread plus a 300bp coupon step-up then and every three calendar years thereafter. The notes also have a change of control (CoC) put at 101 at any time up to one month prior to the first reset date and at par thereafter. The step-up of 300bps could happen upon the occurrence of a CoC event, a breach of covenants, debt default or a dividend stopper breach. A decrease of 300bps could occur if a relevant event is remedied. The notes have a distribution deferral at the issuer’s sole discretion, on a cumulative and compounding basis, subject to a dividend stopper. Proceeds will be used to refinance existing debt and for general corporate purposes.

DNB Bank raised $700mn via a PerpNC5.5 AT1 bond at a yield of 7.389%, 49bp inside initial guidance of 7.875% area. The junior subordinated notes are rated Baa2/BBB, and received orders of over $2.1bn, 3x issue size. The coupons are fixed until 30 November 2029, and if not called by then, resets then and every five years thereafter at the 5Y CMT+271.7bp. A trigger event would occur if at any time the CET1 Ratio of the Issuer and/or the Group falls below 5.125%.

New Bonds Pipeline

- Amcor hires for $ 5Y bond

Rating Changes

- Fitch Upgrades Saudi Electricity Company to ‘A+’; Stable Outlook

- Moody’s Ratings upgrades El Salvador’s ratings to Caa1 from Caa3; maintains stable outlook

- Turk Telekom Ratings Raised To ‘BB-‘ On Successful Bonds Issuance; Outlook Positive

- Moody’s Ratings upgrades MashreqBank psc’s long-term deposit ratings to A3, changes outlook to stable

- Fitch Downgrades Lippo Malls Indonesia Retail Trust to ‘C’ on Exchange Offer

- Fitch Downgrades China Vanke to ‘BB-‘; Outlook Negative

Term of the Day

Original Issue Discount (OID)

Original Issue Discount (OID) refers to the difference between the original face value amount and the issuance price of a bond, wherein the issuance price is less than the redemption price. The OID is paid as a total sum at maturity, along with the original amount invested. OIDs are offered to make bonds more attractive as it offers investors the potential for capital gains as they can buy the bonds for lower than their face value.

Talking Heads

On Treasury Yields Plow Higher as Traders See First Fed Cut Later

Andrew Brenner, head of international fixed income at NatAlliance Securities

“The short end is fearful of the Fed”

David Rogal, PM at BlackRock

“The minutes show many participants are uncertain about the degree of how restrictive the policy rate is”

On Bigger investors pouring money into emerging markets belie EM outflows

On ECB Still on Course for June Rate Cut After Data – Bank of France Governor, Francois Villeroy

“We should not over-interpret, we keep confident in the disinflationary process… As we have increased confidence on the inflation front, we are very probably, barring a surprise, going to have a first rate cut in our next (meeting)”

On Bigger investors pouring money into EM belie outflows

David Hauner, head of global EM-fixed Income strategy at BofA

“I think that is the beginning of a structural story. You’re seeing outflows from dedicated (funds) and at the same time people involved in crossover. That is the new thing. I don’t recall that this has ever happened before”

Top Gainers & Losers- 24-May-24*

Go back to Latest bond Market News

Related Posts: