This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Rally on Softer ISM Manufacturing

June 4, 2024

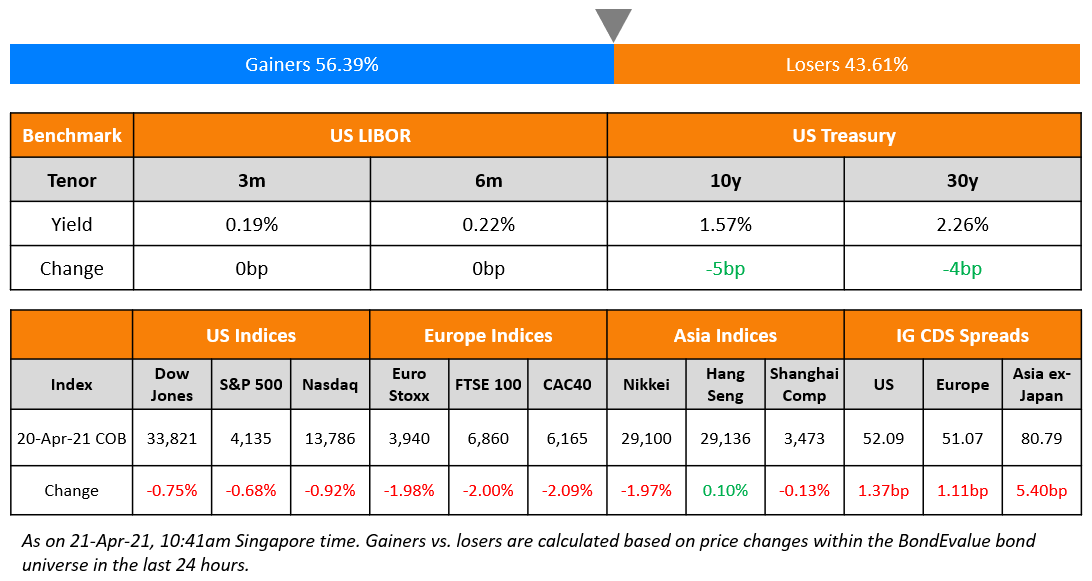

US Treasury yields dipped by nearly 8bp on Monday on the back of softer than expected data. The US ISM Manufacturing Index sank further into contraction territory to 48.7 in May vs. expectations of 49.5 and April’s 49.2 reading. Among the subcomponents, the ISM New Orders Index fell to 45.4 vs. expectations of 49.4 and the prior 49.1 reading. The inflationary Prices Paid component declined to 57.0 vs. expectations of 59.0 and the prior 60.9 reading. Whilst cooling off a bit, this was still its second-highest reading in two years. Equity markets ended higher, with the S&P and Nasdaq up 0.1% and 0.6% respectively. US IG CDS spreads tightened 0.3bp and HY spreads were 0.8bp tighter.

European equity markets ended mixed. Europe’s iTraxx main CDS spreads were 1.1bp tighter and crossover spreads were tighter by 5.6bp. Asian equity indices have opened broadly weaker this morning. Asia ex-Japan CDS spreads tightened 2.4bp. China’s Caixin Manufacturing PMI climbed marginally to 51.7 in May vs. expectations of 51.6 and the prior 51.4 print. This was the highest reading in the index in nearly two years.

New Bond Issues

Mashreqbank raised $500mn via a PerpNC5.5 AT1 bond at a yield of 7.125%, inside initial guidance of high 7%s. The junior subordinated notes are unrated, and received orders of over $2.1bn, 4.2x issue size. The coupons are fixed until the reset date of 10 December 2029, and if not redeemed, resets then every five years thereafter at 5Y UST+270.5bp. Proceeds will be used for general corporate purposes and further strengthening its capital base.

NAB raised 2.5bn via a three-tranche deal. It raised:

- $900mn via a 3Y bond at a yield of 5.087%, 23bp inside initial guidance of T+70bp area. The bonds are issued by National Australia Bank Ltd/New York.

- $850mn via a 3Y FRN at a yield of 5.963% or SOFR+62bp, vs. initial guidance of SOFR equivalent

- $750mn via a 10Y bond at a yield of 5.181%, 22bp inside initial guidance of T+100bp area.

The bonds have expected ratings of Aa2/AA-/AA-. Proceeds will be used for general corporate purposes.

iFast Corp raised S$100mn via a 5Y bond at a yield of 4.328%, 42.2bp inside initial guidance of 4.75% area. Proceeds will be used for general corporate purposes including refinancing existing borrowings, financing capex, investments injections into iFast Global Bank Ltd., and working capital.

New Bonds Pipeline

- REC Limited hires for $ Long 5Y Green bond

- Continuum Green Energy India hires for $ green bond

- Paratus Energy Services hires for $ 5Y bond

Rating Changes

- Moody’s Ratings upgrades Suedzucker to Baa2/P-2; outlook stable

- Fitch Upgrades Autopistas del Sol’s Notes; Outlook Positive

- Fitch Upgrades Lockheed Martin to ‘A’; Outlook Stable

- Moody’s Ratings affirms ENEL and Endesa’s Baa1 ratings; changes outlooks to stable

- Fitch Affirms Kernel at ‘CC’; Places Senior Notes on Rating Watch Negative

Term of the Day

CET1 Ratio

Common Equity Tier 1 (CET1) Ratio is a financial ratio applicable to banks to measure its core capital as against its Risk Weighted Assets (RWA). Core Capital (CET1 Capital) includes common equity and stock surplus (share premium), retained earnings, statutory reserves, other disclosed free reserves, capital reserves representing surplus arising out of sale proceeds of assets and balance in income statement at the end of the previous financial year. RWAs are calculated to measure the minimum regulatory capital required to be held by banks to maintain solvency. The calculation methodology is such that the riskier the asset, the higher the RWAs and the greater the amount of regulatory capital required. CET1 capital must be at least 4.5% of RWAs according to Basel III.

Contingent Convertible (CoCos) bonds/AT1s commonly have triggers based on CET1 ratios – if the bank’s CET1 ratio falls below a certain threshold, the bonds would convert into equity.

Talking Heads

On Dollar wallowing at multi-month lows as Fed cut bets grow

James Kniveton, senior corporate FX dealer at Convera

“The persistent high-interest-rate policy of the Federal Reserve is under scrutiny as it continues to weigh on the U.S. economy. Analysts are closely monitoring the upcoming job data for indications of economic strain”

On Traders Pushing Treasuries Higher as Data Reinforces Fed Cut Bets

Michael Kushma, CIO at Morgan Stanley Investment Management

Bond market is “desperate for good news. It wants a reason to rally, it seems”

Richard McGuire, head of rates strategy at Rabobank

“Pricing for Fed rate cuts is continuing to take a modestly more constructive policy outlook”

On Seeing Ample Demand for Growth in Treasury Bill Supply – JPMorgan

“Until the need for more borrowing capacity emerges in mid- to late-2025, that share is unlikely to rise significantly higher than 22%, as it stands… the good news is that when that time comes, there are structural buyers ready to digest that supply”

Top Gainers & Losers- 04-June-24*

Go back to Latest bond Market News

Related Posts: