This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

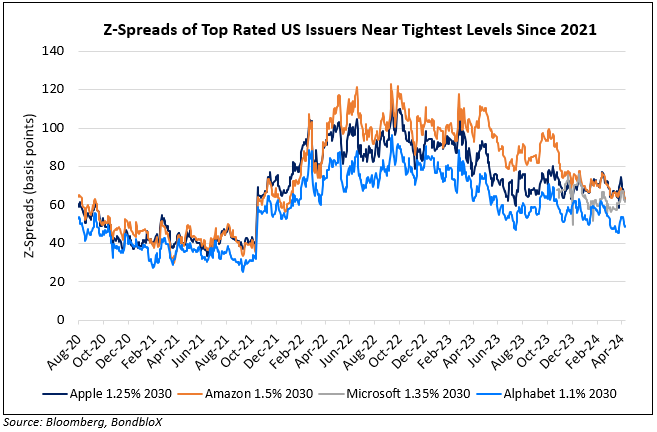

Top Rated US Issuers’ Credit Spreads Near 2021 Tightest Levels

April 26, 2024

Credit spreads of the highest rated US corporate issuers, as measured by the z-spread, are at its tightest levels since 2021 where the pandemic situation eased, alongside massive stimulus by the government and the central bank. With the current levels, especially in bonds that are due to mature in the next 2 years, z-spreads are trading almost flat to the comparable US Treasury yield. Analysts note that at the current levels, these bonds are trading as an alternative to US Treasuries. Rich Familetti, CIO of US total return fixed income at SLC Management said, “That’s possible only because of the demand for credit… Normally at this level of credit spreads, we would reduce our corporate credit exposure… (however now) willing to remain more invested than we would normally”. As seen in the chart below, bonds of top US issuers like Apple, Amazon, Microsoft and Alphabet that mature in 2030 have been trending lower since mid-2022 and are currently at 45-60bp, close to its tightest levels seen in 2021 that stood at 25-40bp.

Go back to Latest bond Market News

Related Posts:

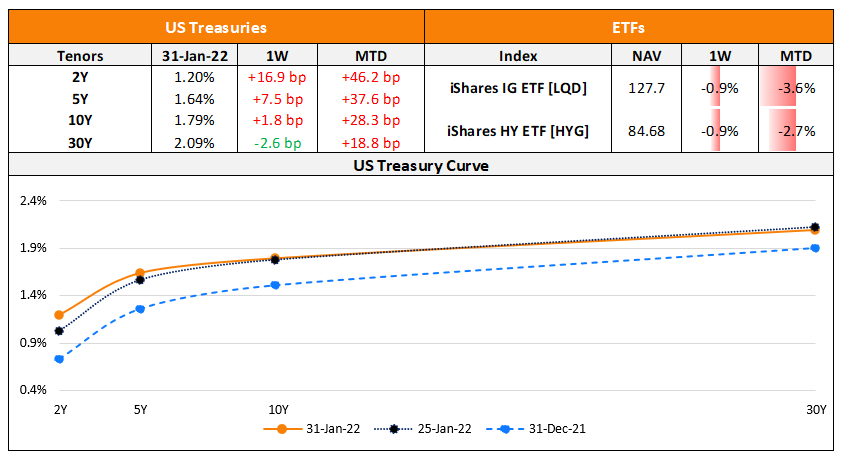

The Week That Was (24 – 30 Jan, 2022)

January 31, 2022

EDF Cuts Nuclear Output Outlook Again on Power Supply Risks

February 8, 2022