This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Hold Steady; Fed Speakers Voice Their Rate Paths

December 18, 2023

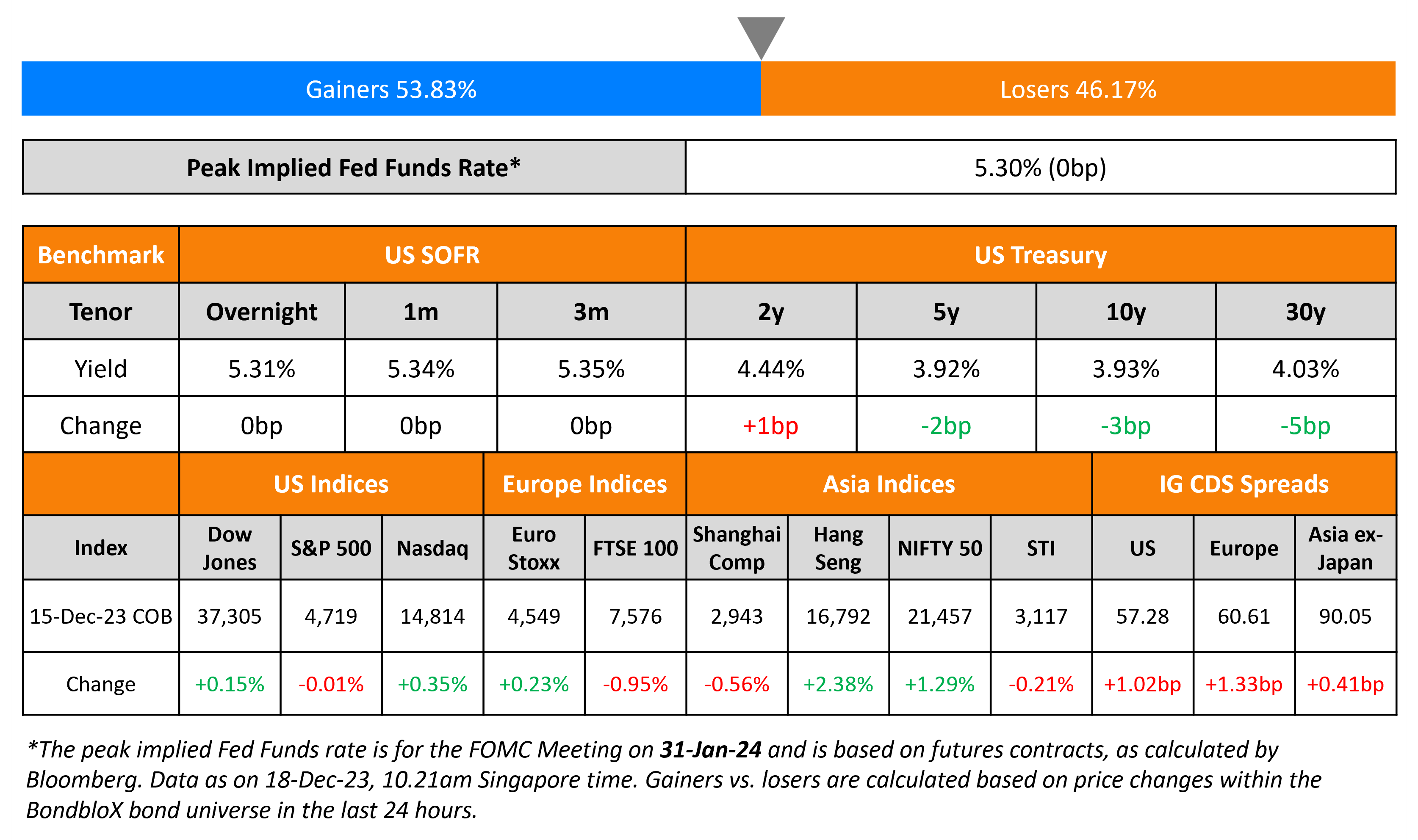

US Treasury yields held steady on Friday. Manufacturing output rose 0.3% in November, slightly below estimates of 0.5%. S&P flash manufacturing PMI fell to 48.2 in December amid shrinking orders from 49.4 in November. The flash services sector PMI rose to 51.3 from 50.8 with new orders, employment and input prices sub-components all rising. Thus, the flash composite PMI rose to a five-month high of 51.0 from 50.7 in November. Atlanta Fed President Raphael Bostic, who votes on monetary policy next year, said that he expects two rate cuts in 2024 probably beginning only in Q3. Separately, Chicago Fed President Austan Goolsbee said that it was an overstatement to consider rate cuts until officials are convinced inflation is on a path lower to its target. US credit markets saw IG CDS spreads widen by 1bp while HY spreads widened by 3.1bp. In US equity markets, S&P was flat and Nasdaq was up 0.4%.

European equity markets ended higher. In credit markets, European main CDS spreads were 1.3bp wider and crossover spreads widened by 2.1bp. Asian equity markets have opened in the red today. Asia ex-Japan IG CDS spreads were wider by 0.4bp.

New Bond Issues

- Cixi State-Owned Assets $ 3Y Sustainability at 6.3% area

Taian City Development raised $120mn via a 364-day bond at a yield of 8.9%, 20bp inside initial guidance of 9.1% area. The senior unsecured bonds are unrated and come with a change of control put at 101. Proceeds will be used for general corporate purposes and refinancing existing debt.

New Issues Pipeline

- India Vehicle Finance hires for $ 6.5Y Sr Secured bond

Rating Changes

- Howmet Aerospace Inc. Upgraded To ‘BBB-‘ From ‘BB+’ On Improved Credit Metrics; Outlook Stable

- Ethiopia Foreign Currency Ratings Lowered To ‘SD’ On Suspended Eurobond Coupon Payments

- Moody’s downgrades BankUnited (long-term issuer rating to Baa3 from Baa2); outlook stable

- Fitch Revises Outlook on JSW Infrastructure to Positive; Affirms at ‘BB+’

- Fitch Places Lippo Malls Indonesia Retail Trust on Rating Watch Negative

Term of the Day

Credit Default Swaps

A Credit Default Swap (CDS) is a financial contract between two counterparties that allows an investor to “swap” or offset the credit risk with another investor. CDS acts like an insurance policy wherein the buyer makes regular payments to the seller to protect itself from an issuer default. In the event of a default, the buyer receives a payout, typically the face value of the bond or loan, from the seller of the CDS as per the agreement. CDS spreads are a commonly used metric to track the market-priced creditworthiness of an issuer. A widening (increase) in CDS spreads indicates a deterioration in creditworthiness and vice-versa.

Talking Heads

On Bond Bulls Looking to Juice 2024 Returns in Niche Trades

Pilar Gomez-Bravo, co-CIO of fixed income at MFS Investment

“People are digging for value opportunities in places that are not that obvious”

Ninety One UK Ltd.

“There isn’t a huge cost in holding those bonds in terms of negative carry so we think it’s a pretty good story”

David Loevinger, MD of EM at TCW

“If Pakistan can eventually get access to markets, they can — even if fundamentals don’t change — borrow to pay off debt coming due.”

On Trading the Fed’s Pivot, Wall Street Turning to Short-Dated Debt

Lindsay Rosner, a PM at Goldman Sachs Asset Management

“The Fed gave us their 2024, 2025 expectations for where rates go, and they go lower”. Investors should aim for “a mixture of two and fives as out the curve is not where we see much value”

BrandyWine Global Investment Management

“Cash is great and you should have been moving out the curve… bypass 2 years and buy 5-years and further out

On Wall Street Rethinking 2024 Outlooks After Fed-led Rally

John Roe, head of multi-asset funds at Legal & General

“The pivot will make us rethink our fundamental view — we’re still deciding how much… We were very surprised they’ve acted so early with inflation still above mandate consistent levels”

Piper Sandler’s Michael Kantrowitz

“Fed pivot has clear bullish historical precedence… stocks can drift higher on the back of lower yields”

Dan Suzuki, deputy CIO at Richard Bernstein Advisors

“Both stocks and bonds have run pretty hard in a very short period of time… wouldn’t expect that to continue in a straight line”

On not convinced inflation is under control – UBS CEO, Sergio Ermotti

“One thing I’ve learned is that one must not try to make predictions on the coming months – it’s nearly impossible… still not convinced that inflation is really under control”

Top Gainers & Losers- 18-December-23*

Go back to Latest bond Market News

Related Posts: