This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Rally after CPI; IIFL, H&H Launch $ Bonds

January 16, 2025

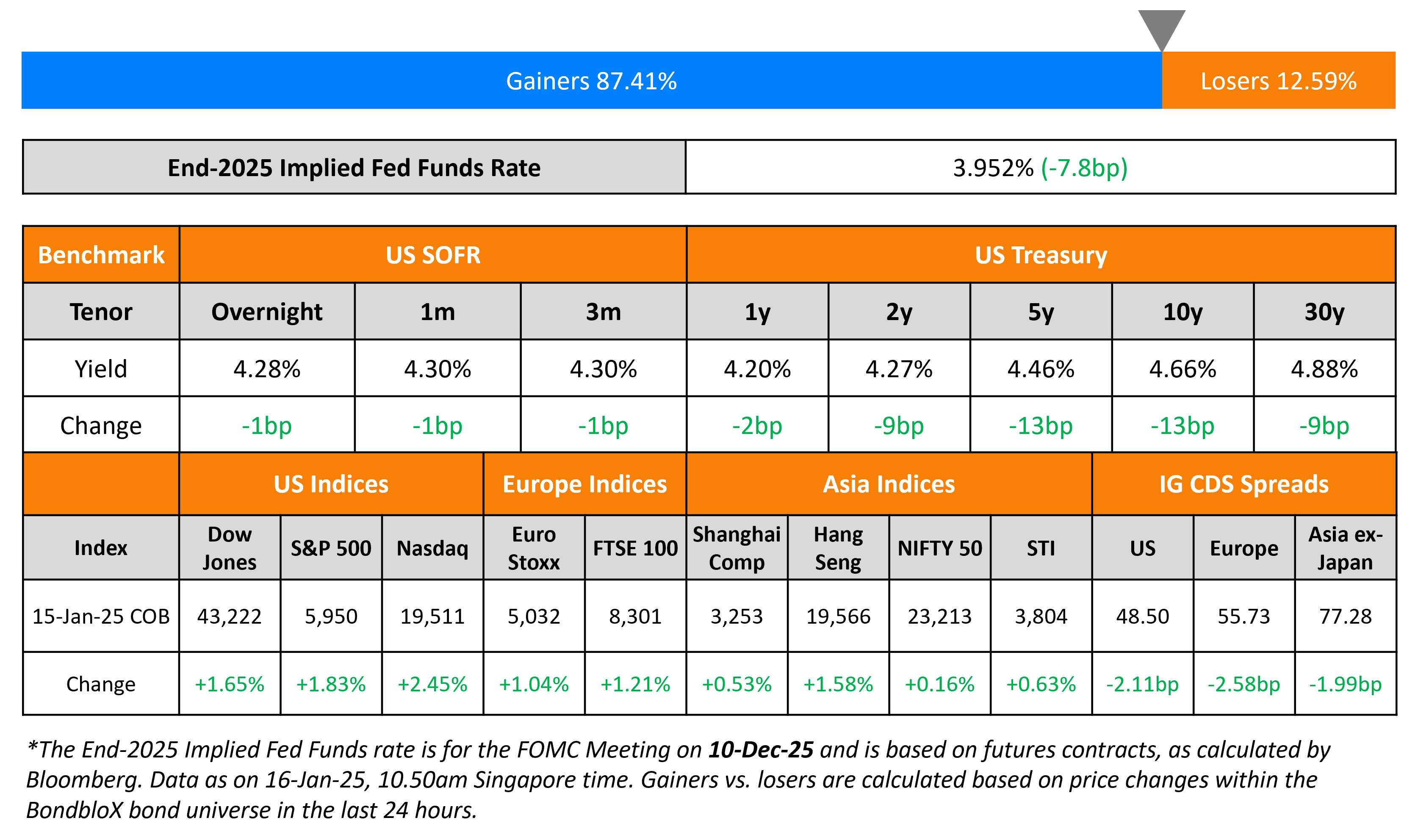

US Treasury yields dropped across the curve, with the 2Y yield down 9bp and the 10Y down 13bp, following the modest inflation report. US CPI YoY rose by 2.9%, in-line with expectations. However, Core CPI YoY eased to 3.2% vs. the prior month/surveyed 3.3% print. The Core CPI MoM rose by 0.2% after rising 0.3% for four months consecutively, making this the first stepdown in six months. Market have now repriced the next cut in June/July in the wake of the inflation print, after having pushed it out to September/October immediately following the strong NFP report last Friday. Richmond Fed president Thomas Barkin said that data showed continued progress on lowering inflation towards the 2% goal.

US IG and HY CDS spreads tightened by 2.1bp and 13.5bp respectively. US equity markets rallied, with the S&P up 1.8% and the Nasdaq up 2.5%. European equities ended higher. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 2.6bp and 11.5bp respectively. Asian equities are trading in the green this morning. Asia ex-Japan CDS spreads were 2bp tighter. BOJ officials noted the possibility of a rate increase from the current 0.25% at the end of its two-day meeting scheduled on January 24.

New Bond Issues

-

IIFL Finance $ 3.5Y at 9% area

-

Health & Happiness $ 3.5NC1.5 at 10.125% area

Al Rajhi raised $1.5bn via a PerpNC6 AT1 sukuk at a yield of 6.25%, 50bp inside initial guidance of 6.75% area. The junior subordinated note is rated Baa3. If not called by 21 January 2031, the coupon will reset to the 6Y UST plus 159.4bp, without any coupon step-up.

New Bonds Pipeline

- Turkcell hires for $ 5Y/7Y Sustainability bond

Rating Changes

-

Moody’s Ratings downgrades Kohl’s CFR to Ba3; outlook negative

-

Sinclair Inc. Downgraded To ‘B-‘, Outlook Stable; Secured Debt Rating Placed On CreditWatch Negative

-

Fitch Places Grupo Sura on Rating Watch Evolving

Term of the Day: Chapter 11

There are different types of bankruptcies in the US. Chapter 11 is know as the “reorganization” bankruptcy and is available to individuals, sole proprietorship, partnerships and corporations. Corporations file for chapter 11 so that they can continue to operate while being protected from creditors claims to collection activities and property repossession.

Petitions to file for Chapter 11 can be voluntary or involuntary. In the case of a voluntary filing, the debtor must provide a schedule that provides details of its financial position. Upon filing a voluntary petition for relief under Chapter 11 or, in an involuntary case, the entry of an order for relief, the debtor automatically assumes an additional identity as the “debtor in possession.” Once the petition is filed, there is an automatic stay order that suspends all judgments, foreclosures, collection activities, and property repossessions by creditors that arose before the petition.

The bankruptcy court requires debtors to propose a restructuring plan within 120 days from the date of filing, which then grants the debtor another 180 days to obtain confirmation of the restructuring plan. The plan is deemed to have been accepted by courts if it is accepted by creditors with at least two-thirds in amount and at least half of the number of allowed claims.

Talking Heads

On Treasuries ‘Death Spiral’ Risk Brushed Aside by Foreign Funds

Chris Jeffery, Legal & General Investment

“On the risk of a ‘death spiral,’ any bond market can become caught in a cycle of mutually reinforcing higher yields and higher debt projections”

Anne Beaudu, Amundi

“US bonds appear more attractive at these levels, as rising yields will ultimately weigh on growth prospects or risky asset performance… bar for hiking rates remains very high”

Kaspar Hense, RBC Bluebay Asset

“The curve will remain very steep with a lot of new issuance coming to the market, and that again feeds negative into Treasuries”

On BlackRock Getting Record Client Cash

“This is just the beginning. BlackRock enters 2025 with more growth and upside potential than ever… For many companies, periods of M&A contribute to a pause in client engagement.. client activity accelerated into the fourth quarter”

Top Gainers and Losers- 16-January-25*

Go back to Latest bond Market News

Related Posts: