This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Sell-Off Across the Curve

October 22, 2024

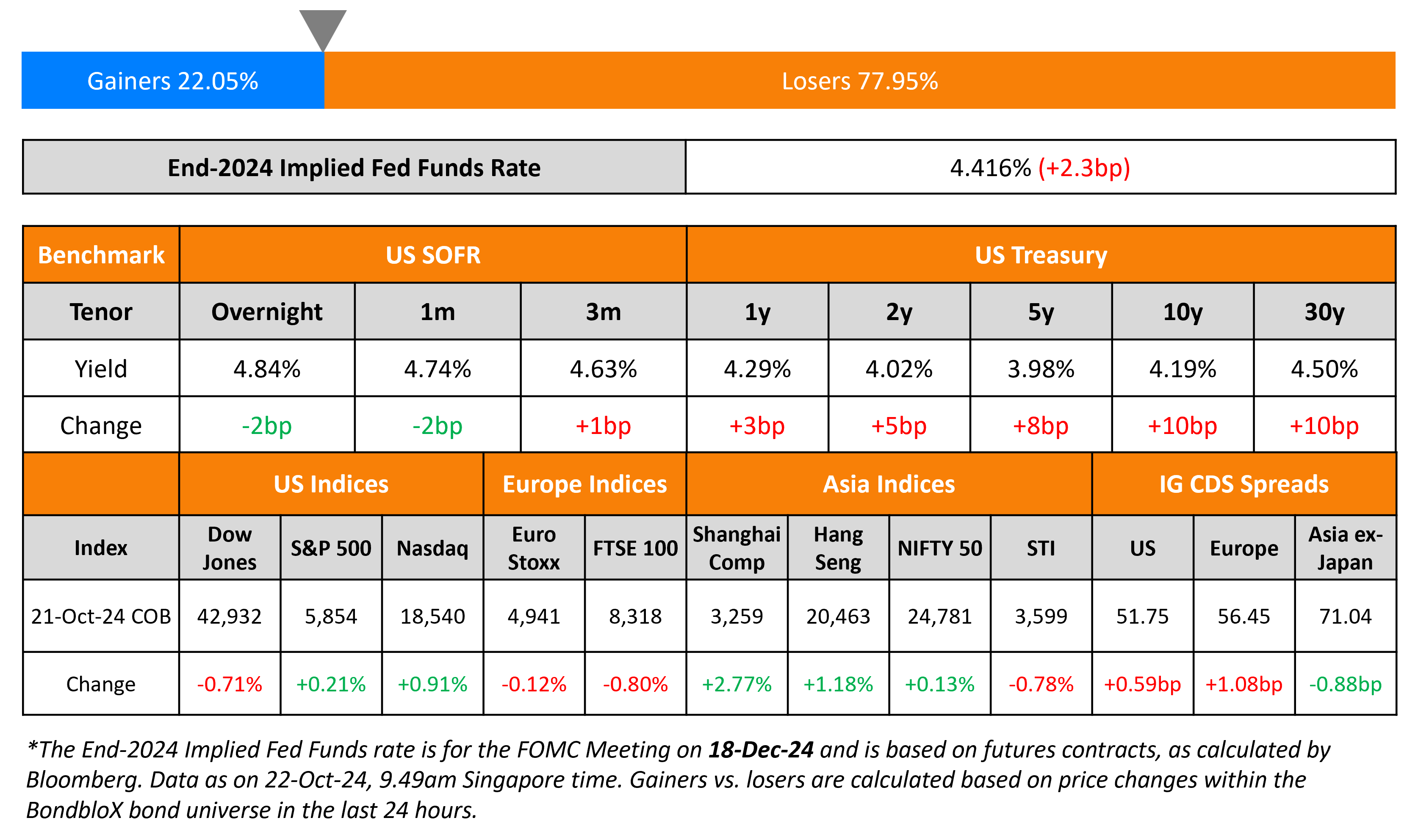

US Treasuries saw a sharp sell-off yesterday, with long-end yields rising by about 10bp on average. Quite a few Fed speakers offered their comments about the pace of rate cuts moving forward. San Francisco Fed’s Mary Daly was hawkish in her outlook and said that she does not see any substantial reason to stop cutting rates. She cited the mandate to preserve the strength of the labor market and that the current 4.75-5.00% interest rate range is too restrictive for an economy that is already enroute to the Fed’s 2% inflation target. However, other Fed Presidents Jeffrey Schmid, Neel Kashkari and Laurie Logan all spoke in favor of a more modest pace of rate cuts, referencing the Fed’s goal of attaining the “neutral” interest rate level in the medium-term. All of them reiterated that their preference would be to avoid any outsized rate moves in monetary policy that could significantly add to market volatility. US IG and HY CDS saw a widening of 0.6bp and 3.2bp respectively. Looking at US equity markets, the S&P and Nasdaq closed higher by 0.2% and 0.9% respectively.

European equities closed broadly lower. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 1.1bp and 6.3bp respectively. Asian equities have opened with mixed moves this morning. Asia ex-Japan IG CDS spreads were 0.9bp tighter.

New Bond Issues

Rating Changes

- Fitch Upgrades Kernel to ‘CCC-‘; Removes Senior Unsecured Debt from RWN

- Moody’s Ratings reviews CVS’s ratings for downgrade

- Fitch Revises Stellantis N.V.’s Outlook to Negative; Affirms IDR at ‘BBB+’

- Ingram Micro Inc. Placed On CreditWatch Positive On Planned IPO

- Moody’s Ratings affirms Seagate’s ratings; revises outlook to stable

Term of the Day

Builder Basket

A builder basket is a basket that has the potential to increase during the life of the facilities, based on the performance of the borrower through retained excess cashflow or a percentage of consolidated net income. It generally recognizes a borrower’s ability to utilize a portion of the profits or cashflows generated, so that a better performance by the borrower results in bigger increases in the quantum of the builder basket. This provides freedom to utilize any excess cash for purposes beyond debt servicing.

Talking Heads

On US Election Is ‘Big Risk’ to Bond Yields – Brendan Murphy, Insight Investment

“It’s a big risk to bond yields in general, but it would also be a risk to risky assets and to credit spreads because the market’s pretty fully discounted a return to normalization… marginal benefit you get from doing that (extending out or going down in credit quality) is quite small”

On Fed Funds Rate Being an Imperfect Liquidity Measure – JPMorgan

“Taking a step back, we are somewhat surprised that the Fed appears to be placing more weight on the fed funds rate as a gauge of liquidity in the marketplace… reflects the price at which banks trade their ‘excess’ reserve balances, the fed funds market is small… SOFR provides a more comprehensive gauge of liquidity in the marketplace”

On Clear That Rates Will Be Lowered Further – ECB GC member Gediminas Simkus

“The direction is clear — less restrictive monetary policy…can’t yet tell what will the decision be in December. But the direction is clear — down.”

Top Gainers and Losers- 22-October-24*

Go back to Latest bond Market News

Related Posts: