This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Pullback on Stronger ISM Services

August 6, 2024

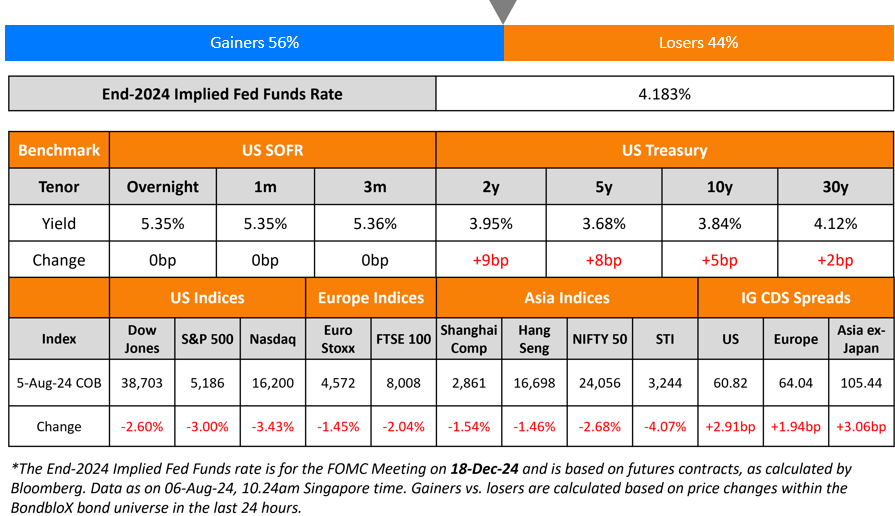

US Treasury yields inched higher on Monday after the massive rally last week. The 2Y yield was up 9bp to 3.95% and the 10Y was up 5bp to 3.84%. The pullback in Treasuries comes after the ISM Non-Manufacturing Index rose to 51.4 in July, higher than expectations of 51.0 and June’s 48.8 print. Among its subcomponents, the New Orders Index rose to 52.4 from 47.3 and the Prices Paid Index rose to 57.0 from 56.3. However, US equities continued to sell-off, with the S&P and Nasdaq down sharply by 3% and 3.4% respectively. US IG and HY CDS spreads widened by 2.9bp and 11.6bp respectively.

European equity markets continued to drop. Looking at Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 1.9bp and 9.6bp respectively. Most Asian equity indices have opened in the green this morning with the Nikkei Index up by a massive 10.3%. Asia ex-Japan CDS spreads were wider by 3.1bp.

New Bond Issues

- Lightning Power $ 8NC3 at 7.25-7.5% area

Rating Changes

- Fitch Upgrades Volcan to ‘CCC+’; Assigns Expected ‘B-(EXP)’ Rating to New Proposed Secured Issuance

- Fitch Upgrades Broadcom to ‘BBB’/’F3’; Outlook Stable

- Moody’s Ratings upgrades Alam Sutera’s CFR to B3, revises outlook to stable

- Pfleiderer Downgraded To ‘CC’ From ‘CCC’ On Debt Restructuring Agreement; Outlook Negative

- Ascot Group Ltd.’s HoldCo Outlook Revised To Positive On Sound And Less Volatile Earnings Than Peers; Ratings Affirmed

- Analog Devices Inc. Outlook Revised To Positive From Stable On Durable Business Profile; ‘A-‘ Rating Affirmed

Term of the Day

Carry-Trades

Carry trades are a popular trading strategy where an investor borrows money from a country with low interest rates (and a weaker currency) and invests the money in another country’s asset with a higher interest rate. Historically, a famous example has been the Japanese yen-funded carry trade. This was mainly owing to the zero-to-negative interest rates in Japan for the better part of two decades, and bets that rates there would remain at rock bottom levels. In this case, investors globally and even locally would borrow at low interest rates in Japan and invest the money in overseas equities and bonds like the US stock market. Carry trades typically work well when central bank policy certainty is high and expectations are for low market volatility. However, with the BOJ recently raising rates for the second time in 17 years in July and hinting at more hikes, the famous yen-funded carry-trade has seen an unwinding. This unwinding has been one of the factors cited for the recent global equities sell-off by analysts.

Talking Heads

On stocks sinking with bond yield and dollar on recession fears

Eric Wallerstein, Yardeni Research

“It’s really a confluence of things”… everything from unwinding of yen-funded trades and the escalation of Middle East tensions to the disappointing U.S. earnings updates and the weak U.S. jobs report, played a role in the sell-off.

On Calls for Aggressive Cuts to Fed Funds Rate – Wharton’s Jeremy Siegel

“I’m calling for a 75bp emergency cut in the Fed funds rate, with another 75bp cut indicated for next month at the September meeting – and that’s minimum”

On Jolt in Credit Fear Gauges Pushes Company Borrowers to Sidelines

Michael Contopoulos, director of fixed income at Richard Bernstein

“The downside can be massive from these levels… expect spreads to continue to widen”

Raphael Thuin, Tikehau Capital

“This is a lot to digest for a month of August, at a time of tight spreads coming after an extended period of strong performance”

Thomas Leys, Abrdn

“The market was overdue a correction and there was too little differentiation between cyclical and non-cyclical credits”

Top Gainers & Losers- 06-August-24*

Go back to Latest bond Market News

Related Posts:

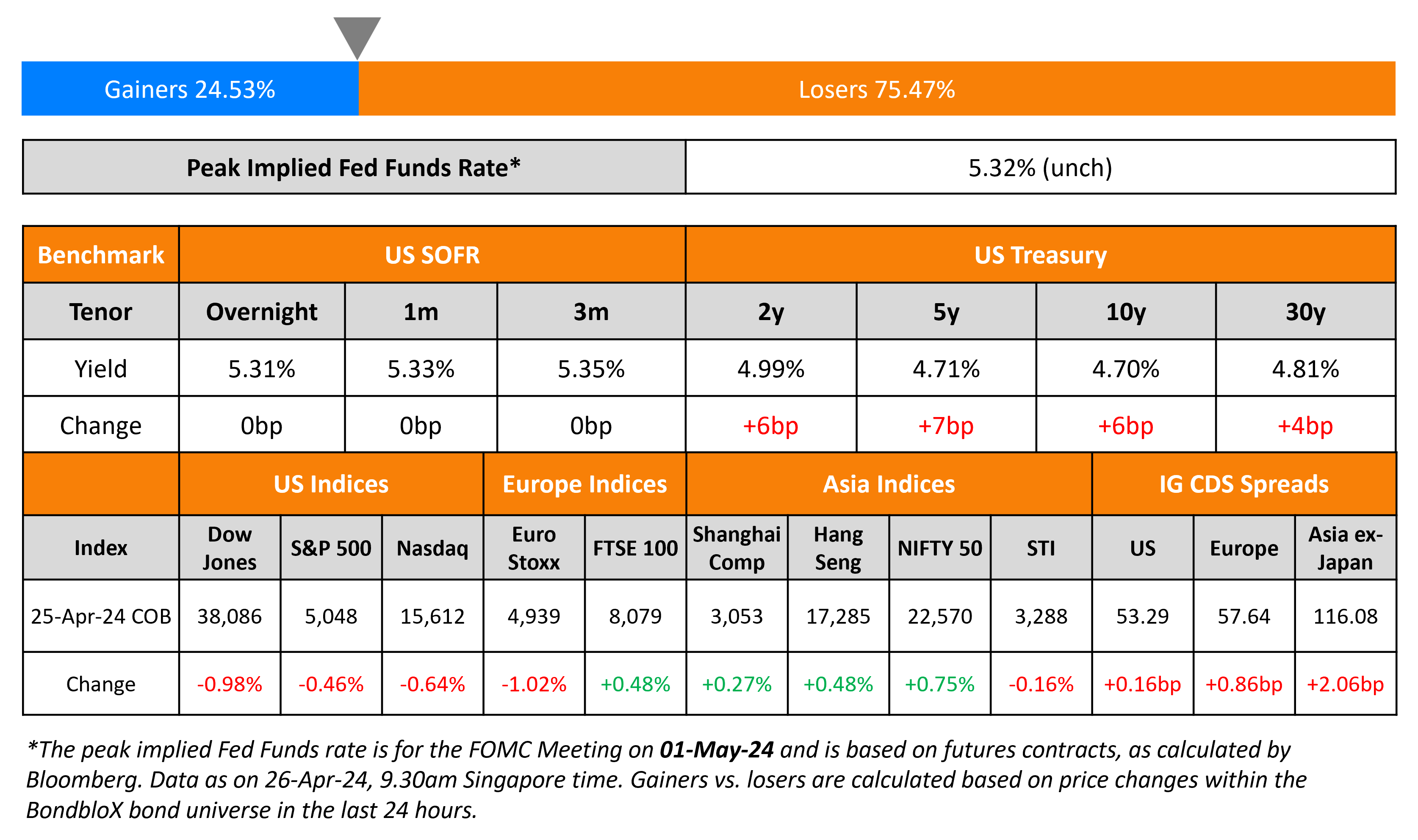

US GDP Softens; KIB Prices $ AT1

April 26, 2024

Turkey, FAB, Astrea Price Bonds; Muthoot Taps 2028s

July 10, 2024