This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

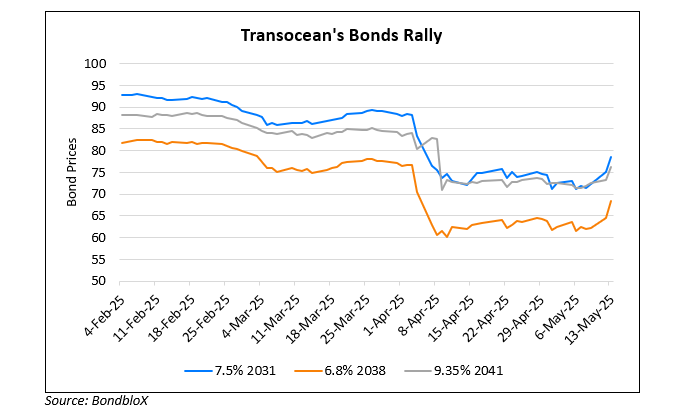

Transocean’s Bonds Rally By Over 3-4 Points

May 13, 2025

Transocean’s bonds were higher by over 3-4 points across the curve (as seen in the chart above). While there was no specific update on the company, analysts have noted that Transocean may benefit from the potential acquisition of oil major BP. BP recently received a bid from Shell, and analysts note that other oil majors like Exxon Mobil and Chevron are also in the works for a potential bid. They believe that the speculation surrounding BP’s acquisition could lead to increased activity in the offshore drilling sector, as acquiring companies may seek to expand their drilling operations. This heightened demand for drilling services could benefit Transocean, they noted. This comes amid the recent backdrop of Transocean’s financial performance where it reported a significant improvement in free cash flow to ~$200mn vs. a net outflow of over $300mn a year ago. Besides, Transocean has secured a significant backlog of contracts, amounting to $9.3bn, giving revenue and cash flow visibility over the next two to three years.

For more details, click here

Go back to Latest bond Market News

Related Posts: