This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Rally on Softer ISM, 10Y Below 4% Mark

August 2, 2024

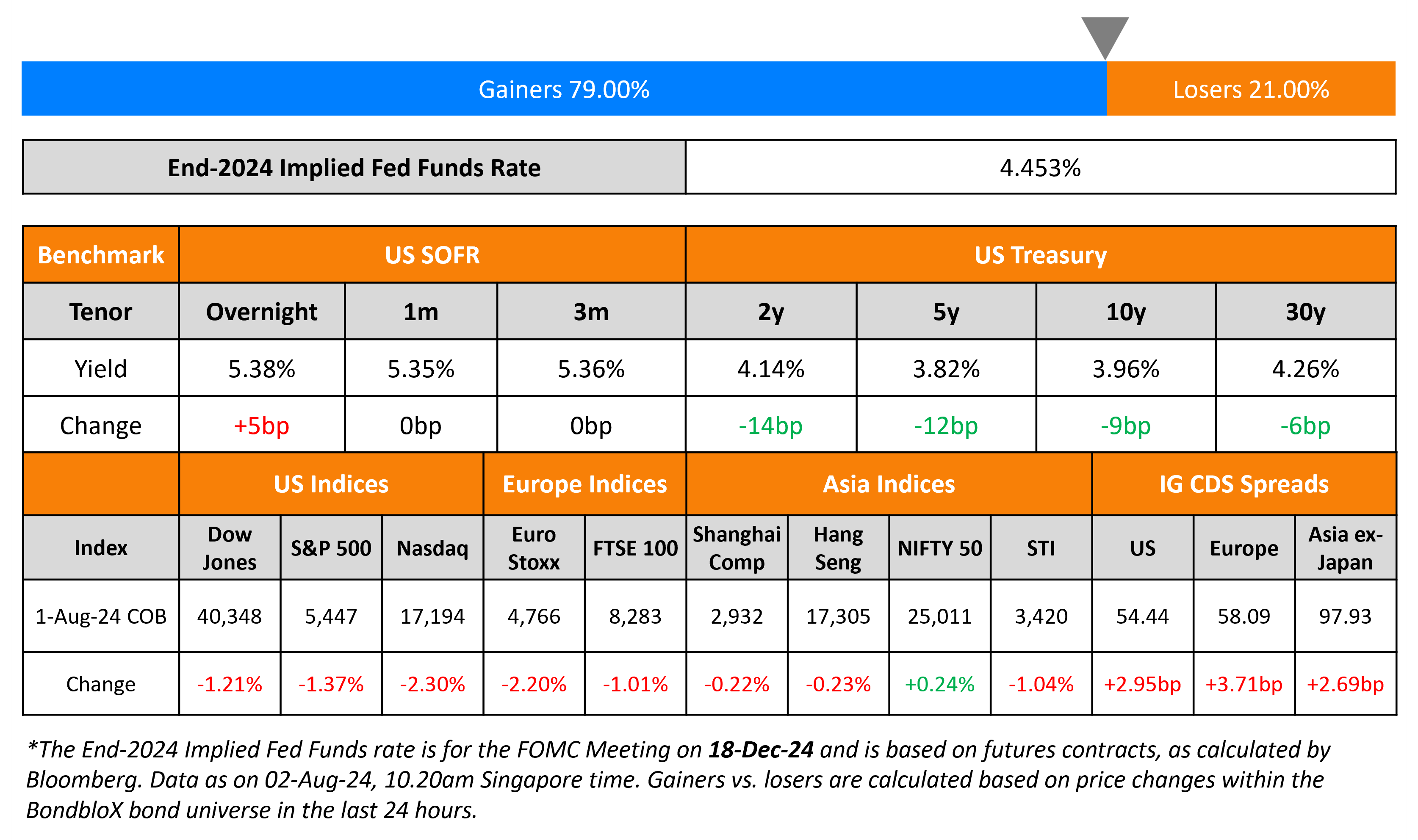

US Treasury yields dropped again, with the 2Y yield down 14bp and the 10Y down 9bp, on the back of the soft ISM Manufacturing data. The 10Y yield slipped below the 4% mark for the first time since February. The ISM Manufacturing Index declined further for a fourth consecutive month, to 46.8 in July vs. the surveyed 48.8 and prior month’s 48.5 print. The Prices Paid sub-component climbed slightly to 52.9 vs. 52.1 priorly, while the New Orders component fell to 47.4 from 49.3. The Employment component dropped further to 43.4 from 49.3 – this was its worst reading since June 2020. Separately, US initial jobless claims for the previous week rose to 249k, its worst reading in eleven months.

Looking at Fed Funds Futures curve, markets are now fully pricing-in three rate cuts of 25bp each, by the Fed this year. US equities saw a sharp sell-off yesterday, with the S&P and Nasdaq down over 1.4% and 2.3% respectively. US IG and HY CDS spreads widened by 3bp and 17bp respectively.

European equity markets ended lower too. Looking at Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 3.7bp and 15bp respectively. Euro-area consumer price inflation unexpectedly rose by 2.6% YoY in July vs. 2.5% seen in June and expectations of 2.4%. Separately, the Bank of England cut interest rates from a 16-year high to 5.00% from 5.25%. Asian equity indices have opened in the red this morning. Asia ex-Japan CDS spreads were wider by 2.7bp.

New Bond Issues

Peru raised $3bn via a two-trancher. It raised $1.25bn via a long 10Y bond at a yield of 5.384%, 40bp inside initial guidance of T+180bp area. It also raised $1.75bn via a 30Y bond at a yield of 5.867%, 40bp inside initial guidance of T+205bp area. The bonds are rated Baa1/BBB-/BBB. Proceeds will be used to finance general budgetary requirements for fiscal year 2024. The new 10Y bonds are priced at a new issue premium of 7.4bp to its existing 3% 2034s that yield 5.31%.

Rating Changes

- Fitch Downgrades China United Property Insurance to ‘BBB+’; Outlook Stable; Off Watch Negative

Term of the Day

Schuldschein

Schuldschein (pronounced schuld-shine) is a debt instrument popular with German issuers that is similar to a bond albeit with lower expenses for the issuer. These instruments do not need to be registered at an exchange, thereby reducing documentation and time taken. They are more flexible than a bond, as they can be adjusted to the customer’s needs regarding repayment terms, drawdown periods, etc. and thus have some features of loans. Commerzbank notes that Schuldschein transactions can be arranged very quickly, with a tenor of 2 and 5 years, in order to improve asset-liability management (ALM). Lending can be done by one bank, which might look for participants afterwards.

Messer SE sold €950mn in Schuldschein debt, marking the biggest deal so far this year in this market.

Talking Heads

On investors assessing whether Fed can stick the ‘soft landing’

George Catrambone, head of fixed income and trading at DWS

“There are reasons to think the soft landing is still alive … but the risks are two-sided. Soft landings don’t materialize by waiting too long.”

Peter Baden, CIO at Genoa Asset Management

“You’re seeing that fraying at the edge. Now the question becomes, does a fraying at the edges turn into a full blown slowdown?”

Jack McIntyre, PM at Brandywine Global

“Now you’ve got the lag effect because as the Fed sets on an easing cycle, now some of the negative stuff could be baked into the economy… Even if the Fed starts in September, it might not be enough to alter the course”

On ‘Blockbuster’ BOJ Decision Putting Ueda on Risky Path to More Hikes

Krishna Bhimavarapu, APAC economist at State Street Global

“Today’s BOJ meeting proved to be the blockbuster event that we have been forecasting… Either way, the BOJ has taken the big bold step towards normalization”

Takeshi Minami, chief economist at Norinchukin Research

“Ueda has done much more to normalize policy and at a faster pace than I expected when he took the helm… The question is whether the economy and inflation will really come along with what the BOJ is expecting”

Top Gainers & Losers- 02-August-24*

Go back to Latest bond Market News

Related Posts: