This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Hold Steady with Tariffs Being Planned

January 23, 2025

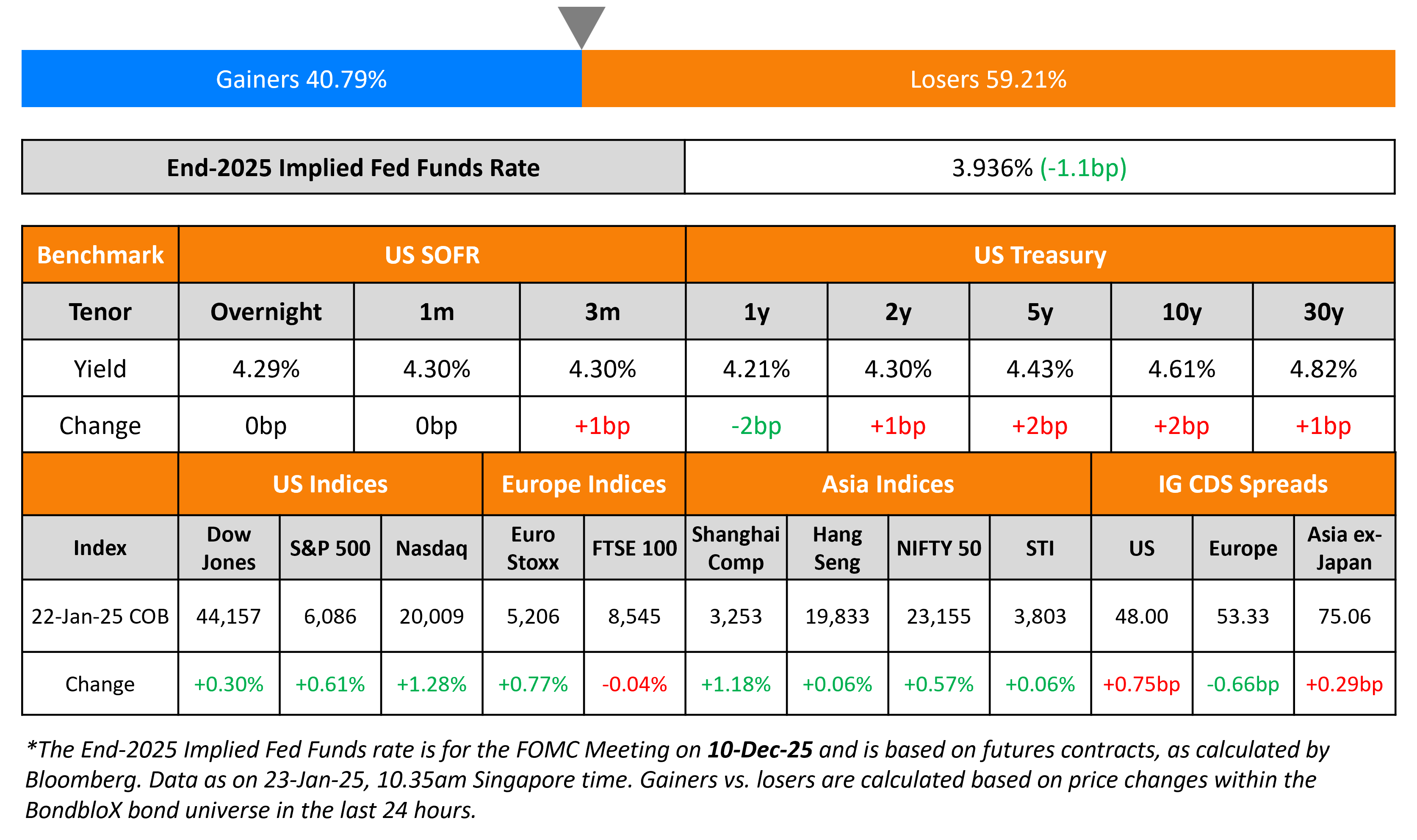

US Treasury yields ticked marginally higher by 1-2bp across the curve. US President Donald Trump is reported to be deliberating a 10% tariff on imports of Chinese goods as early as February 1. There were no major macro developments from the region. US IG and HY CDS spreads widened by 0.8bp and 2.4bp respectively. US equity markets ended higher, with the S&P and the Nasdaq up by 0.6% and 1.3% respectively. European equities ended higher too. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.7bp and 2.8bp respectively. Asian equities have opened in the green this morning. Asia ex-Japan CDS spreads were 0.3bp wider.

New Bond Issues

- KDB $ 3Y/5Y/5Y FRN at SOFR MS+58/77/SOFR+77bp area

Rating Changes

-

Moody’s Ratings changes Bharti Airtel’s outlook to positive; affirms Baa3 ratings

-

Moody’s Ratings changes NIKE’s outlook to negative; affirms A1 senior unsecured notes rating

-

Fitch Places Aptiv’s Ratings on Rating Watch Negative Following Announced EDS Spin-Off

-

Ambipar Outlook Revised To Positive On Deleveraging; New Bond Rated Preliminary ‘BB-‘; Existing Ratings Affirmed

Term of the Day: Debt Service Coverage Ratio (DSCR)

Debt Service Coverage Ratio (DSCR) is a credit metric used to understand how easily a company’s operating cashflow or EBITDA can cover its annual interest and principal obligations. The ratio shows how much profit a company makes for every dollar it uses to pay off its debts. The ratio is typically calculated as: (EBITDA)/(Principal+Interest)..

Talking Heads

On Goldman Sachs CEO saying important for US, China to improve ties – CNBC

Rebalancing of certain trade agreements could be constructive for U.S. growth if it is handled right. “The question is, how far? How quickly, how thoughtfully?”

On ECB Is Confident on Inflation Stabilizing at Target – ECB’s Olli Rehn

“The threat of a trade war and the resulting disruption of international trade also pose a risk of rising prices… On the other hand, inflation can surprise downwards as well if economic growth in the euro area does not start as expected… pace and scale of interest rate cuts are decided at each meeting separately based on the latest data and our overall assessment”

On UBS CEO Warning Policymakers Not to Ignore Risk of High Debt Level

“Maybe we shouldn’t be too innovative in thinking about something completely new and be a bit more careful about the level of debt… potential for rippling effects in my view are still in this non-bank sphere”

Top Gainers and Losers- 23-January-25*

Go back to Latest bond Market News

Related Posts: