This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Inch Higher on Delayed Tariff Plans

January 21, 2025

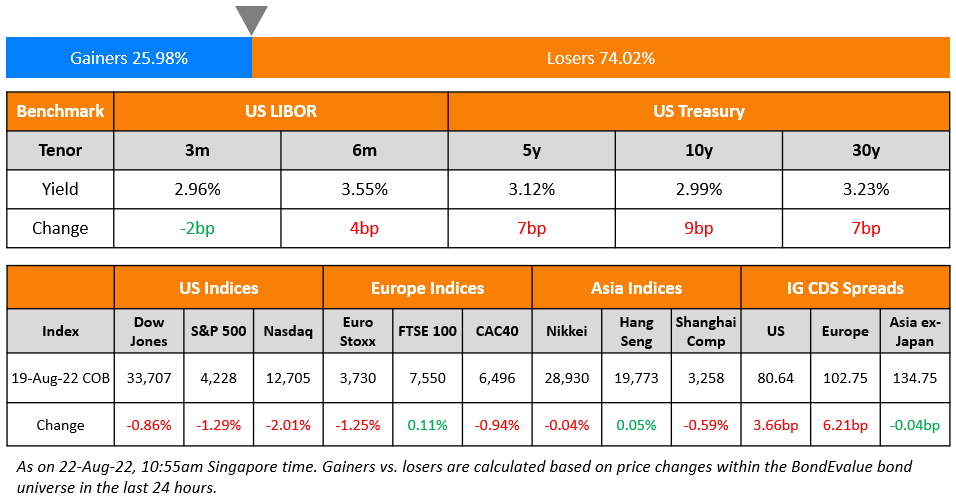

After US markets were closed yesterday due to the Martin Luther King Jr. Day holiday, US Treasury yields have opened lower this morning. The 2Y yield is down 4bp and the 10Y is down 7bp. Donald Trump took oath as the 47th US President and indicated a delay in his broad tariff plans. Markets took this to be a sign of a more measured response by Trump after initially having expected tariffs to be announced upon his inauguration. However, he said that he planned to impose 25% tariffs on Canada and Mexico from February 1. Besides, he also indicated a potential renaming of the Gulf of Mexico to the Gulf of America or making Canada the 51st state of the US.

US CDS and equity markets were closed yesterday. European equities ended higher. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.2bp and 1.4bp respectively. Asian equities have opened broadly higher this morning. Asia ex-Japan CDS spreads were 1.1bp tighter.

New Bond Issues

Rating Changes

-

Fitch Upgrades Vedanta Resources to ‘B+’; Outlook Stable

-

Elior Group S.A. Upgraded To ‘B+’ From ‘B’ On Refinancing And Continued Deleveraging; Outlook Stable

-

China Vanke Downgraded Two Notches To ‘B-‘ On Weak Liquidity; Ratings Placed On CreditWatch Negative

-

Fitch Downgrades China Vanke to ‘B-‘; Vanke Hong Kong to ‘CCC+’; Rating Watch Negative

-

Moody’s Ratings downgrades four Formosa companies to Baa1; outlook remains negative

-

Moody’s Ratings downgrades NTT’s and NTT Finance’s ratings to A2 from A1; changes outlook to stable from negative

-

Fitch Revises BPER’s Outlook to Positive; Affirms IDR at ‘BBB-‘

Term of the Day: Senior Non-Preferred (SNP) Bond

Senior non-preferred (SNP) notes are type of debt security that banks issue as part of their Tier 3 capital. These bonds have an inherent bail-in feature where in the case of bankruptcy, creditors holding these notes may be subject to conversion into shares. In a liquidation scenario, SNP bonds are ranked higher than Subordinated Bonds. However, they rank inferior to Senior Preferred Bonds or Senior Unsecured Bonds.

Talking Heads

On Traders Ditching EM in Rocky Start of the Year

Pablo Goldberg, BlackRock

“It’s hard for the market to take big bets in front of big events… right now we’re still in a very uncertain period”

Carlos Legaspy, Insight Securities

I’d rather buy a a two-year Treasury with a yield near 4%… then to wait and give Trump 100 days to see if he starts delivering on his threats

Arif Joshi, Lazard Asset

“The magnitude and timing of those changes are highly uncertain… not wise at this time to have duration or FX risk in emerging markets”

On US Set to Exceed World War II Debt Levels by 2029 – CBO

“The fiscal situation is daunting, the debt trajectory is unsustainable. It’s just the economy is a bit bigger than we thought it was last June, and therefore there’s more revenue.”

On Regional Banks Facing Headache From Rising Treasury Yields

Steven Kelly, Yale Program

“Rising long-term yields certainly leave the banking system more fragile in the short run, if more profitable in a base case economic scenario”

Tomasz Piskorski, Columbia Business School

“Instead of escaping this area of bank fragility, we are moving toward an increasing area of bank fragility”

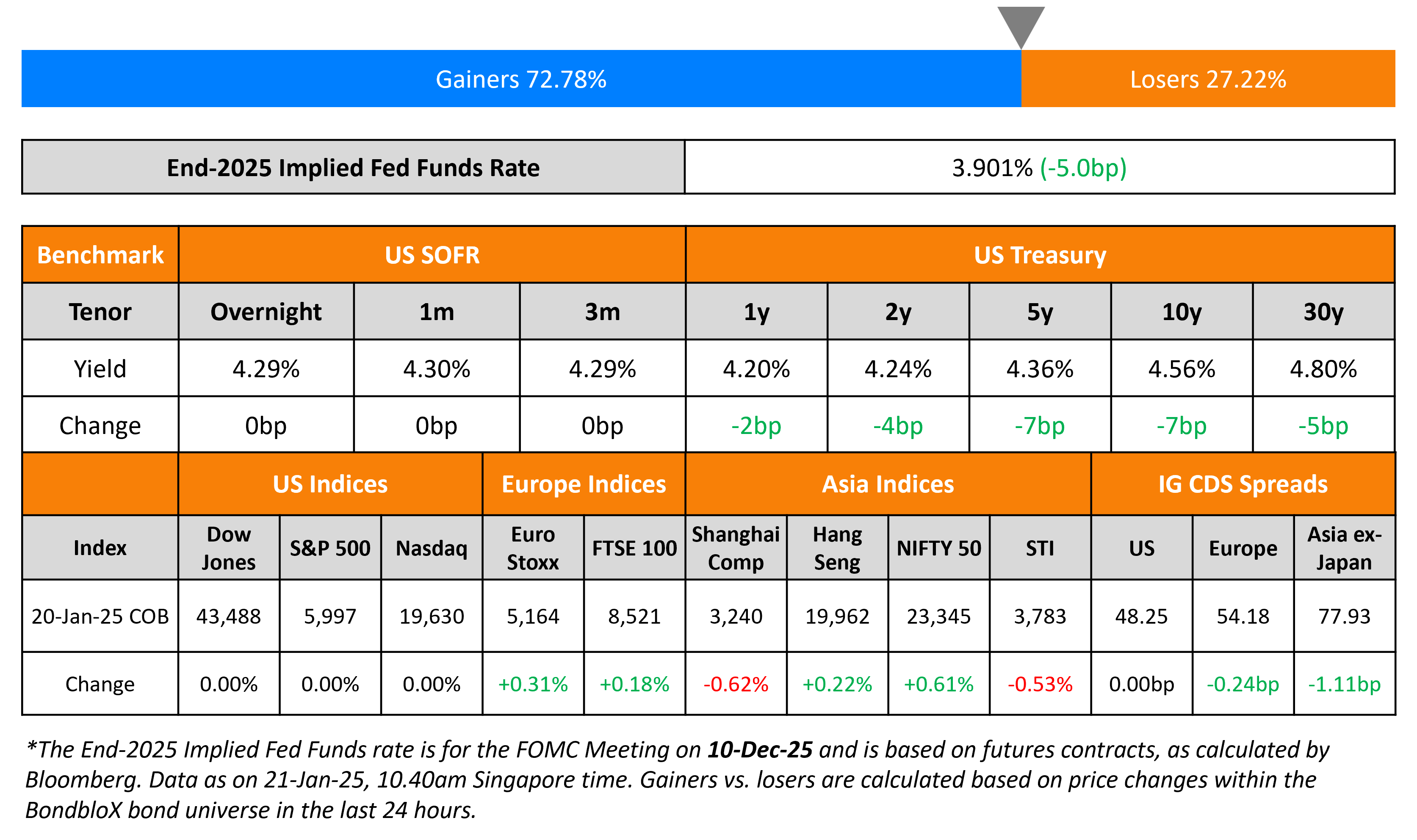

Top Gainers and Losers- 21-January-25*

.png)

Go back to Latest bond Market News

Related Posts: