This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Rally 8-10bp on Dovish FOMC; BOJ Hikes Rates

August 1, 2024

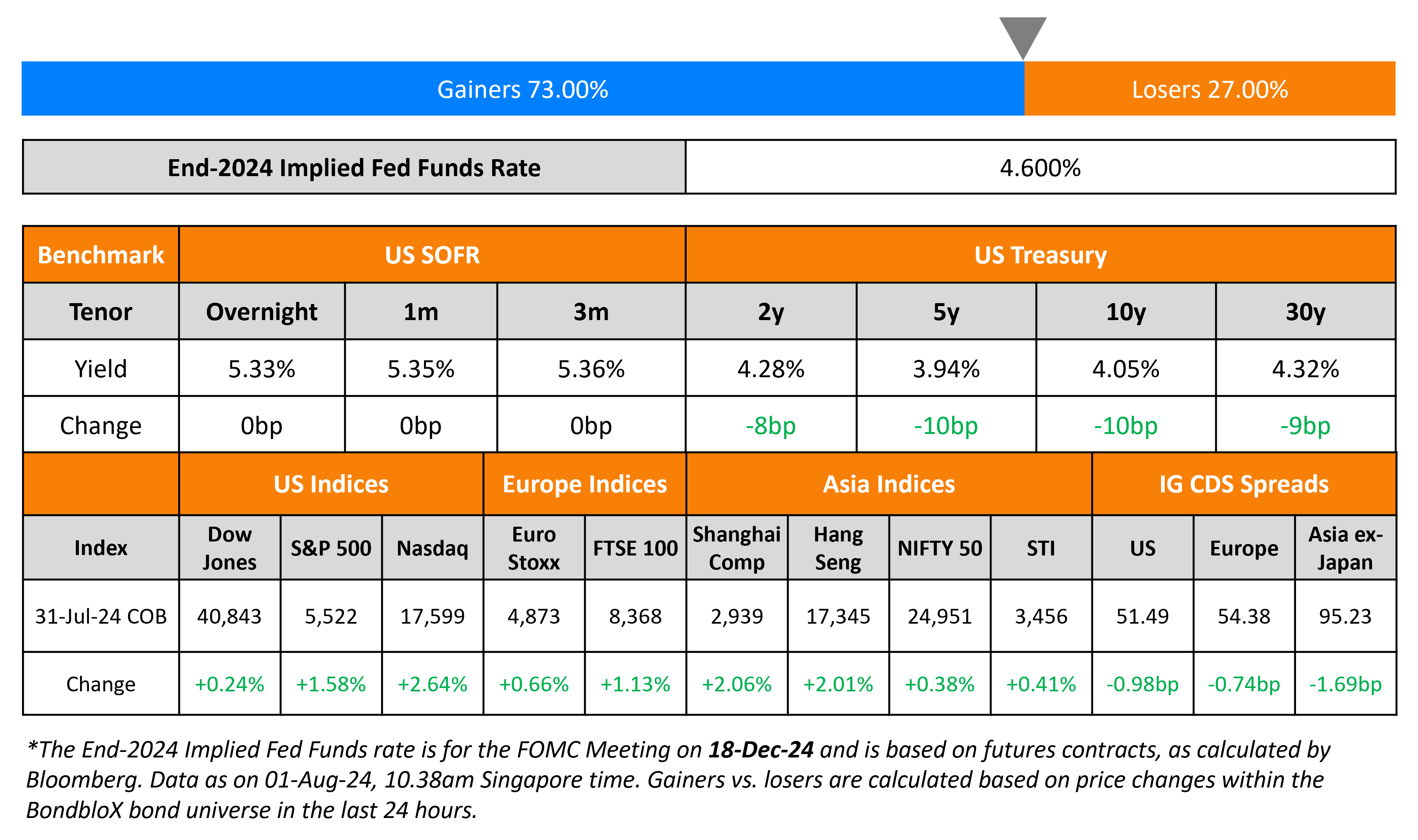

US Treasury yields dropped sharply, by 8-10bp after the FOMC meeting where Jerome Powell said that a rate cut “could be on the table as soon as the next meeting in September”. He added that there was a real “discussion back and forth of what the case would be for moving [on rate cuts] at this meeting”. he further noted that the slowing down in inflation boosted their confidence. US equities saw a sharp rally with the S&P and Nasdaq up 1.6% and 2.6% respectively, US IG and HY CDS spreads tightened by 1bp and 7bp respectively.

European equity markets ended higher too. Looking at Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.7bp and 4bp respectively. Asian equity indices have opened in the green this morning. Asia ex-Japan CDS spreads were tighter by 1.7bp. The BOJ surprised markets by hiking its policy rates to 0.15-0.25% from the prior 0-0.1%. Additionally, it set out a plan to halve bond purchases by 2026. Additionally, BoJ Governor Kazuo Ueda hinted that they will keep raising interest rates. Separately, China’s factory activity contracted for the first time in nine months with the Caixin PMI falling to 49.8 in July from 51.8.

New Bond Issues

Rating Changes

- Fitch Upgrades Crescent Energy to ‘BB-‘ After Acquisition of SilverBow; Outlook Stable

- Ecobank Nigeria Ltd. Downgraded To ‘CCC/C’ And Placed On Watch Negative On Anticipated Further Weakening Capitalization

- Fitch Downgrades TalkTalk to ‘CC’

- Fitch Downgrades Lippo Malls Indonesia Retail Trust to ‘RD’ on DDE; Upgrades to ‘CCC+’

Term of the Day

CET 1 Ratio

Common Equity Tier 1 (CET1) Ratio is a financial ratio applicable to banks to measure its core capital as against its Risk Weighted Assets (RWA). Core Capital (CET1 Capital) includes common equity and stock surplus (share premium), retained earnings, statutory reserves, other disclosed free reserves, capital reserves representing surplus arising out of sale proceeds of assets and balance in income statement at the end of the previous financial year. RWAs are calculated to measure the minimum regulatory capital required to be held by banks to maintain solvency. The calculation methodology is such that the riskier the asset, the higher the RWAs and the greater the amount of regulatory capital required. CET1 capital must be at least 4.5% of RWAs according to Basel III.

Contingent Convertible (CoCos) bonds/AT1s commonly have triggers based on CET1 ratios – if the bank’s CET1 ratio falls below a certain threshold, the bonds would convert into equity.

Talking Heads

On BOJ’s Rate Hike Putting Brake on Long-Tenor Corporate Bond Sales

Kazuma Ogino, senior credit analyst at Nomura Securities

“Investor demand for long-term corporate bonds will probably fall due to higher rates. Investors will likely want more five-year corporate bonds and fewer 10-year notes”

On Pakistan’s banks enjoying soaring profits on mounting government debt interest

Mohammed Sohail, CEO of Topline Securities

“Bankers and their shareholders were the happiest people in Pakistan in this most recent economic crisis and rate cycle”

Rehmat Hasnie, chief executive of the National Bank of Pakistan

“Where there was an opportunity for higher returns, they were capitalised on. It’s basic economics”

Mattias Martinsson, CIO of Tundra Fonder

“When you have these difficult times, you know interest rates go up and they will basically compensate for a depreciating currency”

Top Gainers & Losers- 01-August-24*

Go back to Latest bond Market News

Related Posts: