This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Hold Steady; BOJ’s Ueda Signals Possible Rate Hike

December 2, 2024

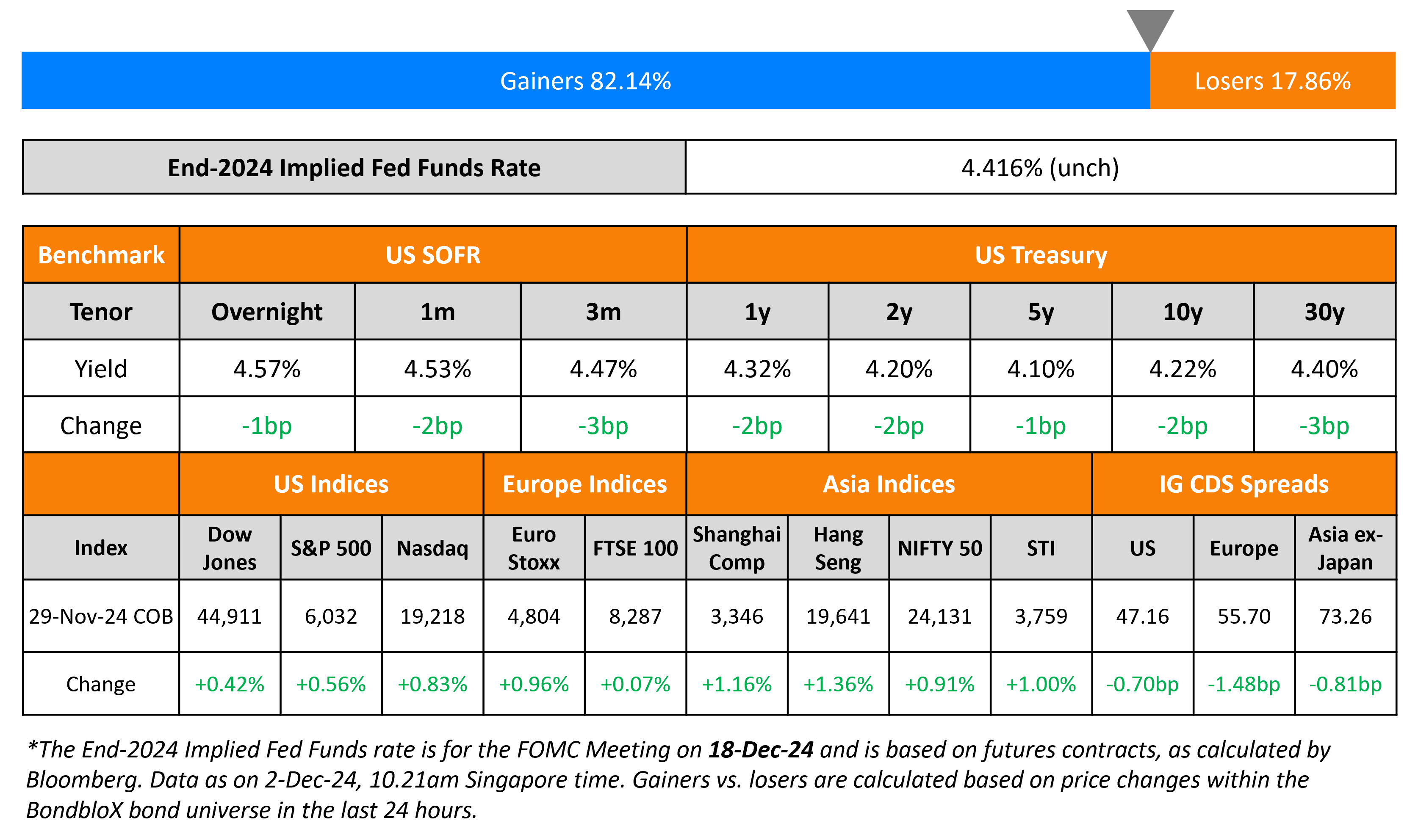

US Treasury yields held steady on Friday. The following week will see the release of key data points, including the NFP, unemployment rate and ISM reports. Besides, a few Fed speakers are scheduled to offer their remarks, including Alberto Musalem, Adriana Kugler and Christopher Waller, preceding the FOMC meeting coming up this December.

US IG and HY CDS spreads tightened by 0.7bp and 2.4bp respectively. Looking at equity markets, the S&P and Nasdaq closed 0.6% and 0.8% higher respectively. European equities followed suit and closed higher across the board too. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 1.5bp and 7.7bp respectively. Asian equities have opened higher this morning. Separately, BoJ Governor Ueda remarked that inflation rates approaching the central bank’s expectations of 2% would imply that interest rate hikes are “nearing”. He expressed confidence in his outlook that the economic data being released is on track with what the BoJ expects. Asia ex-Japan CDS spreads tightened by 0.8bp.

New Bond Issues

Rating Changes

-

Moody’s Ratings upgrades Indofood CBP’s ratings to Baa2; changes outlook to stable

-

Aragvi Holding International Ltd. (Trans-Oil Group) Upgraded To ‘B’ On Completed Notes Refinancing; Outlook Stable

-

OCI N.V. Downgraded To ‘BB+’ From ‘BBB-‘ On Completed Disposal Of Fertiglobe; Ratings Remain On CreditWatch Negative

-

Outlook On ICD Revised To Positive On Improved Risk Management; ‘A-‘ Rating Affirmed

-

Erste Outlook Revised To Positive On Strengthened Capitalization And Resilient Performance; Affirmed At ‘A+/A-1’

-

Outlook On KBC Group And Core Entities Revised To Positive On Resilient Performance; Ratings Affirmed

-

Moody’s Ratings changes Panama’s outlook to negative from stable, affirms Baa3 ratings

-

Moody’s Ratings changes outlook on Angola to stable, affirms B3 ratings

New Bonds Pipeline

- Rakuten hires for $ PerpNC5 bond

Term of the Day: Private Placement

A private placement is a sale of securities directly to select private investors, rather than issuing them via a public offering. Investors in privately placed bonds generally comprise large banks, mutual funds, or insurance companies. The advantage of private placements is that they may not be subject to the same strict regulations regarding disclosure and reporting of public offerings. Also, the cost and time savings add to its attractiveness. On the other hand, they may carry a higher rate to entice investors and they limit the number and variety of investors that can take part unlike public offerings. Unlike bonds issued via public offerings, privately placed bonds may not trade on the secondary market.

Talking Heads

On Stocks vs. Bonds Dilemma Hitting EM Investors

Sylvia Jablonski, Defiance

“We’ve had countries where EM bonds have offered compelling yields. Expecting US rate cuts has also been a supportive factor”

Dominic Pappalardo, Morningstar

“The largest difference between EM bonds and EM equity is exposure to China”

Mark Hackett, Nationwide Funds

“If growth is weak, rates will fall and earnings will struggle, driving relative performance of bonds over stocks”

On Bond Vigilantes Upending France’s Debt Market

Ella Hoxha, Newton Investment

“On Europe, what’s been worrying us is certainly France. It’s rare in markets that you see dislocations of the spreads that we saw in the summer and we’ve now re-established at a higher level”

Goldman Sachs

“Rather than driving fear of contagion, the widening in OAT spreads appears to have been treated as an idiosyncratic and transitory issue”

On Corporate Bond ETFs Are Fueling a Rise in Monster Block Trades

Barclays

“The depth and the breadth of liquidity in the US corporate bond market has really improved”

Grant Nachman, Shorecliff Asset

“The price for higher liquidity in these asset classes is probably going to be more volatility. Volatility doesn’t necessarily make an asset more or less safe”

Top Gainers and Losers- 02-December-24*

Go back to Latest bond Market News

Related Posts:

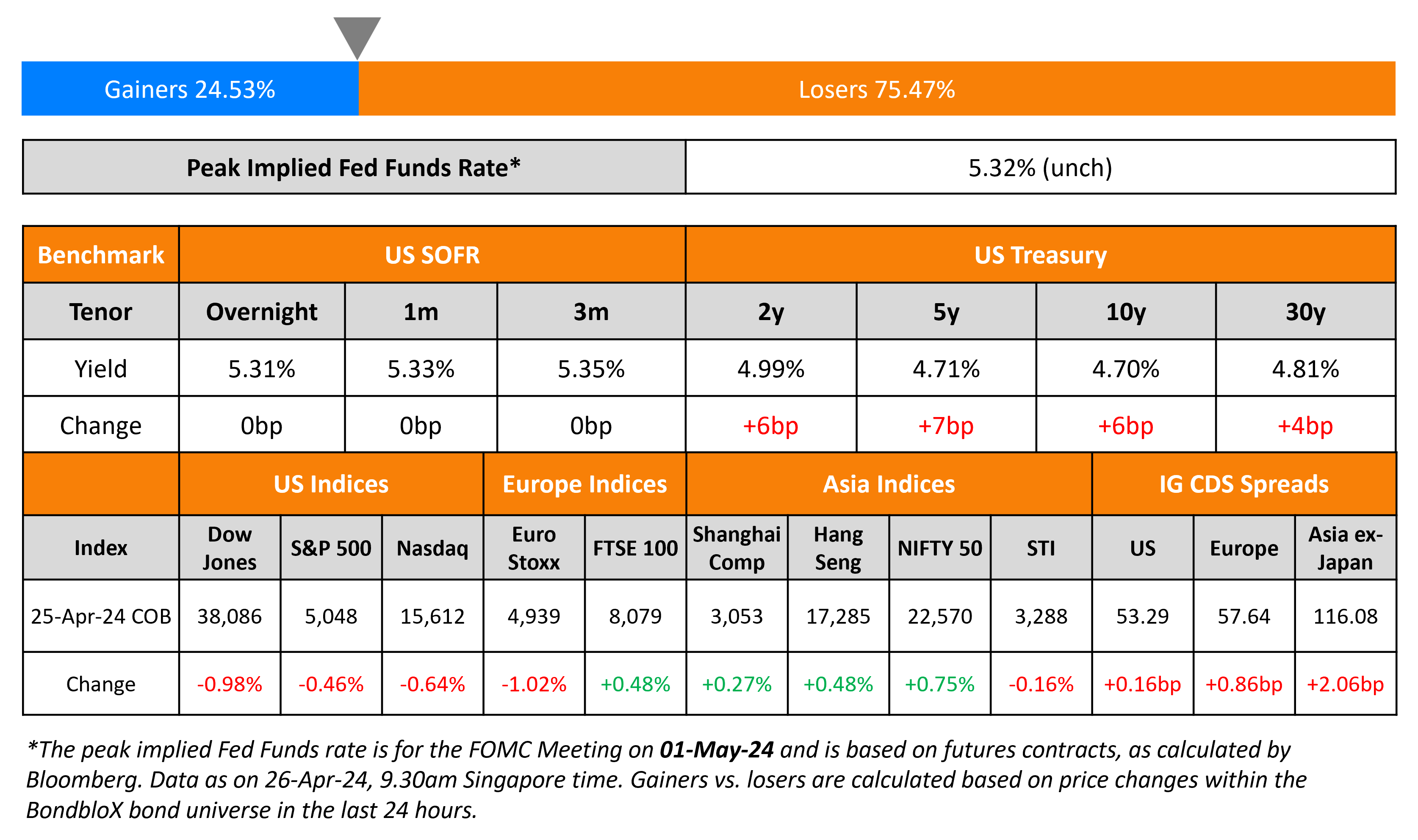

US GDP Softens; KIB Prices $ AT1

April 26, 2024

Turkey, FAB, Astrea Price Bonds; Muthoot Taps 2028s

July 10, 2024