This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Rally on Soft NFP Report

September 8, 2025

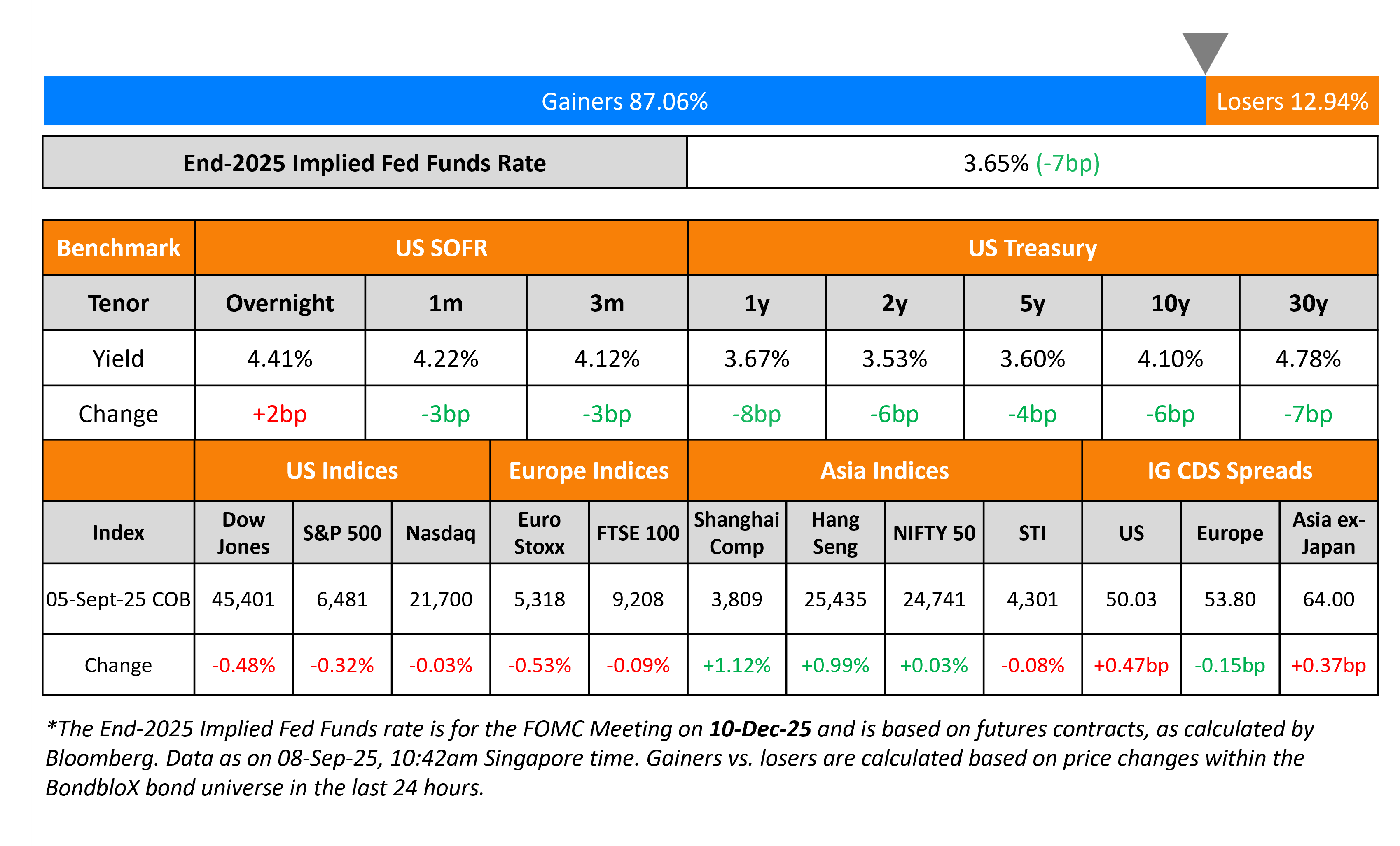

US Treasury yields fell by ~6bp across the curve after a softer than expected jobs report. US NFP for August came-in at only 22k, much lower than expectations of 75k and the prior month’s revised 79k. The Unemployment Rate came-in at 4.3%, near a 4Y-high, albeit inline with expectations, but higher than the prior 4.2% reading. Average Hourly Earnings (AHE) YoY rose 3.7%, lower than expectations and the prior month’s readings of 3.8% and 3.9% respectively. Following the soft jobs report, markets are now fully pricing-in a 25bp rate cut in September and ~70bp in combined rate cuts by the end of the year. Separately, Chicago Fed President Austan Goolsbee said he was still undecided regarding the September rate decision, adding that he would like to see more data on inflation.

Looking at US equity markets, the S&P was down 0.3% while the Nasdaq ended flat. US IG and HY CDS spreads were wider by 0.5bp and 3.3bp respectively. European equity markets ended lower. The iTraxx Main CDS spreads were 0.2bp tighter while the Crossover spreads were 0.2bp wider. Asian equity markets have opened in the green today. Asia ex-Japan CDS spreads were 0.4bp wider.

New Bond Issues

New Bond Pipeline

- Petron Corp $ Senior Perps

- SM Prime $ 5Y Bond

Rating Changes

-

Moody’s Ratings upgrades U. S. Steel’s CFR to Ba2; changes outlook to positive

-

ATI Inc. Upgraded To ‘BB’ On Strong Credit Metrics; Outlook Stable

-

Kohl’s Corp. Downgraded To ‘B+’ From ‘BB-‘; Outlook Negative; Debt Rating Actions Taken

-

Fitch Places PEMEX on Rating Watch Positive Following Tender Offer Announcement

-

Braskem Idesa S.P.I. Ratings Placed On CreditWatch Negative On Tight Liquidity

-

Fitch Revises Poland’s Outlook to Negative; Affirms at ‘A-‘

Term of the Day: Digital Bonds

Digital bonds are a type of bond issuance that aims to revolutionize traditional bond issuances by leveraging blockchain or Distributed Ledger Technology (DLT). The use of blockchain allows for faster settlement of bond trades among other benefits. Benefits include reducing the cost and time of issuance, distribution and settlement of bonds, and enhancing the security and transparency of transactions.

The Hong Kong government appoints banks to prepare for a third digital bond issuance since 2023

Talking Heads

On Junk Bonds Being the New High Grade Bonds

Stephanie Doyle, JPMorgan Asset

“Spreads are compressed everywhere. The market is really reacting to a lot of strength on the demand side”

Gordon Shannon, TwentyFour Asset

“Corporate and household balance sheets are healthier than average, maybe way healthier, so that justifies it a bit. But then there is all the geopolitical and macro headwinds”

On EM Rushing to Debt Markets to Seize Risk-On Moment

Eduardo Ordonez, BI Asset

“Seize the moment in case the risk-off mood strikes”

Grant Webster, Ninety One

“The reason why people didn’t wait is that easing is largely priced… Who’s to say that five-, 10-, 20-, 30-year points on the curve are really going to be lower?”

Arun Sai, Pictet Asset

“What we seem to have is a relative period of stability… not surprising that people are a little bit more constructive about getting their funding needs”

On Fed needing to be fully independent from Trump – White House’s Kevin Hassett

“I would say 100% that monetary policy, Federal Reserve monetary policy, needs to be fully independent of political influence, including from President Trump… don’t have a plan to overhaul the Fed right now. I’m just happy to do my job”

Top Gainers and Losers- 08-Sep-25*

Go back to Latest bond Market News

Related Posts: